The industrial sector is grappling with inflation, evolving customer demands, and fierce competition. But there's good news: our 2023 Global Pricing Study reveals a powerful opportunity for growth. Value-based commercial excellence may be the key to move beyond inflation recovery and toward growth and profitability.

The industrials sector is in a state of flux. While 2023 saw improved price realization for many companies, driven largely by inflationary pressures, a crucial question lingers: are industrial businesses truly wielding the power of pricing, or simply riding the wave of inflation?

Simon-Kucher's latest Global Pricing Study, surveying over 945 executives and managers across 13 global industrial subsectors, sheds light on this critical issue. This blog provides key takeaways from the study to help you understand market complexities and achieve better growth.

Pricing power is on the rise, but are you missing the mark?

One of the most encouraging findings is the resurgence of pricing power. 65% of respondents reported the ability to pass through price increases beyond inflation and cost fluctuations. This signifies a potentially more inelastic environment, where demand remains robust despite price adjustments.

92% of global industrials firms increased their revenue in 2023, with over half exceeding average inflation rates. Additionally, 75% witnessed improved margins due to a combination of price hikes, increased sales volumes, and strategic product mix adjustments.

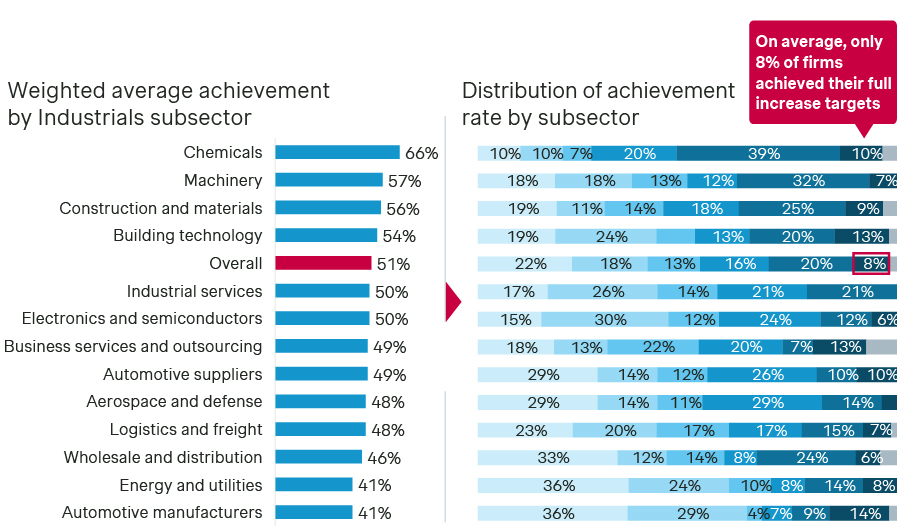

However, a deeper dive exposes a potential vulnerability. Firms achieved only 51% of their initial price targets, with less than10% fully realizing their goals. This suggests a heavy reliance on external factors like inflation, market demand, and decreasing profitability.

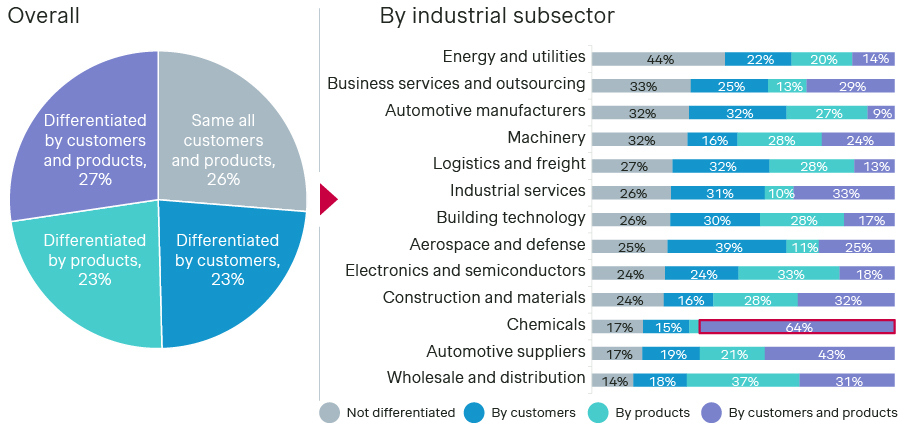

Despite strong price realization, a concerning truth emerges – only 27% of respondents differentiate price increases by both customer and product. This lack of maturity in pricing strategies raises a red flag. While inflation may have provided a temporary boost, to achieve long-term success, the sector must move beyond reactive pricing and embrace a value-based approach.

The differentiation advantage

The path to achieving pricing objectives becomes clear when we examine the impact of differentiation. Subsectors like chemicals, construction, and industrial services exhibited higher rates of price increase differentiation across both customers and products. These subsectors boasted an above-average target realization rate of 66%.

On the other hand, the energy sector, with only 44% differentiated price increases, saw the lowest achievement rate at just 41%. This contrast underscores the importance of tailoring pricing strategies to specific customer segments and product offerings.

