New technologies force companies to change, disrupt their entire business models, and inspire them to create new ones. Just think about the internet: while some companies were successful in tapping into its potential, others missed the opportunity. It brought about the decline of brick-and-mortar shops and traditional media companies, but gave birth to the biggest tech companies we know today. The next imminent question is, which technologies of the future will have a similar impact? In this article, we look at blockchain, exploring some of the most fascinating use cases and developments.

Rather than the technical depth of how blockchain works, as monetization experts, we are always most interested in the commercial opportunities of a new technology. Still, before getting into the monetization potential of blockchain, let’s quickly highlight its key properties and benefits. Technology gurus Don and Alex Tapscott do a good job of summing things up: “The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.”

Basically, blockchain is a decentralized database. This database is immutable, transparent, trustless, and, in many cases, public. Advantages include a highly secure network, transparent information, privacy, no need for middlemen, 24/7 availability, and accessibility for anyone with the internet.

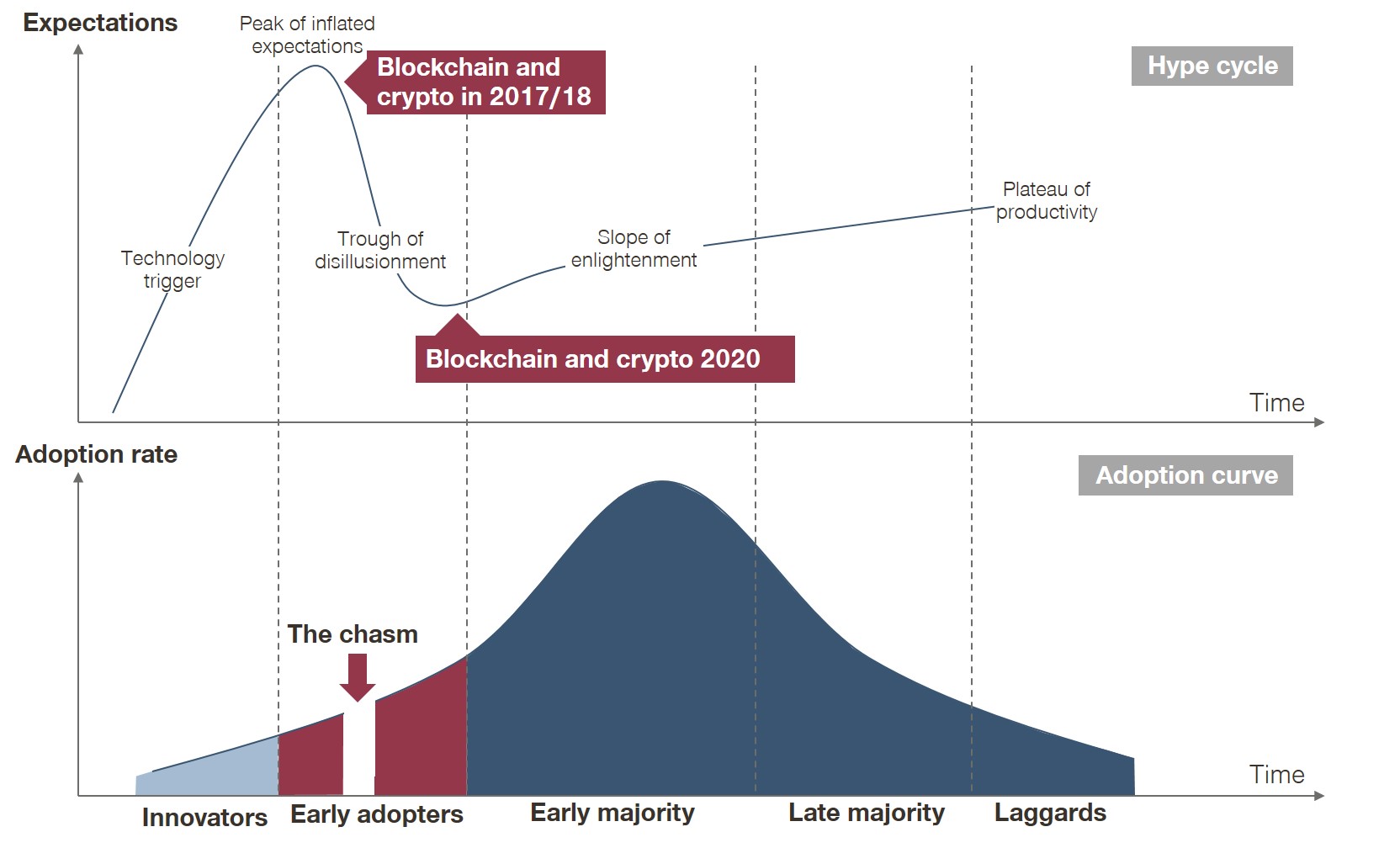

Blockchain customer segments and adoption curve

The peak of the cryptocurrency hype and the underlying blockchain technology was undoubtedly in late 2017 and early 2018. Everyone was talking about Bitcoin, as well as Ethereum and other tokens, and the internet was full of experts predicting the next big coin to “make you rich”. Then, in the first half of 2018, the bubble burst. The industry had to consolidate and start focusing on building actual businesses instead of quick ICOs (the unregulated risky sibling of IPOs). Today, we are at the beginning of the “slope of enlightenment”. Use cases, such as those in supply chain management, are about to bring real value to the table. It is just a matter of time until we see new or existing companies succeeding by using blockchain technology.

