All around the globe, while economies are slowly recovering from the impacts of the COVID-19 crisis, inflation is on the rise. This poses a challenge for many industries, consumer healthcare being no exception. Countermeasures include securing sustainable revenues and a stable topline. But are consumer healthcare companies taking sufficient efforts to ensure this? Looking at the figures form our most recent global pricing study, we don’t think so.

The global economy’s rebound from the COVID-19 crisis is being accompanied by a rising price inflation. The US, for example, is currently experiencing the biggest surge in inflation in nearly 13 years, with consumer prices rising in May by five percent from one year ago. And the European Commission’s 2021 summer forecasts predicts inflation in the EU to average 2.2 percent this year, up 0.3 percentage points over estimates in May, and 1.6 percent in 2022. This poses a challenge for many industries, and consumer healthcare (CHC) is no exception.

Top-line activities important to make up for inflation

Rising prices – whether for raw materials, supply chain costs, or salaries – are bound to tighten CHC companies’ margins. To counteract this development, they need to deploy measures to rise their topline. Higher revenues result in higher profit margins and are therefore an effective way to offset the negative impact of price inflation. And profitable pricing is one of the strongest levers to ensure a high topline. How are consumer healthcare companies doing in this regard? To find out, we once again conducted our renowned Global Pricing Study (GPS). Looking for insights especially regarding the consumer healthcare sector, we interviewed more than 50 international experts on their views and opinions about pricing and other top-line topics.

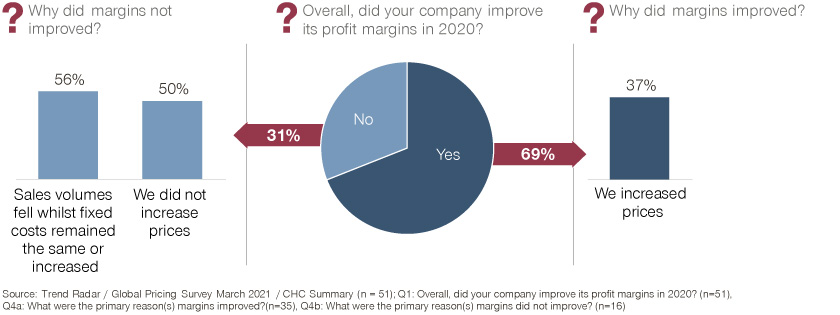

Overall, a majority – almost 70 percent - of companies was able to raise their margins in 2020. In line with our reasoning, they named price increases as the number one factor for this favorable result. Looking at the companies who were not able to increase their margins, 50 percent actually accounted that to the fact that they didn’t adjust prices.

Planned price increases not sufficient to ensure margins

Taking these figures into account, price increases seem to have a key role among initiatives to raise CHC companies’ topline. However, if you ask them about their plans for the future, just over 20 percent of study respondent stated that they plan a price adjustment above inflation; almost 80 percent intend to increase their prices not at all, just below or in-line with inflation. Therefore, it seems, consumer healthcare companies are not focusing on price increase to offset inflation impacts. What’s even worse, they don’t even seem to have the ability to do so: Last year, the realization of price increases in the industry was poor. Less than one in five companies achieved at least 60 percent of their planned price increases. More than 40 percent were only able to realize zero to 20 percent of their target prices.

CHC companies: Mindset shift needed

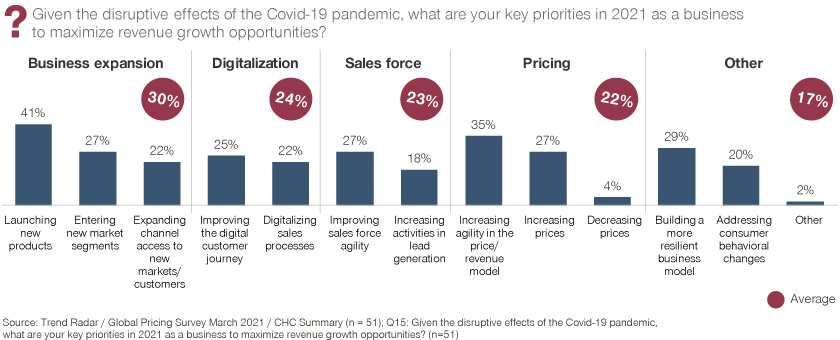

As it appears, CHC companies lack the expertise to use pricing yet as a powerful lever to counteract the effects of rising inflation. Instead, they plan to focus on business expansion, and in particular new product launches, as key priority to maximize revenue growth opportunities.

Digitalization initiatives like an improved digital customer journey and digital sales processes come in second. And projects to optimize the effectiveness of CHC companies’ sales force are a close third. Pricing measures rank fourth among the stated key priorities.

Will this be enough to cope with the volatile market situation predicted for the coming months and years? Right now, healthcare companies neglect pricing as the basis for stable top-line growth, and they seem unable or unwilling to change this in the future, even though profitable pricing would ensure them the profit margins needed to support their short- as well as long-term business initiatives. In our opinion, a mindset shift is needed to putting pricing excellence more into focus and combine it with other measures to achieve an increased topline.

Reach out to our experts for more information!