The FCA’s Consumer Duty, which came into force on July 31st, mandates firms to assess whether their products deliver ‘fair value’ to customers. But how do you measure the relationship between the price a consumer pays for a product and the benefit they receive from it? More importantly: how do you ensure (and demonstrate) this relationship is ‘reasonable’?

A strategic compass to drive better growth

In our view, it is critical that UK financial firms first adopt a strategic mindset when conducting their fair value assessments under the Consumer Duty. This is not another ‘regulation tick box’ exercise. Ultimately, companies that embrace the question of ‘fair value’ will build the foundation for financial sustainability as well as customer trust and engagement.

Indeed, history has demonstrated that when firms lose sight of fair value they are likely to destroy shareholder value whilst alienating their customers. Just think of the PPI scandal, in which millions of policies were mis-sold to people who did not want or need them and the UK banking industry ended up paying an estimated £50bn in remediation.

A systematic framework

Secondly, UK financial firms must develop a systematic framework for assessing fair value. This framework needs to be flexible enough to accommodate the specifics of different products, whilst also providing a degree of consistency. This is so that it can be applied without reinventing the wheel each time another product is to be evaluated. This enables firms to demonstrate why the specific metrics they chose to measure value are rigorous and intellectually honest (as opposed to cherry-picking methodologies that will just give the most favourable results).

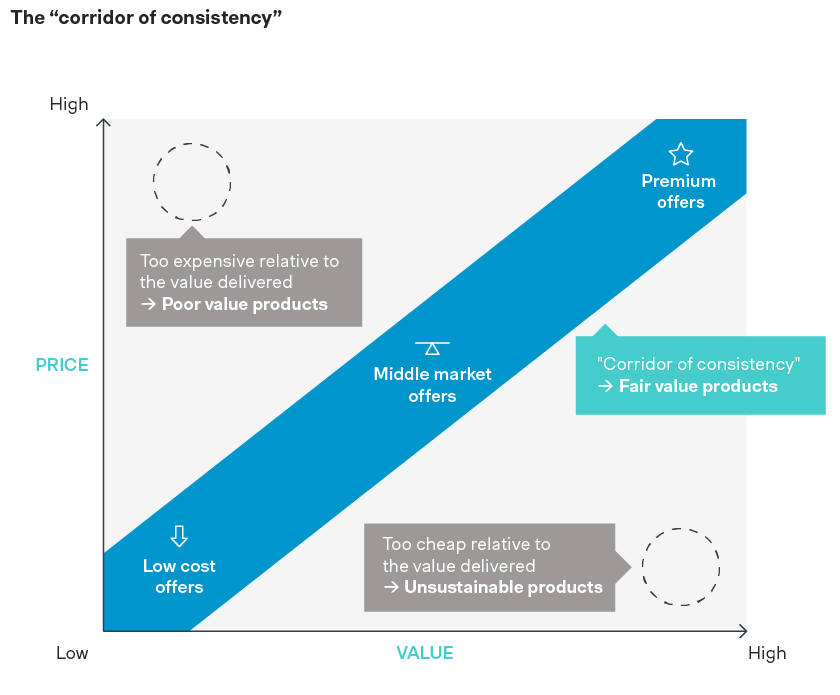

The ‘corridor of consistency’

So how to build this framework? At Simon-Kucher, we have been helping clients design offerings that deliver true value to customers at every price point for 35 years. And we have one guiding principle: your price position should reflect the value you deliver.

This is what we call the ‘corridor of consistency’, where the price charged is in line with the value delivered. In other words, it’s fine to have a low or high price… as long as the benefits delivered are commensurate.

A holistic view

Of course, the immediate question is: how do you rate each product across the two axes of price and value?

The guiding principle is that firms need to take a holistic view of both axes. A frequent temptation is to consider costs… and only costs. Firms should indeed factor the cost of manufacturing and distributing a product in their fair value assessments – but they should not limit themselves to a mere price-to-cost relationship analysis. Instead, they must adopt a broad view, considering all the necessary quantitative data points and indicators required to form a conclusion about whether their products deliver fair value to consumers.

To start with, the vertical axis (price) should compile indicators regarding both monetary and non-monetary costs. For monetary costs, this should obviously entail looking at the price paid for buying the product, but also additional charges, such as any cancellation or amendment fees. For non-monetary costs, this could include the number of steps and documents required to sign up, amend or cancel a product for example..

Value is in the eye of the beholder

Regarding the horizontal axis (value), one key element is to adopt the consumer’s point of view – as ultimately, value is in the eye of the beholder. This necessarily implies collecting external data points, typically through customer surveys and interviews.

Take the example of an insurance policy. An organisation-centric approach to assess its value would consider the costs incurred in manufacturing or distributing the policies, or the proportion of premiums paid out in claims. Whilst these are indeed key inputs, they should be looked at in conjunction with other indicators regarding consumers’ needs and satisfaction with the policy. This could require looking at customer feedback, complaints trends, or the availability of support channels.

Conclusion

In essence, what is required of UK financial firms is to ‘get under the skin’ of the pricing model for each product in their portfolio. Who pays what and what do they get in return? This is a significant challenge, even for the most sophisticated firms.

At Simon-Kucher, we support financial firms in developing an assessment framework as well as collecting and handling all required internal and external data. Done well it well help to orient the company towards a better sort of growth whilst also addressing the regulatory imperative.