So much value is lost in the space between what pharma companies expect to earn and what they actually realize. In the US, this gross-to-net drag now tops $356 billion, yet many still treat it as accounting, not strategy. It’s time to change that. GtN mastery means making it a core pharma strategy for ROI optimization – spending smarter, not more.

For years, gross-to-net (GtN) has been a back-office calculation in US pharma and biotech pricing strategy. Finance tracks the waterfall, while commercial teams account for a wide range of concessions. But the list keeps growing: rebates and discounts, patient assistance programs (PAPs), wholesaler and distribution fees, and other government and channel discounts. The collective spend creates a GtN drag estimated at more than $356 billion annually, with select brand-drugs losing half of their list-price revenue to these deductions.

The key is that not all concessions are created equal. Statutory programs such as Medicaid and 340B set a non-negotiable floor. Negotiated rebates with Pharmacy Benefit Managers (PBMs), Group Purchasing Organizations (GPOs), and providers define the commercial battleground. Discretionary investments such as copay and PAPs shape patient affordability and pull-through.

The reality is that while the GtN stack has many layers, three levers shape leakage exposure most directly:

- Rebates and discounts to commercial channels (payers, PBMs, GPOs, and providers)

- Copay and PAPs

- 340B and Medicaid statutory discounts and rebates

Every dollar must be deployed with foresight, anticipating payer and regulatory moves, and ensuring execution delivers tangible results.

Much of the conversation in the industry today focuses on building bigger systems or automating reconciliation. Those are useful tools, but they are not strategy. True GtN optimization begins with clarity on which concessions matter, how to allocate them with precision, and how to execute pull-through in the market. Technology can help scale and accelerate, but without a strong pricing and contracting strategy, it will not change outcomes.

The hidden problem: Dollars without pull-through

Many manufacturers believe that because they spend heavily on drug discounts, rebates, and copay, they are securing access that drives prescription volume. In reality, billions of those dollars are potentially wasted:

- Discounts and rebates often flow reactively to all PBMs and payers for a given access position, without account-level segmentation that applies strategic intention to who receives what. Some of these accounts exert meaningful control over prescribing relative to access, but others do not, so concessions fail to consistently translate into tighter formulary positioning or meaningful volume and share shift.

- Copay dollars fail to reduce abandonment because programs are not targeted or aligned with patient affordability thresholds.

- 340B and Medicaid utilization erode value further when incremental discounts are granted broadly, particularly through discretionary supplemental Medicaid rebates and 340B sub-ceiling pricing, without a clear understanding of the underlying mix of demand across channels.

Traditional GtN processes rely on fragmented data and retroactive audits so most companies realize too late that the dollars they spent never delivered the intended pull-through. So, GtN becomes a subsidy rather than a growth engine.

The shift: From defensive management to offensive optimization

GtN can no longer be treated as a back-end measurement; it now demands strategic leadership. Leaders must reframe it not as a cost center, but as a portfolio of strategic investments. The goal is not to contain erosion, but to maximize the return on every dollar deployed.

That requires three mindset shifts:

- From accounting to strategy. Finance can measure, but only a strategic GtN approach can optimize. GtN should be a front-line commercial tool, not just a line on the P&L.

- From broad to targeted spend. Not all concessions deliver the same impact. Precision matters both in who receives the dollars and how they are structured.

- From discounts to outcomes. Every GtN lever should be tied to explicit outcomes in access, uptake, or adherence.

This requires thinking several moves ahead. A rebate granted today should set up tomorrow’s access, not merely defend against immediate threats.

The unlock: Segmentation and execution for US pharma revenue growth

Manufacturers can optimize GtN through payer segmentation, channel understanding, and disciplined execution.

- Segment the payers that matter

PBM consolidation has created a landscape where three major players control more than 80% of the market, yet their power is not uniform when it comes to translating access to value. Some PBMs act like queens, decisive and able to reshape the board and influence downstream payer accounts with a single move. Others are more like pawns, processing claims but exerting little leverage.

The key is to:

- Identify control levels and determine which PBMs meaningfully influence formulary position with downstream payer accounts.

