The bank collapses in early 2023 have exacerbated the issues of deposit outflows, underwater assets, and increased funding costs, particularly for mid-sized and regional banks. How can banks with strong fundamentals ride out the storm to emerge stronger?

US mid-sized and regional banks are contending with a punishing deposit gathering landscape following the collapse of Silicon Valley, Signature, and First Republic banks.

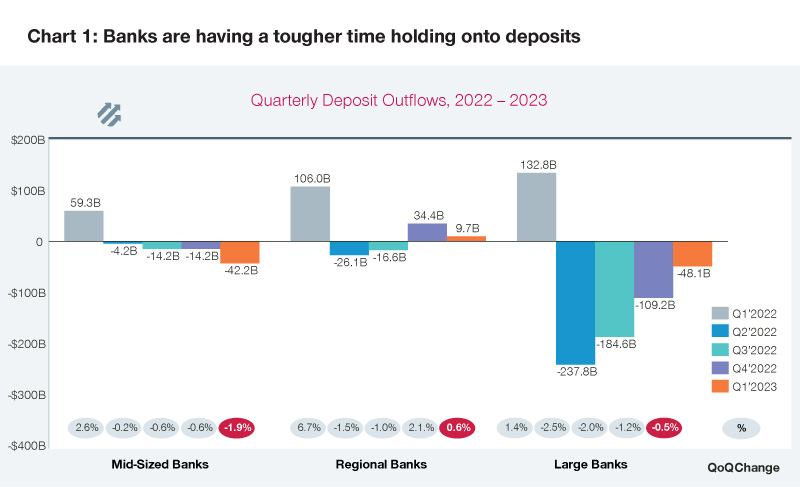

Deposit outflows, which were already rising in 2022 as customers sought out higher yields, accelerated in the first quarter. Outflows were more pronounced from commercial and affluent client segments, compared to retail deposits. Mid-sized banks with assets between $10 billion and $100 billion experienced noticeable outflows, losing 1.9 percent of total deposits in the first quarter of 2023 (chart 1).

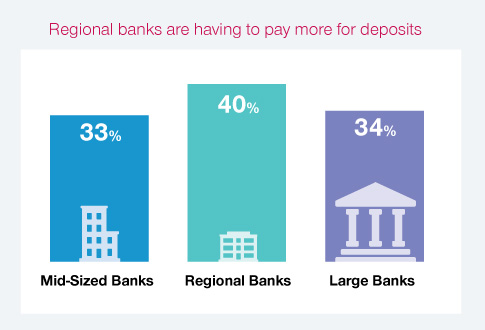

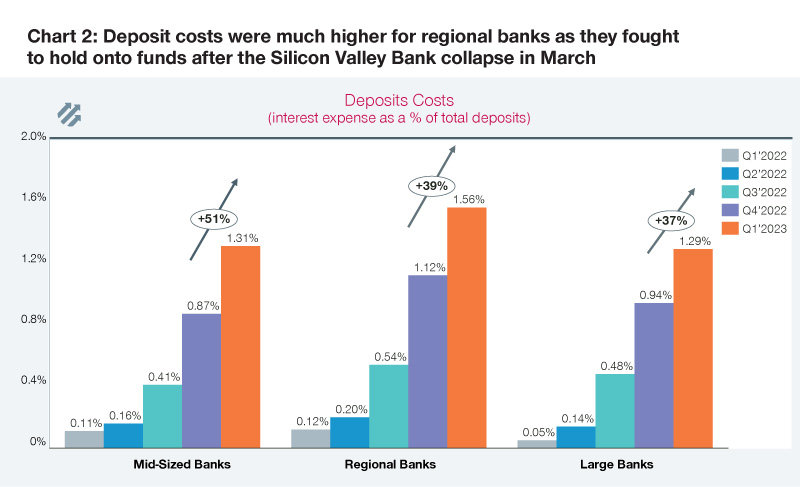

Meanwhile, funding costs were higher for regional banks reaching 1.56 percent of total deposits in the first quarter of 2023 (chart 2). While higher deposit costs are to be expected in the current rising rate environment, a close look at the deposit mix at regional banks suggest they are operating under tougher conditions. Deposit beta for regional banks at 40 percent is higher than at mid-sized lenders and large banks. Regional banks are having to pay more for deposits, a trend we expect will continue as the federal fund rates inch higher.

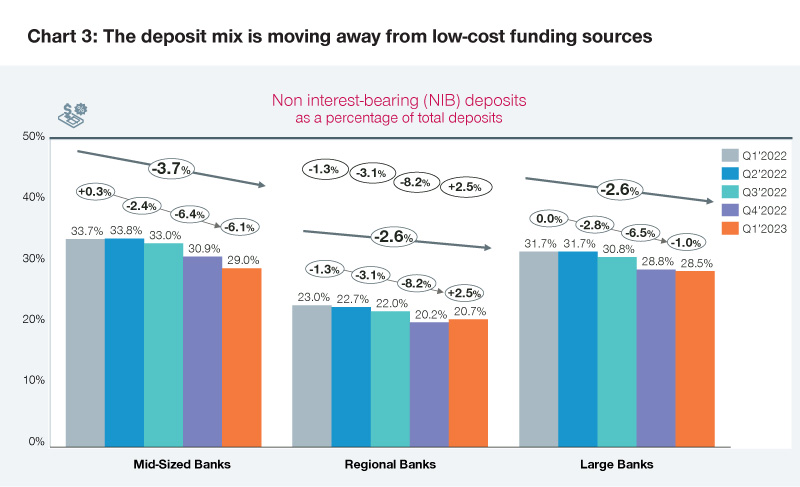

The deposit mix is also moving away from low-cost funding sources (Chart 3). In the 1990s, a period when the US economy experienced a similarly sustained high-interest rate environment, Non-Interest-Bearing (NIB) deposits made up only 16 percent of total deposits in certain years, according to our analysis at Simon-Kucher. With the persistence of high interest rates in 2023, we anticipate NIB deposits at regional banks to constitute less than 20 percent of total deposits.

