Progressive digitalization in the mortgage market is opening new sales channels for banks and creating a breeding ground for the growing number of brokerage platforms. As a result, more and more customers view real estate financing as a commodity, and margins are shrinking. Here’s how banks can escape this price war in the long term.

Due to legal constraints and cumbersome review processes, digitalization in real estate financing has been slow for a long time. In the last few years, however, it has picked up speed, especially in Europe, due to the entry of fintechs into this space. A growing number of lenders can process applications automatically and offer their financing through various channels.

Digitalization increases pressure on banks

Digital transformation has also caused the number of online platforms and intermediaries to rise sharply. This development has played a key role in lowering customers’ inhibition threshold for purchasing financial products online without an in-person consultation. On the one hand, customers are benefitting from having easier ways of comparing different providers’ interest rates in the market and from faster processes. On the other hand, however, the intermediary platforms that are appearing, increased transparency, and consistently low interest rates are exerting sustained pressure on established banks’ margins.

The problem is exacerbated by long-term contracts for fixed-interest products because customers often prefer products with calculable costs and long terms. This is precisely why banks need to be careful when setting prices. Every “lost” basis point in the margin translates into returns for years to come. The high outstanding credit volume coupled with the long terms are a clear indicator that banks can generate significant additional income with even small price optimizations.

Margin erosion must be compensated

Banks have so far been able to partially make up for margin erosion thanks to rising real estate prices and the resulting higher demand for loans. Since income from real estate financing accounts for a large part of for many retail banks’ revenues, a decline or stagnation in real estate prices would be particularly painful. Therefore, it’s important for banks to devise a clear strategy for how to respond to the new circumstances to protect their margins in the long term. The following sections show how banks are adapting in this new environment to escape the increasing price pressure and be able to increase margins in the long term.

Taking up space in the ecosystem

When customers buy a house, they often consider offerings from other competitors. For banks, this represents both a risk of losing existing customers and an opportunity to attract new ones.

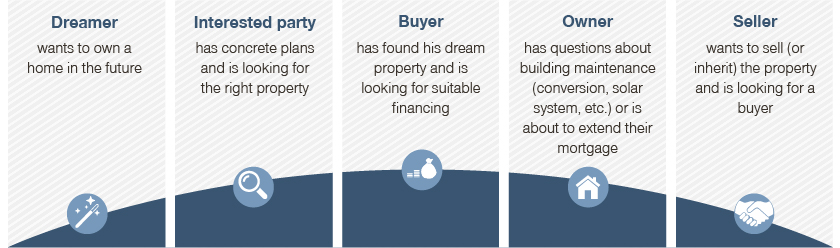

To ensure existing customers don’t even look at competing offers when searching for the right financing, it’s important for banks to closely accompany and support customers on their path to home ownership right from the start. By following this approach, banks build customer loyalty and position themselves as competent advisors on all financial issues. The figure below shows the typical phases a private customer goes through in the real estate ownership lifecycle.

The phases in the lifecycle serve as a basis for banks to align their offering landscape. First, they must identify in which phase they can offer additional services and products. By doing this, banks create targeted added value for their customers early on and strengthen the banking relationship. An example of this are long-term and specially developed savings products that make customers aware of the topic of buying property when they first join the bank and bind them to the bank long term.

However, it’s hardly possible for traditional retail banks to offer services and products for each phase of the lifecycle. Therefore, they must next determine when they can offer their own services and when added value should be generated, for example, through cooperation with other companies and startups. This not only increases the breadth of the offering but also enhances the quality of the services, for example, if they can provide all-round construction consulting in collaboration with an architectural firm.

Offer solutions, not products

A major advantage that retail and universal banks have over intermediary platforms is the breadth of their offering. While intermediaries mainly offer financing as a product, banks with partners from the ecosystem can provide their customers with holistic solutions related to buying real estate. Offering close customer support from the start helps banks identify needs early and enables a targeted customer approach.

Gathering insights into customers’ life situations and needs is enormously important for banks’ sales strategy. For example, standardized transactions can be processed quickly and efficiently via online channels or even intermediary platforms. However, it’s become increasingly apparent that a large proportion of customers have specific needs and depend on and highly value advice.

Banks should create a differentiated range of offers for precisely these customers. Retail and universal banks, in particular, can leverage their entire product offering and link financing with services from their ecosystem.

With a new and flexible offering landscape that can be adapted to the respective customer situations, customer advisors can draw attention to and explain these added values in customer discussions.

Personalized advice and offers as USPs

An essential part of the consultation involves discussing the offer, which typically consists of the services and framework conditions of the financing (e.g., affordability, loan-to-value ratio) and the resulting interest rates. On online platforms without features that enable interaction with customer advisors, special conditions can’t be negotiated and are rather “take it or leave it” offers. However, the price level offered by this kind of online providers is already very low due to the nature of the marketplace, and special conditions are already priced in. Offers on the service side, however, are also highly standardized so that the interest rates can be easily compared. Banks with personalized advisory services can tailor their financing solutions more closely to customers’ life situation and explain any price differences accordingly. This type of value communication is becoming particularly relevant in times of rising interest rates. For a long time, advisors didn’t need to explain rising interest rates. There is probably an entire generation of young advisors who are completely unaware how things used to be. So, it may be particularly helpful for advisors to refer to how costs everywhere have increased, as customers have a certain basic understanding of and are aware of general price increases.

However, this argument can be flanked with a corresponding value and benefit argumentation from additional services because if the prices increase, the service level should also be raised accordingly. Examples of additional services include various flexibility benefits, insurance, and included services such as pension advice.

Refine the value and quality of advice with digital tools

Banks need to link their services to their customers’ specific life situations and highlight the added value they provide. Connecting with customers in this way reduces their price sensitivity and increases their willingness to accept higher prices.

The physical sales process needs to be complemented with digital support in order for offers to be differentiated and tailored to specific needs and implemented successfully. This is the only way banks can systematically identify their customers’ needs and tailor their offers accordingly. In addition, price negotiation can be integrated into the advisory tools in order for customer advisors to receive individual price proposals and negotiation skills for setting prices.

Create added value to reduce price sensitivity

Banks must create tangible added value for customers by offering services along the lifecycle and tailored solutions. This is the only way they can reduce price sensitivity, protect themselves against new competitors, and sustainably protect margins.