By now, companies on a calendar fiscal year will have tallied their revenue, growth, and profits from 2023. After a year where GDP growth ranged from sub 1% for Europe, 2.5% for the US, to 5.2% for China, many companies are making rough guesses around their growth goals. These often fall somewhere between “continued tepid recovery” and “soft landing”.

Inflation is subsiding somewhat and interest rates, while still at 40-year highs, have decelerated. Conflicts are persisting in multiple countries. However, most executives are optimistic about 2024, and different vertical markets are affected to different degrees.

The results of Simon-Kucher’s 2023 Future of Sales Survey indicate that across manufacturing, distribution, and services, the top performing sales organizations are taking action.

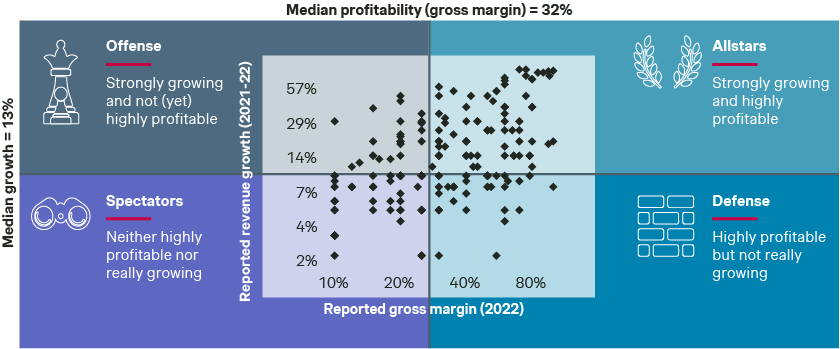

We re-designed elements of our annual survey to shine a brighter light on the best practices demonstrated by the fastest growing, most profitable companies. In the results posted in December, companies were categorized into four groups:

- Defense: Companies with higher than respective industry median gross margins but lower than respective industry median growth

- Offense: Companies with higher than respective industry median growth but lower than respective industry median gross margins

- Allstars: Companies with higher than respective industry median growth and gross margins

- Spectators: Companies with lower than respective industry median growth and gross margins

Do you classify as an Allstar in your industry? Get in touch for a free benchmarking exercise on the most important sales KPIs using our broad sales KPI database.

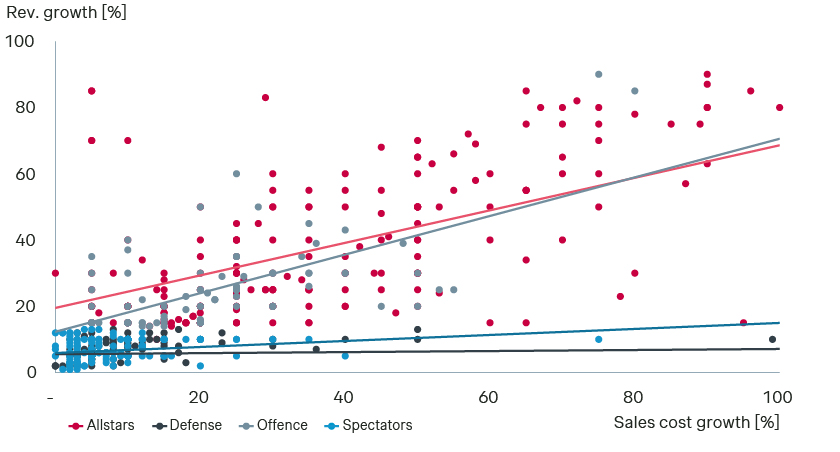

When we probed into the different approaches taken by the four groups identified in our survey, we observed several consistent actions taken by the companies outgrowing the market and their competitors. Allstars succeed by:

- Investing more in growth

- Planning from the outside in and gathering more input from customers

- Proactively addressing the strategic challenges, from segmentation to new channels

- Swinging the post-pandemic pendulum back from digital channels toward more personal interaction

- Re-structuring for efficiency and effectiveness, whether that’s integrating acquired sales forces, deploying specialized sales roles, or building centers of excellence

- Quickly determining what not to do. While labor and raw materials costs are high, growth investments must be focused on the highest ROI opportunities

Leaning forward, looking outward, and taking action

In addition to using incremental investment to drive incremental growth, top companies are also more precise in how they deploy these investments. That precision comes into play in selecting target customer segments and sales talent. Allstars are using quantitative models to determine the total potential in each account and are incorporating voice of customer (VOC) to assess willingness to pay. This gives sales resources confidence in their pursuits and ensures a straighter, more efficient sales funnel with larger transaction sizes and higher win rates. On the talent side, top companies are re-evaluating sales competencies for new selling motions and sales compensation to reinforce the desired focus and behaviors.

To read more about Simon-Kucher’s Future of Sales Survey results, click here!

Integration around strategy, gradual or transformative

As companies try to outgrow the competition, another approach involves a combination of organic and acquisitive growth. Trillions of dollars of mergers and acquisitions were completed in the five years prior to Covid. Many have never been fully integrated. Building consistency around strategic direction, cross-selling, processes, tools, and training are some of the more obvious benefits (both revenue and cost synergies to be realized) in more ambitious integration.

Integration can be a gradual process of building value-added centers of excellence (COE) that market their services internally and measure the impact. A more top-down approach requires strong central leadership and a clear case for action or mandate that builds consensus.

Setting aggressive goals and organizing for execution

We see two types of goal-setting that help companies build the focus and motivation to outgrow the market. One approach is a straight-forward but explicit annual growth target relative to an established industry growth rate (e.g., “200 basis points faster than the industry”). The other is a big, audacious goal that galvanizes the entire organization (e.g., “Double in size in the next five years”). Either way, with any of the tools, levers, and strategies mentioned above, the key to success is making an outward commitment to take market share.

How Simon-Kucher can help

Simon-Kucher has proven expertise in partnering with industrial firms to elevate their sales excellence and propel them toward growth. By focusing on key actions such customer-centric planning, addressing strategic challenges, and balancing digital and personal interactions, we guide industrial firms to Allstar status. Learn more about our services and capabilities.

Explore all the insights from our B2B Masterclass

Unlock practical strategies in B2B pricing, sales, and marketing