Many retailers oversimplify category management and treat it as just a pricing issue. In reality, it’s a much bigger, multi-layered challenge. However, successful category managers don’t just think about price. They think about consumer behavior, product relationships, and how to create a seamless shopping experience that maximizes both sales and margins.

The true definition of category management

Category managers are often measured on short-term financial metrics like margin and revenue growth. This makes sense, but if that’s the only KPI they’re accountable for, it creates tunnel vision. You end up making decisions that optimize pricing and margin in the short run but hurt the category’s long-term health. Let’s say a category manager is told to increase profitability in frozen foods. If they only focus on margin, they might:

- Raise prices on bestsellers – which could actually reduce sales volume and drive customers to competitors.

- Cut slow-moving SKUs – without realizing those products play an important role in offering variety and reinforcing brand perception.

- Push high-margin private label items aggressively – which might alienate customers who prefer national brands and erode trust.

The problem here is category managers aren’t just managing an isolated P&L statement. They’re managing customer choices and behaviors. If the only KPI is short-term profitability, they might ignore key factors like traffic-driving SKUs, cross-category purchasing behavior, and brand loyalty.

Another issue is when category managers lack full visibility into the bigger picture. They’re focused on their specific category, but customers don’t shop in categories. They shop across the entire store.

A pricing decision in one category can affect others. But if category managers are only incentivized to optimize their own margins, they’re not thinking about broader customer impact. This indicates improvement potential in your category management strategy.

The real problem is how success is measured. Success in category management isn’t just about pricing and margin. It’s about ensuring all four levers work together to drive sustainable growth. That means measuring the right KPIs as part of your category management process:

- Pricing: Are our pricing decisions reinforcing our price perception and brand strategy? Are we optimizing for revenue without driving customers away? Where should we invest, and where shouldn’t we?

- Assortment: Are we offering the right product mix that balances choice and simplicity? Is our assortment structured to increase basket size and margin?

- Marketing: Are we engaging the right customers at the right time? Do our marketing efforts align with category goals and drive long-term value?

- Promotions: Are we running strategic, targeted promotions that grow the category, or are we relying too heavily on frequent discounting that erodes margins and conditions shoppers to expect lower prices?

Pricing – more than just a number

Pricing strategy isn’t just a numbers game. It’s a story about how a retailer wants to position itself in the market.

Knee-jerk reaction to price cuts is one of the biggest mistakes retailers make. The moment they see a competitor lowering prices, they panic and follow suit, without stopping to think about whether it’s the right move for their business.

The problem is that pricing isn’t just a race to the bottom. Sure, slashing prices might bring a temporary boost in traffic, but what happens next? If customers start expecting lower prices all the time, it becomes harder to bring them back up without backlash. And worse, it cheapens the retail brand, making it harder to differentiate from competitors who are also stuck in the same downward spiral.

This is where price perception plays a huge role. Customers don’t actually know the exact price of every product they buy, but they have a general feeling of whether a retailer is “cheap,” “fair,” or “expensive.” That perception isn’t built on one or two products or services. It’s shaped over time by pricing strategy, promotions, assortment, market trends, and overall shopping experience.

A retailer that understands this won’t just blindly react to a competitor’s discount; they’ll think about whether their price positioning still aligns with customer expectations and whether lowering prices is really the right move.

Price elasticity is also crucial. Not every product needs to be price competitive. Some items are highly price sensitive, the staples and essentials. Even a small price increase can push customers elsewhere. But for other categories, the premium or specialty products, customers care more about quality and experience than price alone.

If you don't understand which products are elastic and which aren’t, you might be cutting margins on items where they didn’t even need to compete on price in the first place.

What Simon-Kucher brings to the table is a structured, data-backed approach that helps retailers move from reactionary pricing to strategic revenue management. Instead of just following the competition, you can lead with a pricing strategy that reinforces your brand, optimizes margins, and maintains customer trust.

Imagine if you had real-time insights into:

- Which products are truly price sensitive and which ones aren’t (so you only adjust where it actually matters).

- How pricing changes affect customer perception and shopping behavior over time (so you don’t erode brand equity by over-discounting).

- How to balance promotions and regular pricing (so you can drive volume without training customers to wait for discounts).

With Simon-Kucher’s expertise and tools, you can stop guessing and start making informed, profit-driven decisions. Contact us today.

Assortment – the product mix strategy

Assortment is one of the most misunderstood and under-optimized areas in retail. One major issue is finding the right balance between breadth and depth.

- Too many SKUs can overwhelm customers, slow down inventory turnover, and increase operational complexity.

- Too few SKUs, and customers feel like they don’t have enough choice, which can push them to competitors.

It’s a tough balancing act, especially since different types of shoppers want different things.

Another big challenge is aligning assortment with customer demand. Many retailers still make assortment decisions based on historical data or supplier relationships, rather than real-time insights. Some categories might need constant newness and trend-driven innovation, while others need stability and consistency. Fail to adapt to these dynamics, you end up with too much dead stock in some areas and too many stockouts in others.

Another struggle is assortment localization. Customers in urban areas might have totally different shopping habits than those in rural areas. A store in a high-income neighborhood needs a different product mix than one in a price-sensitive market. Yet, a lot of retailers still apply a one-size-fits-all assortment strategy, instead of using data to fine-tune product selection based on location, demographics, and buying behavior.

Then there’s private label vs. national brands. Retailers know that private label can drive margins and build differentiation, but many struggle to figure out how much private label to introduce and in which categories. Some retailers overdo it, cutting out too many national brands and hurting customer trust. Others don’t push private label enough and miss out on higher-margin opportunities.

