Most restaurants anticipate being affected by recession and cost increases over the next year – how can brands continue to drive growth with price differentiation and digital & loyalty initiatives?

Our recent study with 50+ leading US restaurant brands revealed that 97% of brands expect a recession in 2023, the majority of whom believe it will affect the restaurant industry. Combined with an expected average cost increase of 9%, restaurants need to take action to protect margins, traffic, and guests. To do this, it is important for restaurant brands to implement strategic price increases as well as optimize digital initiatives throughout 2023.

Restaurant brands should implement next level price differentiation to combat an expected 9% cost increase in 2023

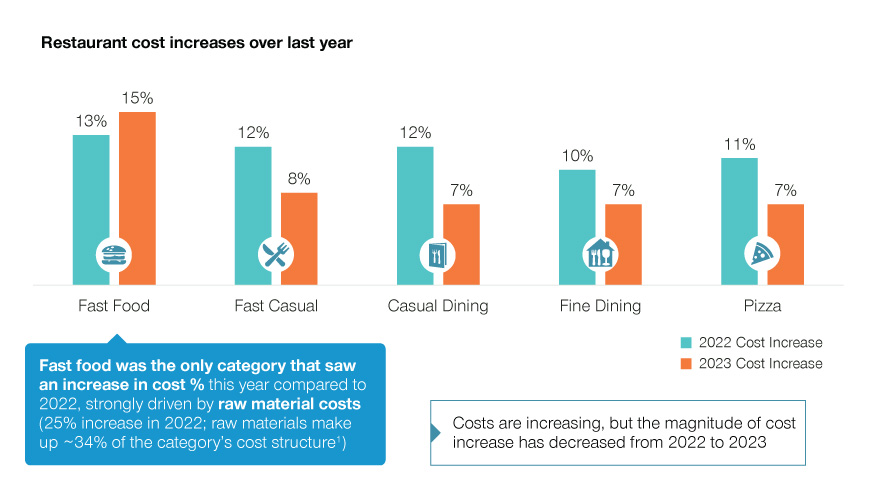

Restaurant brands face several challenges in 2023 with a looming recession and significant cost increases. While cost increases will not be as severe as 2022 for most restaurant types, the brands we surveyed expect an overall average 9% cost increase throughout this year, with fast food restaurants expecting a 15% cost increase.

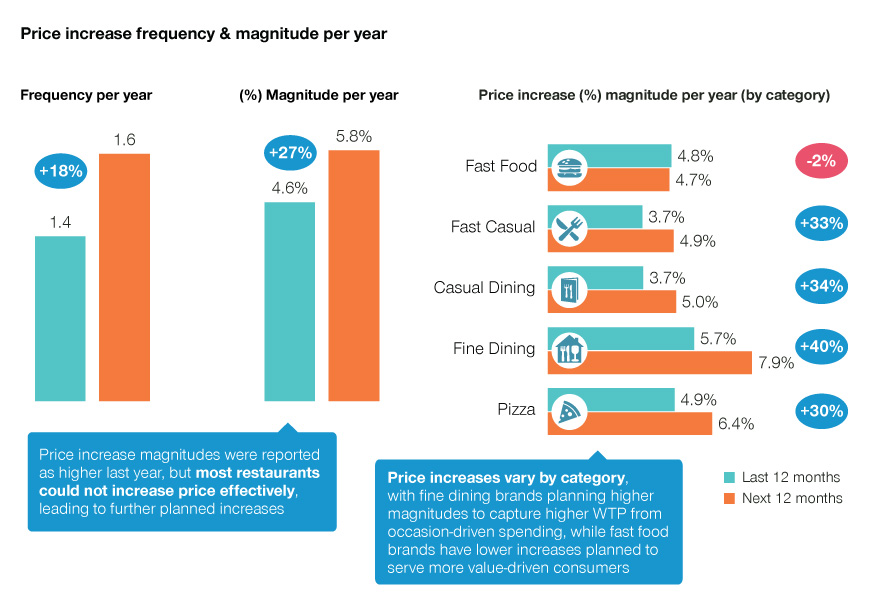

With strong expectations of a recession and as inflation continues to hit consumers’ pockets, it is imperative that restaurants conduct precise price increases to cover costs and protect margin. Restaurants are planning for larger and more frequent price increases in 2023 compared to 2022, with the average total price increase in 2023 expected to be 5.8% (up 27% from 4.6% in 2022). The average planned price increase is even higher in fine dining restaurants (7.9%), likely driven by consumers’ higher willingness-to-pay.

