Getting pricing wrong results in significant loss of revenue for many SaaS businesses. Determining how much to charge for your products is complex and critically important. Price matters because it not only drives revenue and profit, but it also defines the value of your product in the eyes of your customers.

Simon-Kucher’s global B2B software study of 500+ software executives shows that most SaaS businesses are not optimizing their selling, contracting, and pricing processes today, and are sacrificing an incremental 11 – 17% in total revenue each year due to these mistakes.

Mistake #1: No Deal Reconstructions

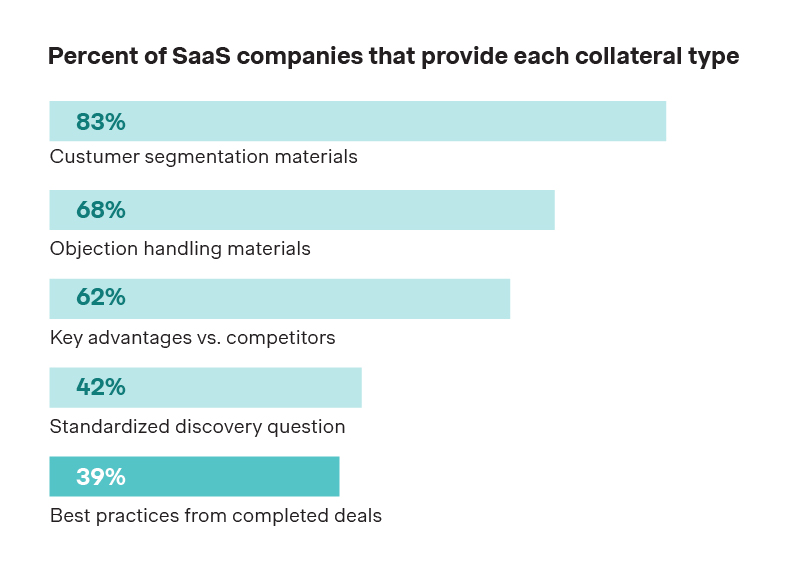

Our data shows that only 39% of SaaS businesses (see Figure 1) provide their Sales teams with best practices from completed deals. While SaaS business typically provide other support , such as segmentation and objection handling materials, sharing lessons learned from successful and unsuccessful deals is important to determining how (and if) your sales collateral is being used. Deal reconstructions are proof points that can help establish the importance and effectiveness of your other sales collateral and can convince the full Sales team to adopt best practices from top sellers.

Why this is a mistake: Institutionalizing lessons learned helps ensure new team members learn from the mistakes of others, instead of their own. In our experience, even simply conducting a monthly deal reconstruction where sellers share learnings from completed deals with each other can have a significant impact on ensuring selling best practices are widely adopted.

One example of this was a project we recently completed with a SaaS data science company. During the diagnostic phase of the project, we discovered that the top quartile of sellers routinely sold premium support with our client’s primary Enterprise product, while the bottom 50% of sellers almost never included premium support, even when selling to large customers. Conducting deal reconstructions would have helped this client’s sales team universally adopt this and other best practices more quickly. Based on our findings, adopting the best practices was worth an incremental $1.9M (2.6%) in ARR.

What it is costing you: 2-3% of revenue, based on Simon-Kucher’s project experience for clients who improved the quality of their Sales training.

Mistake #2: No Annual Price Escalator

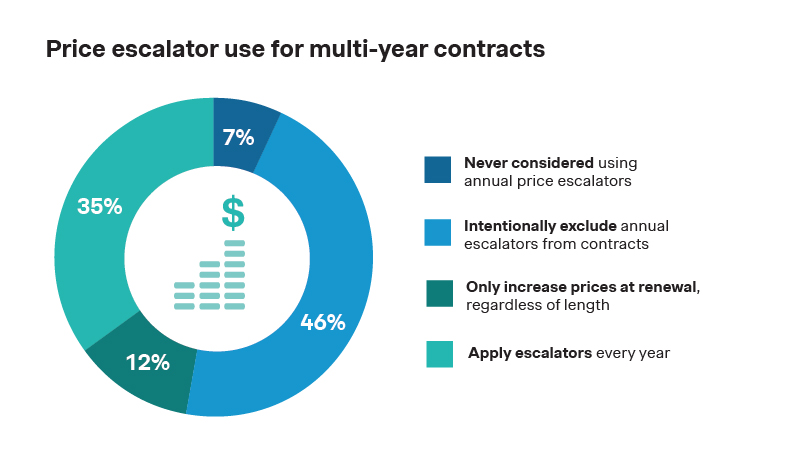

We have all had to get used to an increase in prices, especially in the last 1-2 years. While most software companies target customers with price increases at renewal, the results of our software study show that only 35% of SaaS businesses (see Figure 2) apply annual escalators to multi-year contracts. Most companies in our survey have either never considered annual escalators, intentionally exclude them, or only try to apply price increases at renewal.

Why this is a mistake: If your business is not using annual price escalators for multi-year contracts, you are likely leaving money on the table. In our project work, we usually see that our clients’ customers view escalators as standard, even if our client does not currently have them. Annual price escalators also give your business the opportunity to realize “no sweat” increases and help your business keep up with inflation by automatically raising prices each year, without contentious or time-consuming negotiations.

If your business waits for renewal to raise prices, any price increase is contingent on a successful contract renegotiation. You also risk sticker shock for multi-year customers, since your business may have to significantly increase prices to keep up with costs or market prices, instead of phasing these price increases in over time. Price escalators also create a valuable carrot you can offer to incentivize upsell, cross-sell, or write multi-year contracts (e.g., escalators decrease for customers who increase spend or who sign multi-year contracts.)