- Map payer archetypes such as high-control versus low-control, rebate-driven versus clinical-first, and aggressive versus passive.

- Prioritize the accounts where dollars translate into tangible access, rather than where they disappear into “check-the-box” rebates.

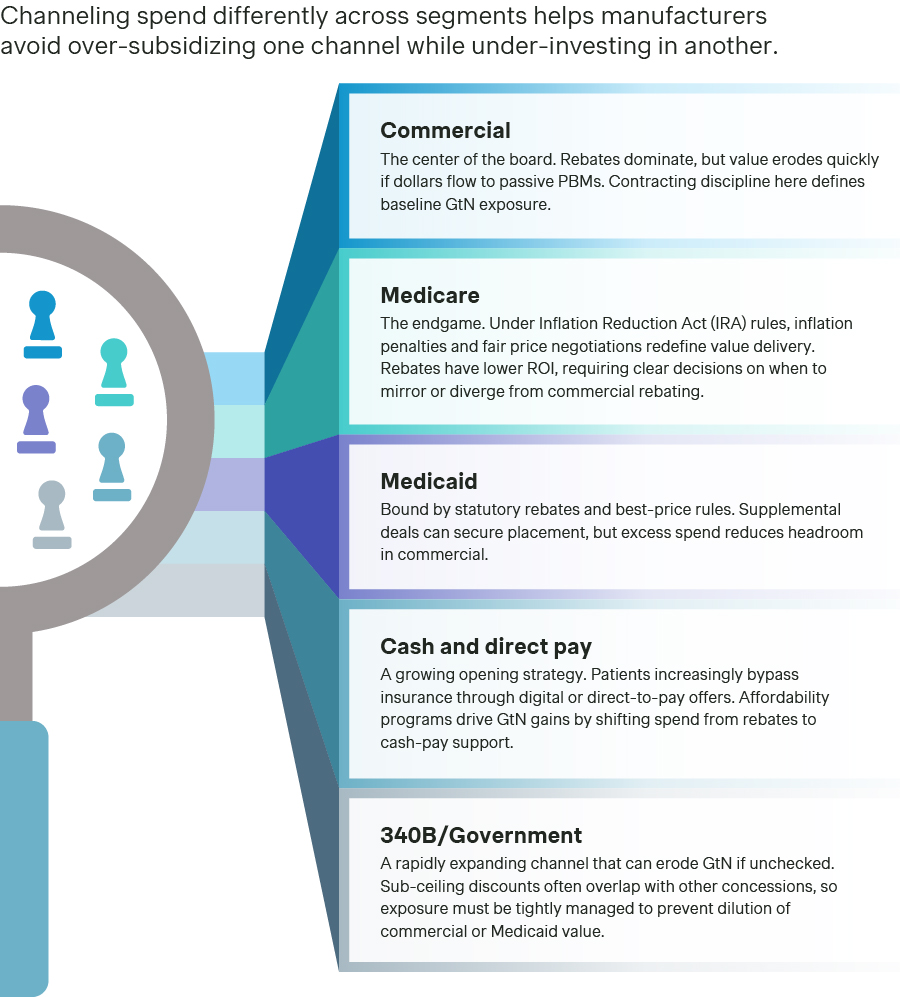

- Segment by channel: Commercial, Medicare, Medicaid, and emerging cash-pay

Each channel is a different part of the chessboard and requires distinct tactics.

Source: Simon-Kucher insights.

- Design discounts with pull-through in mind

Even the best contract will not move the market if execution fails. Concessions create value only when paired with pull-through strategies:

- Provider engagement that equips field teams with clear messaging on formulary wins and affordability.

- Patient affordability alignment that ensures copay programs minimize abandonment.

- Channel execution that leverages site-of-care strategies, specialty pharmacy partnerships, and digital adherence tools.

A major source of GtN erosion is the stacking of discounts across multiple levers, such as rebates, PAP support, and supplemental concessions. Manufacturers often lack visibility into when these layers overlap, so support continues even after access is secured. This overspending rarely produces incremental value and corrodes net price further. Advanced analytics and AI, coupled with clear strategy, can help identify when discount stacking occurs and create the opportunity to pull back with precision. A disciplined, stepwise approach – where manufacturers gradually reduce support much like repositioning pieces in chess – creates more durable advantage than broad, overlapping concessions.