The flight to safety, rising cost of funds, intense competition for deposits, and crisis of confidence have made deposit-gathering particularly challenging for regional banks with $100 billion to $250 billion in total assets.

How can regional banks with strong underlying businesses ensure they can continue to have access to stable, reliable funding sources? How do they reinforce their deposit gathering franchises to be more resilient and responsive to the evolving economic realities of banking?

Regional banks' short-term priority must be to ensure adequate liquidity. Now is the time to achieve maximum efficiency in deposit gathering. As customer priorities shift, banks must respond with the right product offering at the right price.

Banks must also double-down on retention. Here banks can leverage flow-of-funds analytics to monitor fund movements and identify the types of deposits at risk of attrition. Ultimately, the crisis has emphatically signaled that banks need to reassess their deposit gathering strategies in light of the new banking landscape.

Let's expand on each of these priorities.

What should regional banks prioritize in the short term?

1. Become extremely efficient with deposit acquisitions

The crisis has kicked the deposit race into high-gear, and the competition to attract stable funding sources has intensified. To ensure they are hyper-efficient with deposit acquisition, banks must move away from blanket pricing practices toward designing differentiated, personalized deposit offers. It is important to identify price- sensitive customers to customize offers as a way to retain liquidity while also containing costs.

Taking a differentiated approach to deposit pricing means banks can achieve an efficiency frontier where they are getting the most out of each interest expense. Higher rate deposit offerings can be used to attract price- sensitive customers while lower rate deposit offerings with more flexibility can attract less rate-sensitive customers.

Now more than ever, deposit pricing and product design must be precise, competitive, and effective.

2. Introduce customer-centric products and experiences

The banking turmoil, rising rate environment, access to information, and ease of rate comparisons have made bank customers more aware of competitive interest rates and the importance of deposit insurance. Banks must be proactive to anticipate their customers' changing priorities, preferences, and needs, and to introduce compelling and competitive deposit products and experiences.

For example, banks can proactively remind married customers to open joint accounts as well as single accounts for each spouse as a way to maximize FDIC insurance coverage. Deposit sweep programs can help eligible investors diversify deposits across multiple institutions, while cash management accounts can help some customers secure FDIC insurance for amounts above $250,000.

Bank customers are also increasingly seeking guidance and direction from their banks on how to save and best manage their money. There is an opportunity for banks to introduce gamified savings and intuitive money management tools to differentiate themselves in an increasingly competitive marketplace. For customers with higher deposit balances, banks can leverage the chance to guide or offer financial advice to help them reallocate funds into higher-yield products.

3. Identify deposits at risk of attrition for retention effort

Banks must double-down on deposit retention and find ways to prevent churn. Leveraging flow-of-fund data modeling, banks can gain accurate, real-time insights into how their customers' banking behaviors are evolving and changing. A flow-of-funds data model tracks customers’ fund movements internally within the accounts held at the bank (i.e., between a customer’s various deposits, lending, and investment accounts), as well as externally involving the customer's accounts at other financial institutions.

Analyzing fund movements at both sub-segment and individual customer levels can help banks to pinpoint customers at risk of attrition. This process can also serve as an early warning system, alerting the bank of the need to deploy retention strategies. For example, data analysis might reveal that a certain segment of bank customers is likely to move money externally when a deposit instrument’s term ends. To retain these customers, the bank can orchestrate well-timed deposit offers that includes coveted perks like a complimentary HBO Max subscription to convince these customers to stay.

4. Find ways to get more deposits, fast

It is hard to acquire and build a retail deposit base overnight. Harder still if you don't have the branch footprint to attract big dollar deposits. Regional banks can explore a number of options including a digital-only bank offshoot as an alternate deposit-gathering engine.

Digital-only banks, including Ally Bank and Bask Bank (a subsidiary of Texas Capital Bank), have successfully established stable deposit bases without a physical branch presence. Digital-only banks can also be a smart, strategic way for a regional bank to diversify its funding sources. For example, Ally attracted a record 126,000 new deposit customers or $813 million USD in new deposits in the first quarter of 2023. Millennials and younger customers made up nearly 70 percent of these new retail deposit customers.

Intense scrutiny on the vulnerabilities of regional banks will persist. The US economy is slowing, interest rates continue to climb, and inflation remains stubbornly high. There is also the looming threat of a commercial real estate crash, a sector where regional banks have more lending exposure. Regional banks must intensify efforts to strengthen their deposit operations, to protect their customer relationships, ensure access to low-cost, reliable sources of funding and liquidity, and secure financial stability in times of turbulence.

Contributing Author:

- Betty Cowell, Senior Advisor