Geopolitical volatility has already sparked tangible consequences as the global economy faces great uncertainty. Most recently, the US introduced one of the most dramatic trade tariffs in history, representing the largest overnight price shifts the global economy has ever seen, only to pause them a few days later. These sudden shifts have become a sign of the times, where uncertainty is now the new normal.

Where there was once optimism, sentiment has now waned. Recession fears are mounting, particularly in the world’s biggest economy. The implications are far-reaching. Supply chains are being re-evaluated, inflationary pressures are intensifying, and cross-border capital flows are becoming more cautious. Across industries, businesses are waking up to a reality defined by unprecedented uncertainty.

In this context, financial institutions are under real pressure. Their main sources of income from both lending, assets under management, and deposits, are all affected by growing uncertainty as it becomes increasingly difficult to manage risks, cash flows, profits, and client confidence.

This article marks the first in a four-part series on how financial institutions can navigate the climate of uncertainty. This piece covers the impact on retail and SME business banking, with a focus on managing uncertainty within lending rates and risk management. The following three articles will delve into how uncertainty plays out across:

- Wealth & asset management, where fees are highly sensitive to market movements.

- Deposit management, where balance sheet dynamics and margin compression require careful steering.

- FinTech, where an effective pricing strategy requires both short-term and long-term planning to drive increased pricing power, which can be further enhanced through an augmented value proposition.

Managing uncertainty using scenario planning

Right now, banks all over the world are closely following the development in risk of defaults, investment activity, demand for credit, and consumption behavior.

The key thing to accept in an economic and political environment like this is that it is impossible to predict the future.

Instead, banks need to prepare for multiple scenarios and have a set of actions for each. The differences between the winners and losers in a crisis is often the speed of recognizing the need for change and acting upon it.

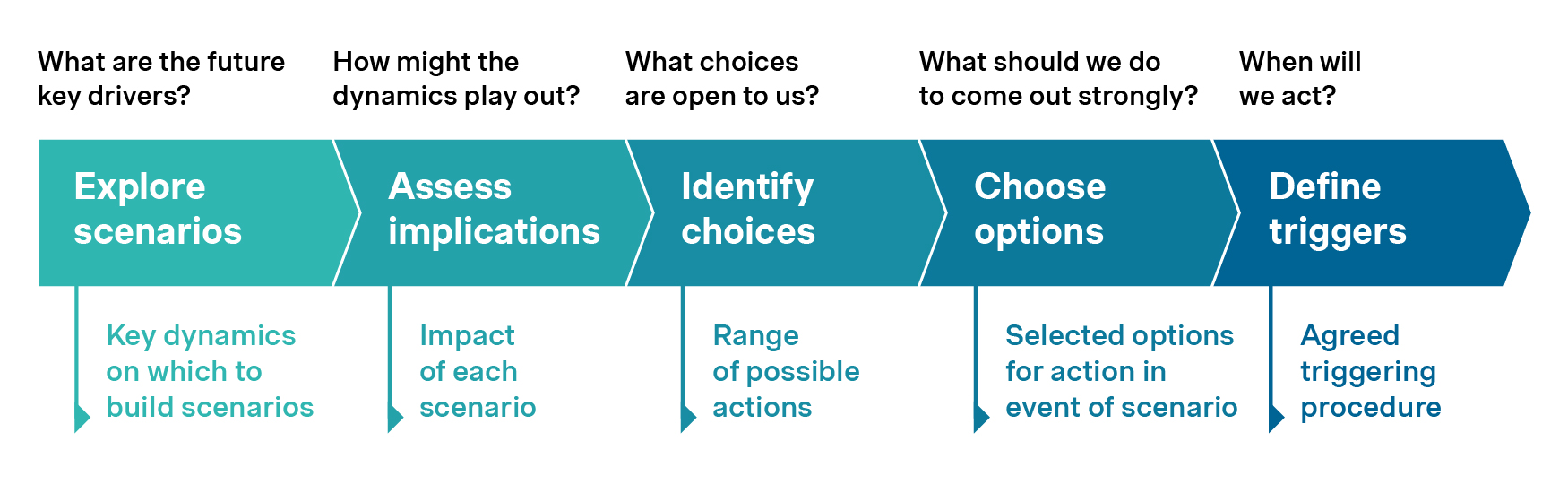

Banks can use a five-step scenario planning approach to manage uncertainty:

- Explore scenarios: Understand which key drivers will shape the economic environment in the coming years. E.g. will we be facing a long-term trade war or will tariffs be short lived as a “negotiation tactic” only? If the former, will it be the US vs. China only, or will the EU and rest of the world also face long-term tariffs? The key is to reduce the number of drivers to 2-3, building a manageable number of scenarios broad enough to cover the main outcome range.

- Assess implications: Understand the impact of each scenario. In the event of a long-term global trade war, this would most likely reduce the economic activity level and risk putting the world into a recession, leading to less lending levels, lower interest etc.

- Identify choices: Understand the options available to respond to each scenario. Keep an open mind and explore the full range of options before prioritizing in the next step.

- Choose options: What should we do to come out strongly? Now is the time to select the key actions should the scenario in question materialize. These actions ought to be concrete enough to implement without later debates.

- Define triggers: Understand when to act. An example a trigger could be linked to the ECB interest level, where a drop below a certain level could trigger wave 1 fee increases. A further drop would trigger wave 2 + cost reduction measures etc.

Scenario planning allows you to prepare and respond quickly to different scenarios. By doing this preparation now, you cut analysis and decision time when it matters and reduce the risk of rushing into bad decisions.