Beyond inflation: Getting back to growth in 2024

While some industrial subsectors remain bullish on 2024's prospects, others anticipate a slowdown or downturn. This apprehension is fuelled by factors like stagnating demand, price pressures from competitors, and the emergence of new entrants.

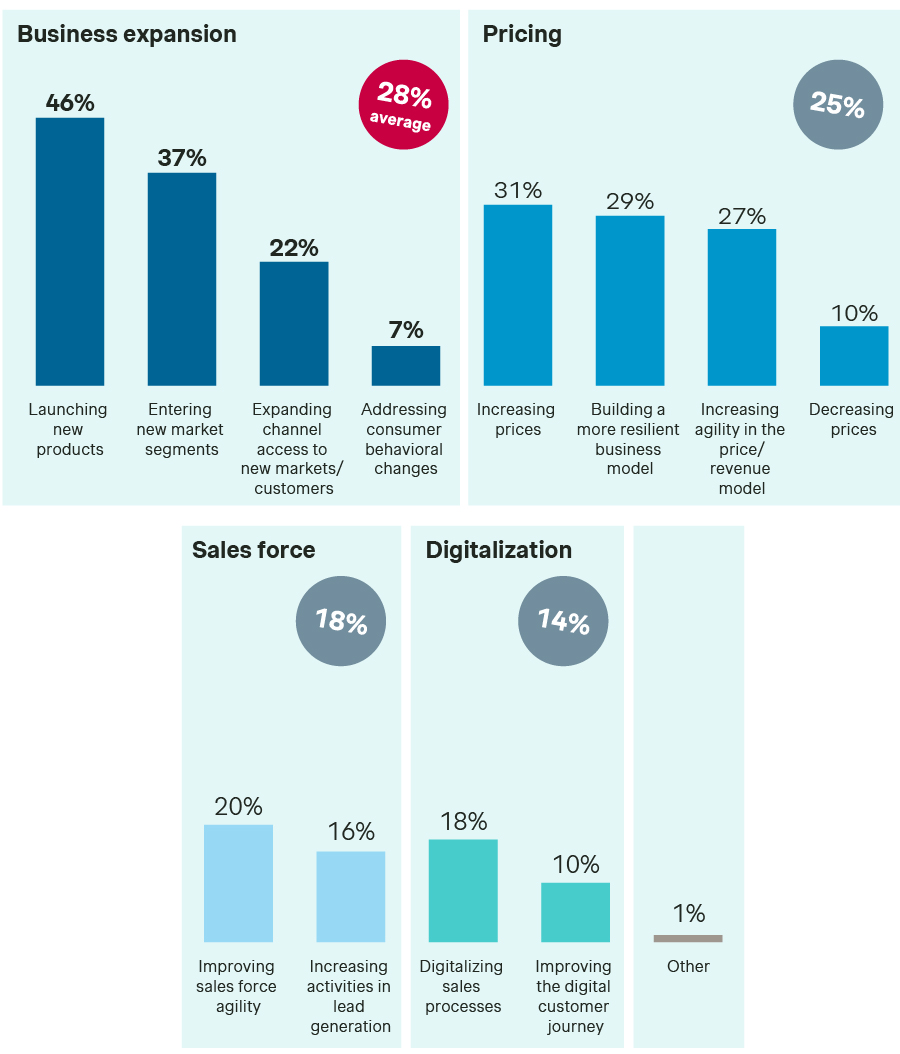

To combat these challenges, firms are prioritizing a multi-pronged approach. 46% of companies are focusing on new product launches, 37% are targeting new market segments, and 31% are emphasizing price increases. However, simply raising prices without a strategic foundation is unlikely to yield sustainable results.

The imperative of value-based commercial excellence

The key to unlocking long-term growth lies in value-based commercial excellence. This approach connects commercial levers directly to the value proposition offered to customers. Here's a breakdown of the crucial steps:

- Quantify value: Employ advanced customer research techniques and measure ROI to determine the true value your offerings deliver.

- Qualify value: Develop segmented value propositions that connect your product attributes to customer motivations and buying behaviours.

- Extract value: Implement structured and differentiated pricing strategies that capture the value you deliver.

- Build value: Foster a culture of innovation, ensuring your products resonate with customer needs and command premium pricing.

- Find value: Identify and expand into new market segments where your offerings hold a strong "right to win" potential.

- Enable value: Equip your salesforce with the tools and training necessary to effectively communicate value and close deals based on value propositions.

Embrace value-centricity in your pricing strategy with Simon-Kucher

The findings from Simon-Kucher's Global Pricing Study offer valuable insights for the industrials sector facing the current economy.

While short-term gains may have been achieved through reactive pricing strategies, long-term success hinges on a commitment to value-based commercial excellence. By differentiating offerings, quantifying customer value, and empowering your salesforce, you can unlock the true power of pricing and propel your industrial business towards viable growth.

Download our latest Global Pricing Study to discover your key commercial priorities to maximize revenue growth opportunities in 2024.

Form placeholder. This will only show within the editor