What it is costing you: Up to 5% of revenue since escalators of up to 5% are typically accepted with minimal churn (depending on SaaS sector). Based on our project recommendations, a Cyber Security SaaS client recently introduced annual escalators of 5%, and while some customers wanted to discuss the rationale for this escalator, churn rates did not increase measurably from their existing baseline.

Mistake #3: Small Annual Escalators

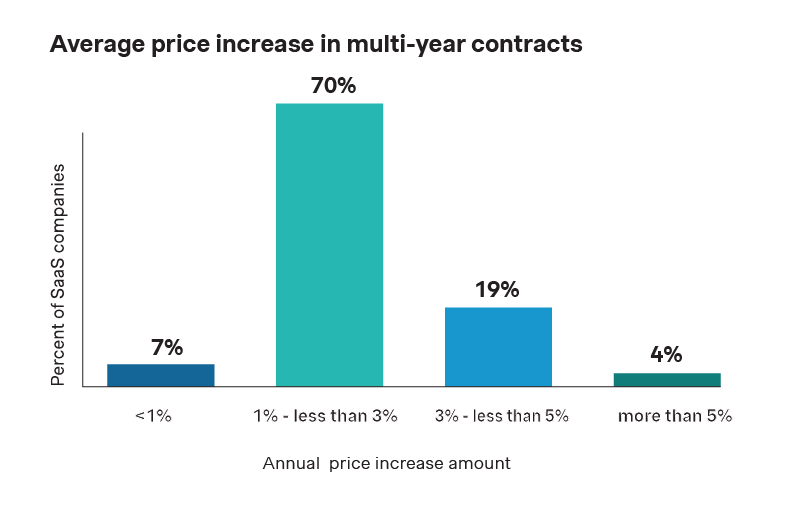

Even SaaS businesses that use annual price escalators struggle with setting their escalator at the right price level. Our data shows approximately 75% of SaaS businesses have annual price increases of <3% (see Figure #3).

Why this is a mistake: Price escalators are a common tool to not only support revenue growth, but to also protect businesses against inflation. Historically inflation has hovered around 2% in developed, global economies. Our Global Software Study shows that most SaaS companies’ annual price escalators barely keep up with this historic rate.

This picture gets even more dire when we reflect on the recent inflationary environment (in the US, annual inflation peaked at 9.1% in June 2022, and sat at 3.7% as of October 2023). Additionally, escalators compound over time so even a small difference (3% vs. 5%) means that your company will sacrifice significant revenue over time (i.e., 10% of total revenue from that customer after five years).

What it is costing you: 2-5% of revenue, based on a recent project that Simon-Kucher completed with a business services SaaS company.

Mistake #4: Lack of Seller Price Accountability

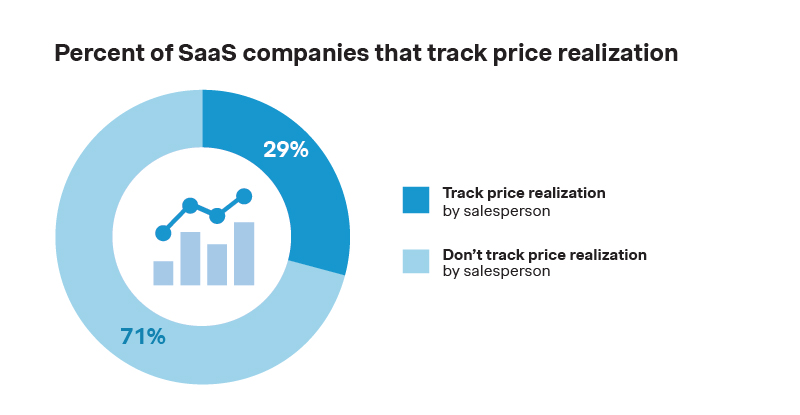

Giving your Sales team the resources it needs to be successful is crucial, but it is also important to hold sellers accountable for their results. SaaS businesses can use multiple metrics to measure sales effectiveness and set compensation, but price realization is one of the most important. Our data shows that only 29% of SaaS businesses track price realization by seller (see Figure 4).

Why this is a mistake: If your business does not measure price realization by seller, then you probably cannot tell if they are sacrificing price to hit their other goals (e.g., revenue, new logos, etc.) If your sales team is accustomed to discounting in order to win deals, then any price increase your company tries to implement may fail, since they can be discounted away. Tracking price realization by seller helps balance discounting discretion against discounting discipline and is an important pillar in helping ensure that your business offers the right discounts to the right customers, for the right reasons.

We recently worked with a SaaS marketing and first-party data company that did not track price realization at the seller level and (as expected) found a long list of transactions with below average price realization. These deals cost our client approximately $8 - $10M annually (approximately 3 – 4% of revenue) each year, so improving their sales incentives and data infrastructure were a key part of our project recommendations.

What it is costing you: 2-4% of revenue, based on project results for a typical client who does not monitor price achievement at the seller level.

We have shared four of the most common mistakes Software companies make, but the list of opportunities is usually much longer, and are unique to each business. Some key questions to consider are:

- Do you understand your competitive advantages and why your customers value your product?

- Do you know your customers’ willingness-to-pay?

- Is your product packaging optimized and fenced appropriately?

- Are your sales team’s incentives aligned with your business strategy?

Recognizing the pricing mistakes your business is making is only a first step; determining which areas to prioritize and how to fix them is even more critical. Reach out to our growth experts at Simon-Kucher to learn how your business can improve.

The Global Software Study survey was conducted from May to July 2023 by Simon-Kucher, with fielding through panel data provided by RepData, an independent market research agency. The study surveyed 500+ software executives across 20 countries, including the United States.