Five no-regret moves that banks should start tomorrow

Independent of the future market scenario, we at Simon-Kucher have identified five key “no-regret” actions banks can already take to strengthen their resilience.

- Pro-actively help your clients navigate the uncertainty

Proactively help clients navigate the uncertainty arising from the recent trade tariffs. For business customers, this may simply mean reaching out to reassure them that they have sufficient liquidity to stand against a short-term dip in income, or for personal customers confirming that their savings remain on track for a secure retirement.

At the same time, the current situation presents opportunities to support business customers more actively, such as offering extended credit lines, tailored trade financing solutions, or advice on managing cross-border risk.

Proactive, personalized contact is especially critical in times of uncertainty. Yet many banks still rely on generic mass communication. In contrast, leading banks leverage internal data to identify segment-specific needs, build focused contact lists, and create timely, relevant messages that resonate and drive action.

- Future proof your revenue model to offset potential loss in net interest margin

Prepare by ensuring a well-diversified income stream. In recent years, banks have benefited from a positive net interest margin and strong earnings on deposits. If the global economy is heading towards a low interest environment, then reducing reliance on interest income is desirable. Growing ancillary services like investments, insurance commissions, and transaction banking services, can add resilience. Increasing selected fees as well as a general review of the bank’s efficiency might also be needed to compensate for lower interest income.

As part of this, identify customer relationships with low or negative profit. If the relationships cannot be made profitable via cross-selling, increasing prices or reducing discounts and special conditions to correct the mispriced client relationships might be necessary.

- Review the trade war exposure of your loan portfolio

The announced tariffs on exports to the US fundamentally affect the competitiveness, and ultimately the revenue and profitability, of many exporters. If these measures persist, they could significantly impact earnings and credit risk across industries with high US exposure. But the ripple effects go beyond business: a slowdown in key sectors could also affect employment, consumer confidence, and household finances.

Assess which industries and customers in your loan portfolio are most exposed to potential changes in economic activity and in particular to the announced tariffs. While this exercise typically involves evaluating credit deterioration by stress-testing portfolios under different economic scenarios, it is typically not sufficient to fully understand the potential impact, in particular for business clients.

The reason is that understanding the impact on profitability is not straight forward. Discussions regarding the impact of US tariffs have until now mostly neglected the reaction of American customers to significant price increases. While price sensitivity is neither constant nor linear, as typically assumed in these type of discussions, understanding the impact of US tariffs requires a quantitative assessment.

In our recent article, Mitigation strategies: Preparing for US tariffs, we highlighted five key factors that will influence the actions companies should take. If banks want to fully understand the impact on their clients, we believe they should follow the same recipe in a data-driven and scalable way. Factors such as export dependency, competitive landscape, market shifts, product substitutability, and pricing power all shape how severely a company or industry may be affected – and how resilient it will be. Businesses with high exposure to the US, limited ability to pass on costs, or vulnerable price positioning, are more likely to face margin pressure, directly impacting profitability and creditworthiness. For banks, these insights are essential to proactively assess client risk.

- Define changes to risk-appetite and translate into pricing strategy

With a more detailed overview of the exposure of the loan portfolio, banks can now leverage this to reflect it in the pricing strategy. To do so, first revise the bank’s risk-appetite and ensure it is in line with the overall strategic ambition. While many banks are adept at adjusting risk appetite and determining when to scale lending up or down, fewer succeed in translating these shifts into a differentiated pricing strategy that aligns with segment-specific ROE targets.

A key challenge is that many banks still lack a structured, data-driven way to operationalize pricing. They often react to changes rather than proactively steering the business, such as adjusting pricing in real time or understanding how macro shifts affect profitability. Decisions are often made in silos, with little connection between front-line actions and financial outcomes. Banks need a more dynamic, forward-looking approach to manage risk, pricing, and performance.

The first step is to create transparency on client-by-client profitability, which will then support data-driven simulations, insights, and strategic decision making. This provides an understanding of how different pricing strategies impact clients while simulating how their evolving risk profiles (including changes to capital consumption, PDs/LGDs and internal resource usage) impact profitability and return on equity (ROE).

- Leverage best-in-class pricing tools and governance

One common challenge for many banks is the lack of tools for operationalizing strategic changes end-to-end within the organization. Leading pricing tools can support this transformation, from guiding relationship managers with next-best-pricing recommendations during client meetings to enabling management to simulate the financial impact of pricing changes at a customer level. These tools also help assess macroeconomic scenarios, such as falling interest rates and their implications for profitability.

However, the ability to run an analysis is insufficient without the supporting governance. Banks need to set up governance that ensures the right people look at the insights with the right frequency to help make the right decisions. Importantly, the insights and tools need to be made available to front line decision makers so they understand the impact on customer profitability and can simulate the impact of various corrective actions.

Strengthen your strategic readiness with Simon-Kucher

In today’s volatile economic environment, uncertainty is no longer an exception, but the rule. For retail and business banks, the ability to respond swiftly and strategically can make the difference between resilience and retreat.

At Simon-Kucher, we work alongside financial institutions to turn uncertainty into a source of strength. With decades of expertise in pricing and commercial strategy, we help banks operationalize scenario planning, strengthen profitability levers, and embed agile decision-making into their core. Whether you’re navigating loan portfolio risk, rethinking your revenue model, or adapting your pricing to shifting risk profiles, we equip you with the tools, insights, and governance to act, not just react.

Contact our retail and business banking specialists.