Due to the ongoing technical hurdles, the majority of early adopters are from the younger generations. However, as user interfaces improve and using decentralized applications becomes easier, the adopters will also age. In terms of regions, Asia is setting the pace, driven by an entrepreneurial spirit and a higher willingness to adopt new technology.

Four examples of new blockchain business models, products, and services

- New DeFi companies and protocols are mushrooming left, right, and center

One area where blockchain is really taking off is decentralized finance, summed up as “banking without a bank”. Saving, lending, trading, and hedging of cryptocurrencies on chain are the top use cases for blockchain right now. Let’s look at the payment and cryptocurrency platform, Cyrpto.com: It allows users to invest in crypto, save crypto with interest, trade cryptos, and spend cryptos with a Visa card. Cryptocurrencies are transferred into fiat currency in the moment of payment at a point of sale. Here, the major difference to a traditional bank is that the assets are always in the possession of the user. There is no deposit (loan to the bank) of money. The only way to access the money is via a private key, which is exclusively with the user at all times. Having a non-custodial digital wallet which grants you 100% access to your money at all times is a compelling selling argument in a world where trust in banks is low, especially in countries where banks have gone bankrupt several times, such as Argentina. - Blockchain allows for faster payments in the music streaming industry

What underscores blockchain’s potential is its ability to solve many problems. Here’s how fintechs Paperchain and Centrifuge teamed up using blockchain to provide a solution for a faster and cheaper advanced payment method: It usually takes three to six months for revenues from a Spotify stream to reach an artist. For small, independent artists, this could lead to serious liquidity issues. To solve this, Paperchain analyzes artists’ streaming data and estimates the revenues to be paid in six months’ time, while Centrifuge provides the infrastructure to convert these accounts receivable into an advanced payment, transferring real-world assets on chain. The tokens generated from the accounts receivable can be used as collateral for borrowing money. Currently, this payment is in form of the stablecoin DAI. One DAI always equals approximately one US dollar, so can be transferred into dollars without the volatility risk of e.g. Bitcoin. The liquidity for the advanced payment in DAI is provided by investors who are incentivized by earning interest. Not only is this advanced payment solution much faster, according to Centrifuge and Paperchain, it is also 80% cheaper than a traditional solution. - Digitizing and trading real-world assets in the real estate sector

Often, a product or service could not exist without the existence of blockchain, such as RealT’s offering. It lets owners tokenize their real estate and sell it in fractions to multiple buyers. On the buyer side, it enables anyone to invest in the real estate market with as little as 50 dollars. The rent of such a property is divided among all investors depending on their property share, and the interest rate on a particular property is the same for all investors, whether it’s a $500,000 or $50 investment. It will be interesting to see if this form of a much more liquid real estate market will succeed. - Increased efficiency in supply chain management and logistics

Blockchain is being increasingly used in the logistics sector, with key benefits including increased trust in the system thanks to greater transparency, traceability of goods, and cost reduction by replacing manual and paper-based administration. An example is Tradelens, an open and neutral supply chain platform underpinned by blockchain technology. Founded by IBM and Maersk, it has grown to 150 members, which includes some of the world’s largest logistics firms: CMA CGM, MSC, ONE, and Hapag-Lloyd. By freeing companies from legacy data systems, manual document handling, and poor visibility, it claims to generate efficiency gains of 15%, worth up to $1.8 trillion in 2020, and $5.2trillion per annum by 2050.

What are the pricing opportunities with blockchain?

One of the leading projects working on IoT and changing pricing models is found in the industrials sector. IOTA is an open-source distributed ledger and cryptocurrency based on the tangle, which has similar properties to blockchain. Transactions recorded on the IOTA tangle are also encrypted and tamper-proof, with the advantage over most blockchains that they are much faster and free from transaction fees. This allows hundreds and thousands of sensors in machines to store their data securely on the tangle in a way a centralized database or typical blockchain could not. With IOTA, manufacturing companies can get paid by the actual output of their machines instead of selling the entire machine. Sensors can measure whatever unit (output volume, time, quality) will be used for determining the price and store the data rapidly and securely on the tangle. Pay-per-use becomes a realistic pricing model in traditional industries, with the possibility of generating higher revenues over time, from currently unreachable customer segments.

How does blockchain impact customer journeys, sales channels, and organizational structures?

One of the biggest issues for cryptocurrencies is that the customer journey is still quite troublesome. It can take days from the decision to invest in Bitcoin to the actual execution. Download an app, create a wallet, send money from your bank account, wait for it to come, and then finally trade it for a Bitcoin. Companies such as Square, PayPal, and Revolut have shown there is demand in the market as well as a lack of frictionless fiat money on-ramp. That’s why the Cashapp from Square integrated Bitcoin in their application, becoming a huge success in the US. More and more banks and fintechs will follow, providing a seamless and frictionless fiat-to-crypto on-ramp. Looking at traditional businesses, the trend toward online sales channels with blockchain technology will only continue. The very nature of blockchain is to digitize assets and automate processes as much as possible. The more seamless and frictionless the sales process becomes, the better. Meanwhile, blockchain is also set to change organizational structures. Governance tokens, launched by fast-growing blockchain development companies in USA to decentralize decision-making, give stakeholders (governance token holders) a vote. The idea is that investors are incentivized to take the best possible decisions for the entire company. Only then, can the organization become more successful, and in parallel, tokens become more valuable.

Stay tuned for more interesting articles on new business models, product, pricing, and sales approaches of blockchain technology!