From new vaccines to healthcare apps, smart watches, and weight loss therapies – the opportunities for healthcare to deliver more value seem endless. Until recently, payers reacted to these trends with scepticism and resistance. How can the industry rethink healthcare and make “better health” a reality?

The past few years showed how quickly the healthcare industry can act. New partnerships were formed, commercial decisions were accelerated, and vaccines were developed at record speed. Healthcare’s response was, in many ways, brilliant. However, it was also a strong reminder that the industry has been mostly reactive rather than proactive.

We know that healthcare dedicates an immense amount of its time and resources to treating disease. But how much effort is put into maintaining and improving the population’s overall health and wellbeing? And is it enough?

The healthcare industry can do better

At Simon-Kucher, we believe in better health. We see opportunity for the industry to deliver even more value by focusing on maintaining and improving health, going beyond just treating it.

We’re proud that in the last 35 years, Simon-Kucher has advised over 500 companies on commercializing products and solutions that treat and cure diseases. Helping to bring innovative healthcare products to market and ensuring patients get access to the most effective treatments remains a top priority for us in the years ahead. But we also recognize that helping populations stay healthy and treating conditions or diseases as early as possible can lead to better outcomes for everyone: for providers, for patients, and for society.

Better health does not mean redirecting attention and funding away from those who are already sick. Rather, it means screening people for risks before they’re unwell and gearing treatments toward the needs of individual patients. It means giving patients more ownership of their health (and not just through cost-sharing), and helping doctors better understand disease early on through the right tests and tools.

Despite previous reluctance, payers are becoming more open to covering better health products. We’ve seen reimbursements for products like Viz LVO, an AI powered workflow and detection tool in the US. It’s no surprise there has been significant industry and PE/Venture Capital in this space, with an approximate 10 times increase in US digital health funding alone between 2012 and 2022.

Here is why we need to shift how we think about health.

Better ways to both heal and help people

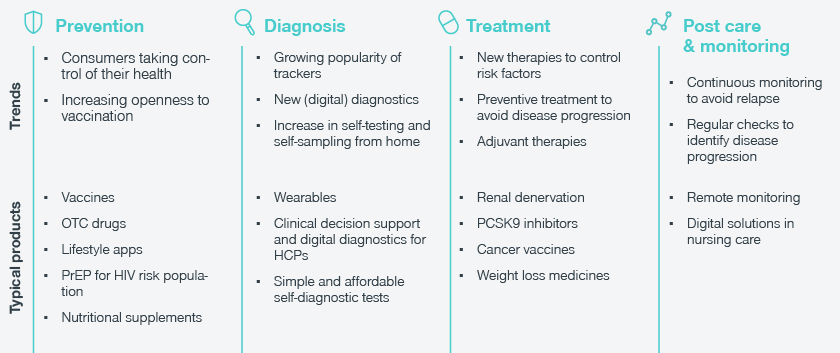

This shift in healthcare is an exciting and promising growth area for the industry, with relevance growing across the full spectrum of healthcare. Along the patient journey (Prevention, Diagnosis, Treatment, Post Care & Monitoring), we see several key trends:

Trends in prevention

Consumers want to take control of their health and wellbeing, seeking products to stay healthy. This proactivity is evident in the OTC drug and dietary supplement market, expected to grow at a CAGR of 6.8 percent from 2020 to 2027. Meanwhile, the global healthcare app market was valued at USD 4.1 billion in 2021, with consumers turning to technology for support with activities like meditation, sports, and diet.

On the pharma side, there is opportunity in preventative health measures. Similar to how pre-exposure prophylaxis (PrEP) medicine is offered as a prevention choice for people at risk of HIV infection, the industry can explore ways to prevent disease development entirely.

Meanwhile, new vaccines in the pipeline such as antiviral vaccines for RSV and rabies as well as anti-bacterial vaccines e.g., for C. difficile, accompany a raised awareness of and openness to vaccination. In response to the COVID-19 pandemic, the size of the global vaccine market more than tripled, from $38 billion in 2019 to $141 billion in 2021.

Trends in diagnosis

Another powerful development in better health stems from data, with many data-supported digital diagnostics and early detection tools in development. Examples include wearable monitors to continuously track heart rate and AI algorithms that analyze large amounts of patient data. These tools have the potential to greatly improve early detection of disease, allowing healthcare providers to intervene before symptoms become severe and potentially life-threatening. Thanks to their role in reducing costs for medical and surgical intervention, such tools are increasingly attractive for healthcare systems.

