E-Mobility and electric vehicles (EV) are hot topics right now. In this series, you learn more about up-to-date market developments, exciting news, and the resulting implications for your business:

Progress in the energy market: Charging with new price and business models

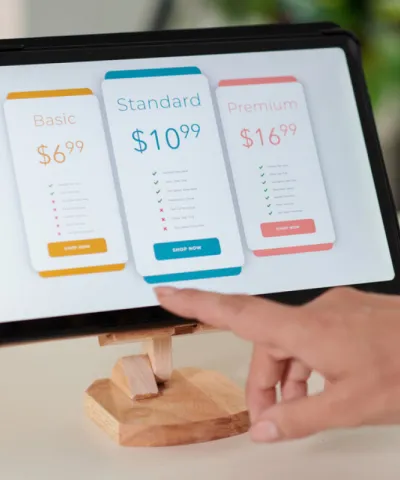

Charging prices are increasing: When energy experts look at the e-mobility market, naturally, they quickly focus on the charging infrastructure. Here, pricing has changed during the last year: In Germany, market prices for public charging have increased by 30 to 70 percent in 2020 in all power segments. As of today, the lowest prices without contract commitment and basic fee are 39 cents per kilowatt hour (kWh) for alternating current, 49 cents/kWh for direct current and 59 cents/kWh for fast-charging. In the high-speed charging network Ionity, prices will even range between 0.79 and 1.09 euros per kWh in the future.

First attempts at dynamic pricing: Even though these prices so far haven’t had any impact on the increasing popularity of electronic cars, it’s safe to say that consumers aren’t amused. One way to counteract this development is dynamic pricing. Tesla, for example, is already experimenting with this in Sweden, where refueling at the company's superchargers between 1 and 6 p.m. is up to 50 percent more expensive. A survey conducted by the German e-car rental company nextmove shows that almost 40 percent of respondents would accept dynamic pricing, if it resulted in lower prices or shorter waiting times at chargers.

Promotion of charging hubs: Besides dynamic pricing, drivers of EVs can make use of another trend: fast-charging parks, where numerous charging stations from different providers are available in parallel. Charging hubs like these receive a lot of support from the German government. It can therefore be assumed that they will be even more common in the future and not only make a significant contribution to a nationwide infrastructure for e-mobility, but at the same time keep charging prices for e-car drivers at an acceptable level through strong competition.

Electric cars and batteries: Novelties cause a stir in the automotive market

VW gains momentum: Looking closer at the heart of the e-mobility evolution, it is noticeable that electronic cars have been entering mainstream. In Germany, VW is especially successful: Immediately after its launch, VW's ID.3 took first place among new registrations (16 percent market share), ousting Tesla (eight percent with its Model 3) and Renault. What’s more, with the ID.4, the next model ready to enter the mass market is already in the pipeline, preceded by the much acclaimed Skoda Enyaq iV. This short launch succession of a whole range of e-cars demonstrates one of VW's clear strengths: With the Modular Electrification Toolkit (MEB), VW’s modular system for manufacturing electric vehicles, the company is creating a foundation to scale up its EV business extremely quickly and even provide the base for competitors like Ford.

Innovations made in China: Not only German carmakers are pioneers in e-mobility, China has exciting news, too: The unveiling of the Nio ET7 has caused quite a stir due to its design, equipment, hardware for autonomous driving, and a range of up to 1,000 kilometers. At the same time, Chinese OEM Xpeng has started the delivery of its G3 in Norway. This is the first step towards an expansion in Europe. Both developments are harbingers that car offerings worldwide and especially in Europe will change very quickly. In particular, generous subsidy programs such as in Germany make the sale of EVs in Europe particularly attractive for Chinese OEMs. For local manufacturers, this results in more competition and an increasing pressure to stay innovative. Then again, customers gain more choice and access to exciting new products.

Virtual reality enables new customer experiences: Apart from new e-car models, there is also innovation going on elsewhere: Virtual reality has found its way into electric car buying. Lucid Motors, the ambitious Tesla challenger from California, is leading the way with the expansion of its showrooms, the so-called “Lucid Studios.” Here – since the vehicles are not yet in production and there is therefore not way for customers to test-drive them – Lucid is relying fully on virtual reality and a digital experience to present its products. With the effects of the COVID-19 crisis in full swing and an increasing relevance of online sales, virtual reality approaches like Lucid’s are gaining in importance.

Solid state batteries on the rise: There are also interesting developments regarding the heart of EVs: their batteries. Solid state batteries are expected to solve core issues of the current battery technology, concerning energy density, thermal management, and safety. A large scale series production is not expected before 2025, but it might happen in time to push the technology into sectors still dominated by combustion engines due to the batteries wide range (more than 700 kilometers are possible). On the downside, this trend is a risk for established European automotive suppliers, as it will speed up the shift from combustion engines to electric cars and it hits many that have been focusing on thermal management when carving their space in the EV space.