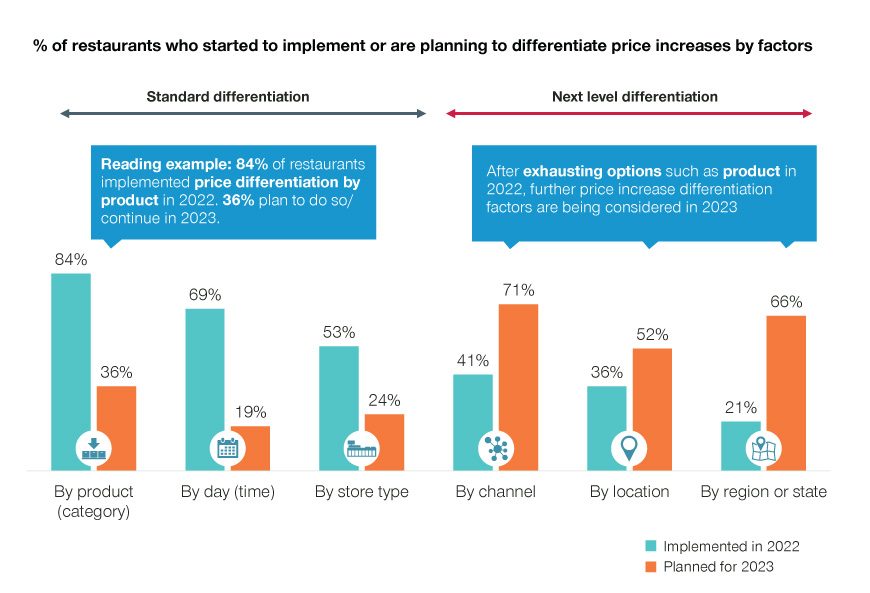

Although the average restaurant price increase in 2023 is expected to be 5.8%, brands should not implement a blanket price increase as they see costs rise. Instead, it is becoming increasingly important to differentiate price increases, including next level price differentiation as brands have exhausted standard differentiation strategies.

In the past, restaurants have primarily focused on differentiating price increases based on products, day/time, and store type. In 2022, we saw most brands implementing these methods to avoid blanket price increases. While these have helped in the past to implement precise price increases on products, times, and store types with higher consumer willingness-to-pay, there is an opportunity in 2023 to optimize next level factors like channel and store location. Differentiating price increases based on channel and location will allow brands to target their price increases toward areas with higher consumer willingness-to-pay to decrease the loss of volume and traffic.

With rising costs and recessionary expectations, digital and loyalty initiatives are increasingly important to develop

Most restaurant brands surveyed expect a recession in 2023, and the greatest changes in consumer behavior are expected to be 1. consumers looking for more promotions, 2. a decrease in the number of unique guests, and 3. consumers shifting to better value items/brands. So, what can address all three of these changes that consumers are likely to make? The answer is restaurants’ digital capabilities and their loyalty programs.

- Promotions: 55% of brands stated that their loyalty programs are used to offer members more attractive promotions compared to the promotions offered elsewhere, and 49% stated they offer more attractive promotions in their digital app compared to other channels. Use your digital channel and loyalty program to provide exclusive promotions to guests who engage with your brand.

- Guest churn: Utilize your digital & loyalty initiatives to create additional touchpoints with guests and provide rewards that reduce churn and increase frequency of purchase.

- Trading down to better value items: Advertise value products in your digital channel or loyalty program to prevent consumers from trading down to lower-priced competitors.

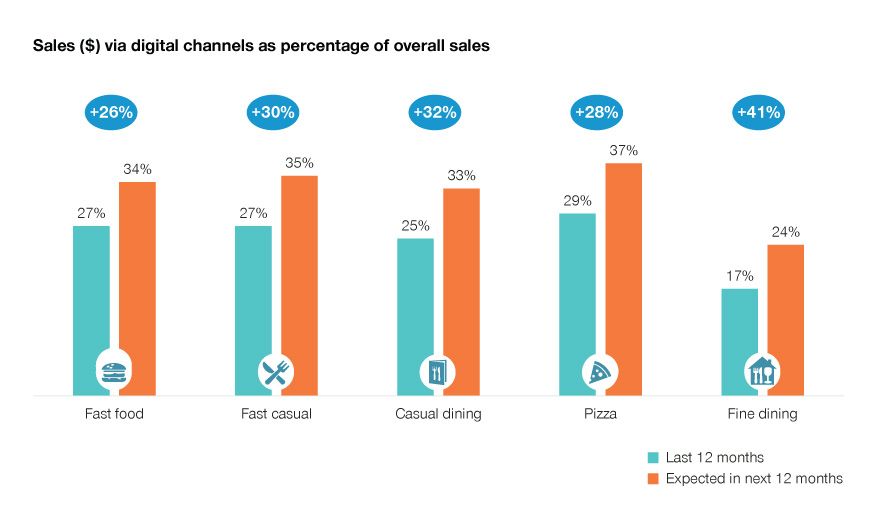

An increased focus on digital initiatives is not only important for combatting expected behavior changes caused by low economic confidence, but digital is also expected to be the largest growing channel throughout 2023 in terms of revenue mix.

Brands expect a higher increase in sales from meal delivery, curbside, and pick-up compared to in-store purchases, which enforces the need to optimize digital initiatives. COVID accelerated the trend of consumers ordering delivery or placing mobile orders, but the convenience of digital ordering is here to stay.

Overall, restaurants face several challenges this year with increasing costs and an overall muted economic outlook. However, there are numerous ways to combat this, including next level differentiation for price increases, enhancing digital and loyalty initiatives as these channels increase in revenue mix, and utilizing digital and loyalty to offer promotions and rewards to reduce churn.

If you are ready to implement new pricing and customer loyalty strategies in your restaurant business, reach out to our experts today.

Contributing Author:

- Erin Kilbride, Senior Consultant