Life cycle theory says that all industries will inevitably reach the maturity stage: a phase of slow growth and stagnation in markets previously driven by innovation and high growth dynamics. Competition becomes fiercer. Customers look to optimize costs rather than adopt new technologies. These developments pose a serious challenge to any commercial organization, but especially those in highly concentrated markets with few suppliers and few customers.

How do you win large deal negotiations in this environment? We provide you with a four-step action plan.

The value of product improvements and new technologies will always level off at some point after decades of continuous progress. This holds true even in highly innovative, high tech markets, such as printing inks, specialty chemicals such as pesticides, and certain types of semiconductors. When customers are satisfied with the available technologies, any supplier can provide a “good enough” solution. Product differentiation through innovation is no longer possible.

This trend has many consequences, as the competitive landscape and dynamics will change significantly. Multi-sourcing strategies become the norm. Cost leadership becomes the rule of the game, and both suppliers and customers start moving operations to lower-cost countries. Customers come under price pressure in their markets too, as technology cycles also phase out. Joint research partnerships with suppliers break up.

In this new environment, companies not only need to re-think their market and sales approaches. They also need to fundamentally change the way they manage large deal negotiations with their customers, many of whom they have worked with closely for years. This change is essential. As Friedrich von Hayek once said: “Never will man penetrate deeper into error than when he is continuing on a road which has led him to great success.”

To carve those new paths to success in large deal negotiations, we recommend four actions:

- Re-evaluate your balance of power with each customer: Negotiations in mature markets become power plays, and the balance of power differs by customer and even by deal. It is essential to understand your product’s importance to the customer, the extent of any competitive edges you can still rely on (even if they are slight), and how large the substitution threats or switching risks are. If the product has become interchangeable, local service technicians may provide a competitive edge. With the switching risk, it is important to distinguish between the willingness to switch and the ability to switch. Sometimes competitors face constraints on their ability to supply certain products or serve certain locations.

- Make sure you understand your customer’s current objectives: Most negotiations fail when the objectives are not clear and the negotiation strategy is not fleshed out accordingly. The onset of market maturity can alter customer objectives. Rising cost pressure means procurement is typically measured and rewarded for achieving cost-saving targets. In the past, your customers likely looked at the value of supply security or the latest product upgrades, but now their focus is clearly moving towards price.

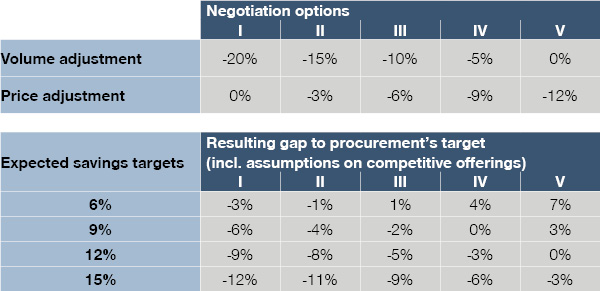

The foundation of your negotiation strategy should shift as well. You now need to cover as many negotiation elements as possible to help your customers save costs and reach their objectives. The example below shows different negotiation options in terms of price and volume adjustments, each of which has implications on the customer’s cost savings. Here, procurement expected price reductions due to learning curve effects, even though these tend to level off in the last phase of the product life cycle. They were also considering shifting volumes to low-cost suppliers.

Creating trade-offs between volume and price adjustments – and making the impact on potential saving targets transparent – helped to define the space for the negotiation strategy to target. Cost savings may also be achieved through more efficient collaboration or process optimization.

- Tailor your sales pitch precisely: A negotiation strategy is only as good as its communication to the customer. Show a deep understanding of your customer’s challenges. Outline your competitive edge and how you help your customers. This might be the long-lasting and very reliable relationship with the customer and the mutual support provided during difficult times. Strong local teams or exceptional technical support might highlight your commitment to your customer’s business. Show your willingness to support your customer in their cost-saving targets. Argue with volume to achieve economies of scale, as shown in Option I in the example above.

- Force procurement into trade-offs and include a longer-term perspective: Run scenario analyses with respect to how you expect prices and volumes to evolve, and the implications of reducing price over time. It is highly unlikely that you will recover margins through additional volume in stagnating or shrinking markets. But at the same time, if you lose volume, it will probably be expensive to gain it back. Finding the right balance depends strongly on your prevailing margin level. High-margin businesses should strive to protect volume more than price. If margins are low(er), price defense becomes more relevant. Tailor your negotiation offers in a way that forces procurement into trade-offs between volume and price, and then guide them to the optimal outcome for both sides. In return for more volume, you offer a lower price. However, if procurement considers reducing your volume and shifting it to another supplier, you keep your prices up. Procurement’s reactions to your offers will expose their preferences: how important are cost savings compared to a well-known, reliable relationship?

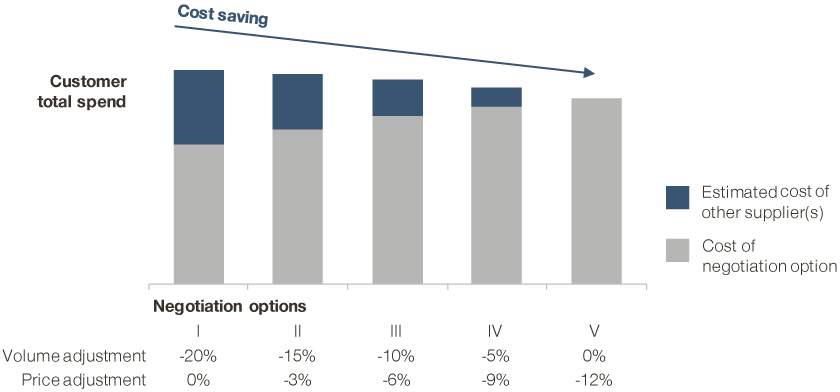

The following diagram illustrates the procurement’s trade-off zone based on the negotiation options of the example above. It takes into account the estimated cost the customer would incur when sourcing volume from other supplier(s). In this specific case, the ability of the customer to source volume from other suppliers was limited in the short term. The worst case would be a 20 percent volume shift (Option I). The diagram shows the total spend of the customer for each negotiation option outlined in table. A win-win negotiation outcome is achieved with Option V. It offers procurement the greatest cost saving and offers the seller value protection through stable volumes.

Companies must re-think their sales approaches and negotiation strategies whenever an industry reaches its maturity stage. Focusing on the benefits of innovation no longer works. Managing the price-volume relationship and protecting value depends on understanding the balance of power and crafting a customized negotiation strategy that forces procurement into precisely calculated trade-offs.