Key takeaway: Optimize your assortment based on real-time customer behavior and store-level insights. With the right approach, you can shift from reactive assortment decisions to a proactive, dynamic strategy that aligns with what customers are buying right now, in specific locations, through specific channels.

This is where Simon-Kucher’s data-driven methodology comes in:

- Use real-time customer behavior analytics to identify which SKUs are actually driving value vs. taking up shelf space.

- Evaluate end-to-end profitability to understand which articles contribute to the bottom line, and which do not.

- Optimize assortment and inventory management by location, ensuring every store (or online channel) has the right mix for its specific customer base.

- Balance private label and national brands strategically to maximize margins while maintaining customer trust.

- Identify gaps and unmet demand, introducing new products where customers are looking for options.

Those who get this right see higher basket sizes, improved margins, and higher loyalty. Reach out to Simon-Kucher so your customers can consistently find what they need.

Marketing – the image and demand engine

How are you fairing in the battle for attention? Today’s consumers are overwhelmed with messaging, but only a few retailers truly connect. In a crowded landscape, it's not just about visibility but about being remembered, trusted, and chosen.

Traditional mass-marketing techniques don’t work as well anymore because consumers expect personalization. Here, data-driven insights can help you target the right customers with the right offer at the right time. The technology already exists to help you do this, e.g., AI-driven segmentation, predictive analytics, dynamic pricing in ads.

And of course, measuring marketing effectiveness is another major pain point. With so many channels and touchpoints, it’s hard to pinpoint which campaigns are actually driving conversion, customer loyalty, and lifetime value. Many still rely on outdated KPIs like click-through rates and foot traffic, rather than measuring how marketing influences actual revenue and profitability.

The thing is, marketing isn't just about driving more people to the store or website. It's about attracting the right customers and influencing their behavior in a way that maximizes revenue.

If you focus too much on just getting traffic, but those visitors aren’t aligned with your brand's positioning or don’t convert into meaningful purchases, you're wasting marketing spend. Campaigns that focus only on short-term tactics can dilute your brand image. Attracting the wrong audience or sending inconsistent signals can weaken the trust and perception you've built over time.

Instead of just asking, "How can we get more traffic?" you should be asking, "How do we get the right customers to engage with our brand in a profitable way?" A strong marketing strategy can:

- Encourage repeat visits by keeping the brand top-of-mind and driving habitual shopping behavior.

- Influence basket size by promoting relevant add-ons, cross-selling, and personalized product recommendations.

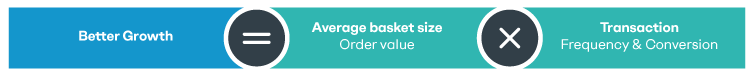

This is the key to better growth:

You don’t just need more marketing. You need better marketing that contributes to your bottom line. That's why, at Simon-Kucher, we help retailers turn marketing into a measurable growth engine rather than just a brand awareness tool:

- Identifying the most valuable customer segments and targeting them with the right messaging.

- Optimizing promotions so they drive price image, frequency and ideally margins, not just discounts and margin erosion.

- Aligning marketing, pricing, and assortment strategies so that every touchpoint is working toward a common goal: profitable growth.

Turn your marketing into a growth engine today with Simon-Kucher.

Promotions – more than just price cuts

Are you using promotions as a blunt instrument, just throwing out discounts to boost short-term sales? If you don't design your promotional activity strategically, you risk eroding margins and weakening long-term price perception. Promotions should feel like an opportunity, not a necessity. If customers start waiting for sales because they know prices will drop, you have lost control. But if promotions are designed carefully, targeting the right customers at the right time with the right incentives, they can actually drive long-term profitability rather than just short-term spikes.

A data-driven, behavioral approach that ensures every promotion serves a purpose beyond just boosting short-term sales. With the right strategy, you can optimize promotions to:

- Increase long-term customer value and enhance customer satisfaction rather than just creating one-time sales spikes.

- Protect margins by targeting the right discounts to the right customers, rather than applying blanket price cuts.

- Shape customer behavior by reinforcing full-price purchases and using promotions as an incentive rather than an expectation.

- Align with pricing and brand positioning so that promotions don’t dilute value perception.

At Simon-Kucher, we help you design promotions that go beyond price cuts. We use tools like predictive analytics, segmentation modeling, and promotion effectiveness tracking to help you make informed decisions and ensure every promotional move actually drives profitability.

Run smarter promotions with the support of our specialists.

Efficient category management: Growth beyond pricing

Price image is incredibly powerful, but it’s just one piece of the puzzle. It has a domino effect on everything: customer perception, frequency of visits, basket size, and ultimately, loyalty. But if your approach to category management only focuses on price, you’re missing the bigger picture.

Pricing is just one lever in a much bigger system. What you need in category management is a holistic, revenue-driven approach. One that ensures pricing, promotions, assortment, and marketing all work together seamlessly.

Think about it this way:

- You can have “perfect” prices, but if your promotion strategy is inefficient, you'll bleed margin.

- You can optimize pricing, but if your marketing program isn’t driving repeat business, you're leaving money on the table.

- You can price intelligently, but if your product offering isn’t aligned with customer demand, you’ll lose sales to better-assorted competitors.

That’s why Simon-Kucher goes beyond pricing. We optimize the entire customer offering to get all the pieces of the puzzle working together. There’s money on the table, and we know how to help you get it. Contact our specialists today.