The big industry trends – electric vehicles and autonomous driving – would have been unthinkable without the recent advances in software. Electronics and software now account for 90 percent of all innovations with OEMs and tier 1 suppliers set to significantly increase their R&D investment in these areas. However, key questions still need to be answered: What effect will software have on monetization strategies and how should suppliers’ adjust their current approaches?

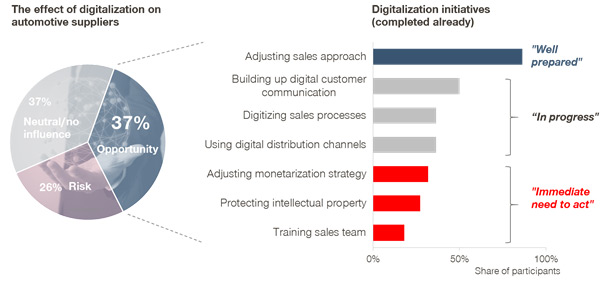

It should come as no surprise that automotive suppliers are paying serious attention to these topics and their potential impact. Spending by OEMs and tier 1 suppliers on software-related R&D is expected to rise at a staggering compound annual growth rate (CAGR) of 16.1 percent, from 37.9 billion euros in 2015 to 168.8 billion in 2025. Simon-Kucher & Partners surveyed automotive suppliers on their attitudes toward digitalization. 37 percent of respondents see digitalization as an opportunity, 27 percent view it as a risk, and the rest don’t expect digitalization to have any impact on their businesses. However, even the companies that see digitalization as an opportunity haven’t laid the necessary groundwork to meet this trend. While most of them are well prepared when it comes to adapting their sales approaches, it is essential for them to critically analyze their monetization strategies and adapt them accordingly.

Why it’s important for suppliers to think ahead

The growing importance of built-in software is altering purchasing processes. For decades, automotive suppliers sold components to OEMs without differentiating between components that included software and those that didn’t. Perspectives have shifted dramatically in recent years. Nowadays, software is often the most important part of a product – even being sold without a physical component. This change affects both OEMs’ purchasing processes and suppliers’ sales activities. Existing approaches for breaking down costs based on grams of plastic or square meters of aluminum simply aren’t applicable to software solutions. Basing price on the amount of code used or the hours taken to program the software aren’t the right approaches either.

So far, OEMs have been reluctant to change their purchasing processes for car projects. However, we are seeing the first signs that this may be about to change. Markus Duesmann, Board Member for Purchasing and Supplier Network at BMW, told a German automotive magazine, “Our goal is to make software more independent from control units. […] Our processes are changing because software has suddenly become a product of its own that we purchase independently.”

Suppliers cannot remain passive observers to these developments in the long term. They should strive to actively shape the way software solutions are monetized. But how should prices for software be calculated and how can they be enforced?

1. Apply toolsets to determine the value of solutions

In the past, the costs of materials acted as a reference point for both suppliers and OEMs to determine price. As mentioned above, this isn’t a suitable approach for software solutions. The process of pricing software starts with determining the value it creates. This assessment should take into account the value generated for OEMs (e.g. reduction of variance via smart components) and for end customers (e.g. how much more end customers would be willing to pay for a certain car/feature).

To determine the value for OEMs, it’s important to quantify the benefit. Having a list of technical characteristics isn’t enough to set a price point and will certainly not convince OEMs. Instead, suppliers need to have a better understanding about what aspects such as better performance, more space, and less variance mean for each OEM in dollars and cents.

Suppliers should also conduct market research regularly to identify end customers’ preferences and willingness to pay. If done right, this information not only provides an additional price point for the negotiation, it is also highly valuable to OEMs and can be leveraged accordingly.

The resulting price indications need to be backed up by systematic competitive comparisons. These should identify what is important to specific OEMs and how well the company’s solution performs against competitors. This value story is extremely important in negotiations.

2. Find the right price model

Selecting the right price model is as essential as finding the right price point. The biggest change brought about by the sale of software products and services has been its effect on price models and the way they are negotiated with OEMs. In the past, negotiations used to only be a matter of discussing round numbers and prices per part. Now software raises an entirely different set of questions. Should OEMs pay suppliers once or should they pay a recurring fee? What about updates to the software? We all know the situation from personal experience with our smartphones. Hardly a day goes by without an app or the operating system needing to be updated to keep things running smoothly. And, perhaps more importantly, securely. Will these updates be included in the purchase price, made part of a recurring fee, or handled via change requests? Is a service-level agreement the right choice?

In an industry like the auto industry, changes to price models and metrics are a tough sell. OEMs largely want to maintain their established working processes and the next supplier in line might be willing to deliver the terms they’re asking for. However, change isn’t impossible, as the German automotive supplier Hella proved when they introduced a license fee for the camera software they sold to a premium OEM.

For suppliers, it’s crucial to develop company-wide frameworks that define which price model is the right one based on product type, OEM, and the specifics of the situation. Not investing enough in this area now will have dire consequences, as competitors will be able to set the rules of the game to work in their favor.

3. Boost sales capabilities to enforce price and price model

Even with the right price model and price point, suppliers will still need to exercise a little power of persuasion to make their offers stick. In order to be successful in negotiations, they should prepare a structured approach and plan it well in advance of the actual negotiations.

Ideally, the initial discussions about price model changes should be conducted with the right stakeholders prior to the RFQ in order to increase acceptance.

During negotiations, maintaining composure requires confidence. This can be bolstered through thorough preparation, i.e. having the right knowledge, sufficient understanding of the situation, and appropriate support tools available. Sales teams should be able to clearly state what benefit their product and price model generate for OEMs (see point 1).

It is also important to enter the negotiation with a clear strategy on which concessions to make, what needs to be received in exchange, and in what timeframe. These concessions could be based on a number of aspects, including the price model, the price level, or the other parts of the offer, such as prototypes or specific software features. As OEMs and suppliers will value certain concessions differently, having the right sequence of concessions will lead to a better result for the supplier.

With the right tools in place, emotions can be taken out of the equation, allowing suppliers to respond to customer objections and counter their tactics in a controlled way.

Ensure your company has the right monetizing strategy for its solutions!

The automotive industry is undergoing changes so large and wide-ranging that no one can predict exactly how the market will look in the future. The amount of software that’s now being integrated into components and vehicles themselves means suppliers have a lot of homework to do. Not only do they have to answer important technical questions, they also have to answer the essential business question, namely, what is the most effective way to monetize these solutions?

Tackling digitalization topics successfully takes considerable determination and only the suppliers and OEMs that act decisively will succeed. After all, there are only three types of companies out there: ones that make things happen, ones that watch things happen, and ones that wonder what happened. Make sure you belong to the first group!