For instance, medical technology company HearthFlow provides a non-invasive diagnostic solution for coronary artery disease. It uses computational fluid dynamics to analyze a patient’s coronary anatomy and blood flow from a CT scan. The information can be used by HCPs to make more informed treatment decisions, while reducing the need for invasive diagnostic procedures.

Meanwhile, anyone with internet access can buy a genome test to understand their DNA – without involving a healthcare provider or leaving the house.

Self-test kits that allow individuals to test themselves for certain diseases in the privacy of their own home are also gaining popularity. Typically requiring a sample of bodily fluid, a small, portable device, provides results within minutes. Such kits can provide increased access to testing, especially for individuals who may face barriers to accessing healthcare facilities. They can also help to diagnose and treat infections more quickly, reducing the risk of long-term health complications. Examples include self-tests for STIs and urinary tract infections that detect bacteria, HIV tests that detect antibodies, tests that detect the presence of specific cancer markers, and of course, the well-known COVID-19 antigen tests.

There’s still untapped potential for the industry. As wearable fitness devices and health apps grow in popularity, many patients are already tracking vital parameters such as steps, sleep, and heart rhythms. But how often does this information come up in clinical conversations? With patient consent, this vast quantity of valuable data could not only be used to make healthcare more personalized. It could also help identify unmet needs across populations, inform medical research and decision-making, and lead to quicker, more accurate diagnoses.

Read more about it here: Early detection tools: Broadening the patient pool for innovative therapies

Trends in treatment

Alongside traditional healthcare products for treating diseases, we see several important trends in the area of secondary prevention. These treatments are often tailored to the needs of an individual patient and aim to prevent the recurrence or progression of a disease after diagnosis.

Adjuvant therapies are used in cancer care to reduce the risk of recurrence and improve outcomes. These could be adjuvant chemotherapy and radiotherapy to help kill remaining cancer cells, hormonal therapy to block the production or action of hormones that fuel cancer growth, or immunotherapy to help the body’s immune system fight cancer. Examples include Erleada to treat prostate cancer and IMFINZI to treat lung cancer.

Patients suffering from high LDL cholesterol levels are often encouraged to make lifestyle changes and are treated with cholesterol-lowering medications, like statins. However, those who are unable to effectively lower their cholesterol may be offered PCSK9 inhibitors, which increase the liver's ability to remove LDL cholesterol by blocking the PCSK9 protein. In line with better health, we expect to see an increasing number of innovations that improve patient health when standard treatments are ineffective.

One interesting example is the weight loss drug, Wegovy (semaglutide). While most treatment for obesity today begins with behavioral and lifestyle changes, Wegovy could change the way healthcare systems and society approach the disease. This once-weekly injection mimics the action of GLP-1 produced naturally by the gut and targets areas of the brain that help to regulate appetite. However, obesity is a new therapeutic area for manufacturers to navigate and in terms of reimbursement, demonstrating value remains a key challenge.

Trends in post-care and monitoring

Once a disease has been diagnosed and treated, it can still be challenging for patients to manage their conditions and identify deterioration in their own health. HCPs often only become aware that a patient has declined when symptoms are severe enough to require acute care. Even within a hospital setting, being able to immediately intervene can have a dramatic impact on patient outcomes.

Healthcare systems are becoming increasingly aware of the value that continuous patient monitoring offers, especially in identifying disease progression and avoiding relapse. Not only does it increase access to virtual care, improve patient-provider communication, and encourage greater patient involvement. Monitoring can reduce the cost of care for payers and providers by shortening hospital stays or helping to avoid them all together.

For example, French company Moovcare, provides remote monitoring solutions for patients with chronic conditions like heart failure. The company’s platform integrates wearable devices and telemedicine technologies to enable real-time patient monitoring and continuous communication with healthcare providers. In France, Moovcare's services are covered by some health insurance plans and are also available as an out-of-pocket payment option.

We need to shift how we think about health

It’s clear that better health provides multifold opportunities. However, this space is new and evolving and comes with its own set of challenges. Demonstrating and capturing value is not as straightforward compared to traditional healthcare and often involves funding flows and go-to market channels outside of the industry’s usual expertise.

Better health can also create tensions between market players. Some physicians’ schedules are too tight to use the simple diagnostic tools already offered by the industry. How can they find more time for the modern patient who tracks their own KPIs and arrives to consultations with their own queries and knowledge? How is the healthcare industry ensuring new technologies are properly used? What role will AI play in healthcare? Are all sides aware of the limitations? And are HCPs receiving the relevant support?