A framework for US GtN mastery

The simplest way to think about GtN mastery is a three-step framework:

- Segment - Build payer and PBM segmentation with key channel archetypes (commercial, Medicare, Medicaid, and cash-pay). Identify who controls access-to-volume and discount dynamics. Extend to providers across medical and buy-and-bill markets, mapping how provider groups, GPOs, and IDNs influence pricing. Maintain balance between payer and provider strategy to ensure concessions in one channel don’t erode another.

- Align spend - Direct rebates, copay programs, and concessions toward high-value channels, payers, and providers. Rationalize low-value spend and manage GtN as a portfolio with deliberate, strategic allocations.

- Measure ROI -Track GtN prospectively and retrospectively across channel, payer, and provider segments. Use account-level views to evaluate outcomes. Align commercial rebates with pull-through, Medicare with IRA rules, Medicaid within statutory limits, and cash/direct-pay to reduce abandonment.

Integrating advanced pricing analytics and AI tools can further accelerate progress. AI-driven forecasting and anomaly detection can reveal leakage and reconciliation errors that manual methods miss. Technology cannot optimize GtN on its own but must be guided by deliberate strategy. Without that foundation, even the most sophisticated models add activity without creating impact.

This framework elevates GtN from a static waterfall to a dynamic, data-driven approach to pharma revenue management.

Why GtN mastery matters now: Rising pressures in US pharma and biotech

Every percentage point of GtN improvement translates into millions of dollars. On a $1 billion brand, even a 0.1% increase can mean $1 million in margin impact. On smaller products, the same percentage change may barely move the needle in absolute terms, but it can still have a significant impact on profitability. Yet despite the stakes, most companies do not have a timely or accurate view of their true erosion. Forecasts are built on expected accruals, but reconciling to actualized rebates, discounts, and concessions often takes weeks or months. This delay is not simply about closing the books. It reflects fragmented datasets and slow reconciliation processes that leave leaders making decisions based on what they think GtN erosion is, not what it actually is.

The IRA has added new urgency to GtN mastery. Inflation rebates, Medicare negotiation, and shifting liabilities are intensifying pressure on net revenues. At the same time, competitive markets such as oncology, neurology, and immunology are seeing escalating rebate wars across payer and provider segments.

Policy risk is also accelerating. Beyond the IRA, new federal moves are introducing reference pricing frameworks and manufacturer agreements that link US pricing more directly to international benchmarks. These developments amplify GtN uncertainty: statutory rebates, negotiated maximum fair prices, and now reference-based mechanisms all increase the likelihood that discounts cascade further and reduce net price headroom. Manufacturers must assume that the guardrails around GtN will continue to tighten, making strategy and disciplined pull-through even more essential.

Manufacturers that fail to optimize GtN will see margins eroded twice: once by wasted concessions and again by regulatory penalties. In contrast, those who adopt a “segmentation-and-pull-through” approach will uncover hidden margin opportunities without raising wholesale acquisition cost or expanding budgets. Like skilled chess players, they will anticipate opponents’ moves and position their GtN spend to maximize advantage.

Turn your pharma GtN strategy into a competitive advantage

The pharma and biotech industry has spent too long treating GtN as unavoidable leakage. It is time to change that narrative.

Source: Simon-Kucher insights.

The GtN drag will not expand indefinitely. External pressures, from policy reform to competitive rebate wars, will eventually force it to contract. Leaders who focus on the levers that truly drive value, and who execute with precision and discipline, will turn margin pressure into lasting advantage.

At Simon-Kucher, we believe GtN mastery starts with strategy. Our experience consistently shows that mastering gross-to-net is less about spending more, and more about moving the right pieces with intention and clarity. We can help you manage GtN as a core strategic capability, not an operational necessity. This helps transform concessions into competitive advantage, improve margins without increasing spend, and prepare organizations for the pressures of the IRA era and beyond.

We partner with pharma and biotech companies to design and execute GtN strategies, combining pricing and market access strategy with advanced analytics and AI.

Interested in a conversation? Contact us today.