Better health is not a magic wand, and numerous key questions need to be answered before hastily jumping on this trend. Companies need to identify and evaluate how to best capture the growth potential in light of their portfolio – particularly important when it comes to:

- Demonstrating value and generating evidence

Convincing payers to reimburse disease prevention or to treat patients much earlier in their disease trajectory (even before symptoms present) is more complex than for traditional drugs and therapies. A particular hurdle is the ability to demonstrate value outside the usual mortality and morbidity benefits. So far, payers have shied away from providing access to some therapies due to their perceived lack of efficacy and the potential stigma as “lifestyle medications”.

For example, even though obesity is linked to many co-morbid conditions, payers still demand manufacturers generate meaningful improvements in health outcomes beyond weight loss, which may be viewed as a surrogate endpoint. There have been endless therapies which were able to show improvements in surrogate endpoints, but payers then argued that they failed to show any benefit in improving outcomes for patients. So, in order to achieve funding, it will be important for manufacturers to really understand what payers value.

New preventive therapies will also need to show evidence to support how they should be integrated into current standard practice. This is especially true for vaccines, which are governed by strict immunization schedules defined in each country. As an example, most countries recommend an influenza vaccine to be administered annually during the influenza season, at least for higher-risk patients.

New and future seasonal respiratory vaccines, like those targeting COVID-19 and RSV, will need to provide evidence around the value they provide to different sub-populations, the durability of protection, and the health-economic trade-offs of recurrent immunizations. Country-specific immunization bodies will then have to decide whether new vaccines for these additional seasonal diseases should be aligned with the schedule and population for which flu vaccines are recommended, or if the available evidence supports a new paradigm.

- Identifying non-traditional access and funding pools

We’ve talked about the exciting new developments in vaccines, but most manufacturers have limited experience navigating this landscape. Earning money with vaccines is challenging considering the centralized procurement processes, willingness to pay, public scrutiny, etc.

Similarly, it is clear trackers, wearables, innovative diagnostics, and continuous monitoring can significantly contribute to better health. But how can manufacturers monetize the added value they deliver? And who, in the end, should pay for them?

Should it be the healthcare system? They rarely provide the necessary funding for such treatments – but keeping the population healthy does provide substantial cost savings. Perhaps the patient should pay out-of-pocket. The question is, are they willing or able to pay? Meanwhile, manufacturers won’t be excited about offering their products for free, but helping patients start their treatments earlier and receiving valuable data about them does yield certain benefits.

- Finding the right go-to-market model

How consumers and patients access healthcare products is also changing. Until now, the main channel has been the pharmacy, with regulatory requirements like OTC status playing a role. But in a world where we can shop at a swipe, more and more consumers will move away from physical stores and toward convenient and accessible options. Here, direct-to-consumer companies are in a strong position to offer a seamless and superior customer experience.

D2C models are becoming essential part of the go-to-market strategy. However, this doesn’t just mean opening up an online shop and distribution channel. It requires effective communication, messaging, brand positioning, value stories, and packaging. Excellence in these areas will allow manufacturers to develop stronger relationships with consumers – becoming a known and trusted brand in daily life, rather than just a necessity during periods of sickness.

By collecting valuable customer data on behavior and preferences, manufacturers can provide personalized support recommendations in line with consumer needs. Meanwhile, this information can be used to improve future products, enhance cross-selling efforts, and develop more targeted promotion campaigns to drive consumer lifetime value. In short, D2C can lead to better outcomes for companies and better health for consumers.

However, D2C as part of an omnichannel strategy has its own challenges. Manufacturers must be even more precise in their brand and product positioning to target different shopping occasions in the most suitable channels and avoid cannibalization. They must ensure that their price positioning is internally consistent, value driven, and in line with market developments. They need to understand the monetization potential of levers like dynamic pricing, bundling, targeted promotions, and behavioral economics. And they need state-of-the-art tech stack solutions that allow for optimal analyses and insights.

Better health: We’re here to help

At Simon-Kucher, we’re excited about the countless innovative trends, technologies, and treatments and their potential to disrupt healthcare for the better. However, healthcare systems and regulations are not so easily disrupted. It will take dedication and a new way of thinking from both payers and providers to make this vision a reality.

There is definitely a drive toward faster, more proactive, more agile healthcare. Yet this transformation won’t happen overnight. With value creation, access pathways, and customer channels outside manufacturers’ usual expertise, we are here to help you benefit from these new and evolving opportunities.

Trending Topic

Better Health

We help you to unlock better health for everyone. We see opportunity for the industry to deliver even more value by maintaining and improving health, going beyond just treating it.