New Year’s resolutions: Usually, they result in jam packed gyms. But, as they are in many ways, things are different in 2021. Social distancing measures and temporary lockdowns due to the COVID-19 crisis significantly interfere with fitness providers’ business models. We identified seven winning strategies to help fitness companies adapt to these circumstances and set themselves up for a sustainably successful future.

The holiday season is over, and 2021 is well underway. In most years, many people take the New Year as an opportunity to start or restart their fitness routines. As a result, the first quarter of the year usually acts as a solid backbone for fitness providers. According to the International Health, Racquet & Sportsclub Association, the number of new members is, on average, 50 percent higher in January than in other months. That won’t be the case this year. After making it through the government-mandated shutdowns of spring 2020, fitness centers in Europe had to close their doors once again three months ago, and it isn’t certain when they’ll be able to reopen. The 480 million euros in monthly losses incurred so far by the German industry alone are expected to increase with the cut down in January registrations this year.

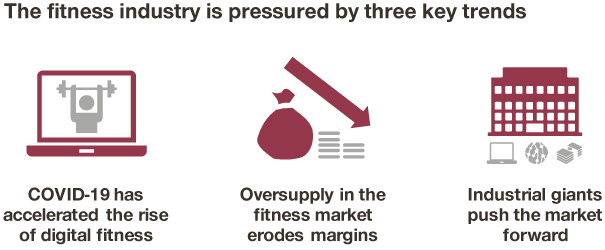

These severe circumstances have accelerated three major trends that will and have changed the world of the fitness industry indefinitely:

The COVID-19 crisis and the resulting lockdowns have forced a change of training behavior and demands and accelerated the rise of digital fitness solutions like apps, online live courses, wearables, and more. While the number of fitness app users in Germany increased by 25 percent in 2020, the number of gym memberships decreased by 16 percent. What’s more, an oversupply of providers, mainly driven by the growth of discount gym chains and inexpensive (or even free) digital offerings, has led to eroding margins.

Fitness companies are struggling to maintain their price levels and customer loyalty these days. After all, a new group of players has joined the fitness market – industrial giants, especially ones like Apple from the tech sector, have claimed their share of the market by introducing new offerings that benefit from their broad organic reach, a critical mass of users, and massive capital investments.

These trends and the continued repercussions of frequent shutdowns will require the fitness industry to change gears to regain profits fast and sustainably.

7 winning strategies and their best practice examples

How can fitness providers start to recoup their revenue losses and even generate new profit sources? We have identified seven strategies to boost the top line. Read on to find out which specific challenges they address and which companies are already deploying them most effectively.

Winning strategy #1: Don’t forget – basic biases of human behavior drive loyalty!

- Challenge: In the highly competitive fitness market, customer loyalty has to be constantly earned. This is especially true with the COVID-19 restrictions. Now that many consumers can’t go to their preferred gym, they’ve started looking for other offerings and digital providers, which might only be a fingertip away, leaving fitness companies scrambling to keep their customers from switching to one of the alternatives.

- Solution: Fitness customers usually have clear goals: Get fit, healthy, and attractive. However, these goals take time to achieve, which is a source of frustration and leads to declining motivation and therefore customer churn. Companies can prevent this and win in retention by creating substitute feelings for these long-term achievements using insights on consumer psychology and behavioral economic tools. This can consist of providing individualized services, introducing gamification aspects into their customers’ experiences, or offering incentive programs for active customers.

- Best practice example: A company that incorporates these kind of techniques very effectively is Freeletics, a provider of digital fitness experiences with more than 50 million global users. In order to generate exceptional user engagement and a retention rate of above 70 percent by fostering three key feelings. Through “mastery” of new skills, “belonging” to a fitness community, and “progress,” which is visible through gamification aspects and statistics, Freeletics creates psychological lock-in effects. This has been especially successful during the ongoing COVID-19 crisis, which prevents customers from developing these positive emotional attachments in conventional gyms.

Winning strategy #2: Converge fitness technology to stay relevant!

- Challenge: With more and more fitness providers competing for customers, companies need to upgrade their customer experience to convince.

- Solution: There are a variety of aspects that can help improve the experience of fitness offerings, like modern hardware (e.g. equipment, smartphones, wearables), the accompanying software (e.g. services, apps), helpful content (e.g. training and nutrition plans, live and on-demand workout videos), and infrastructure (fitness centers, but also platforms, servers, and digital communities). Building holistic products that integrate all of these components but are still simple, convenient, and available to customers around the clock makes the difference. For fitness infrastructure providers, like gyms, the convergence of existing infrastructure and hardware with new software and digital content can help create authentic customer experiences that lead to much-needed lock-in effects. At the same time, providers of digital fitness services also need real-world customer experiences to stand out from the other available apps.

- Best practice example: Exemplary in this regard is equipment and media company Peloton, which is stirring up the market with their stationary spin bike. By including smart features and a monthly subscription for personalized live and on-demand fitness classes, Peloton offers a holistic solution that integrates hardware, software, and content into the underlying infrastructure. Customers get an exceptional fitness experience, which is reflected in a net promoter score of 94 out of 100 (a value indicating customers’ likelihood of recommending a product) and has ultimately led Peloton’s market capitalization to nearly quintuple over 2020 and reach 25 billion US dollars.

Winning strategy #3: Make your bundles and upsells meaningful!

- Challenge: In an industry where oversupply and an increased presence of low-cost operators and inexpensive digital alternatives lead to eroding margins, fitness vendors need to monetize their sales effectively.

- Solution: To capture the full value of their offering, fitness companies should start offering bundles as well as up- and cross-sells that lead to the next training level for customers. This requires both portfolio optimization (e.g. with a versioned offer to skim different customers’ willingness to pay) and a solid base of customer and behavior data. This information enables well-trained sales teams or, in the digital world, well-programmed recommendation engines to take a look at customers’ individual needs and preferences and suggest tailored additional services at exactly the right moment. For example, right after a user has achieved a certain running record for the first time, they get an upsell offer for new running shoes.

- Best practice example: Sports apparel manufacturer Nike excels in doing this with its apps Nike Training Club and Nike Running Club, which provide free, customizable workout and running plans, videos, and tips. With these apps, the company is able to collect data on users’ characteristics, training behavior, and product preferences. According to these insights, customers receive personalized product recommendations in the integrated web shop. During the last year, Nike’s apps, inter alia, helped the company to add 55 million new customers to its member database, including valuable data on their product needs.

Winning strategy #4: Claim and defend a niche to conquer the mainstream!

- Challenge: The large number of fitness vendors and offers makes it challenging for smaller players to enter the mass market.

- Solution: A successful strategy is to claim and defend a specific niche market first and then expand into the mass market later. In niche markets, less competition means lower entry barriers, making it easier for players to grow an initial customer base, optimize their product, and solidify their position. This gives them enough experience and a strong foothold to gradually expand into the mass market.

- Best practice example: Zwift, a cycling and running app and community, did this successfully. Starting out as an invitation-only beta program for cycling enthusiasts bored of the monotony of indoor cycling, they strengthened their position by entering into partnerships with professional cyclists, equipment manufacturers, and racing events. After four years, they started a cooperation with the popular tracking platform Strava. This (combined with a product expansion into running sports) helped Zwift establish themselves in larger markets. Today, they register more than 2.5 million users and have become a fitness unicorn, being valued north of one billion dollars.

Winning strategy #5: Fitness is like fashion – drive relevance with constant innovation!

- Challenge: With fitness being the most popular kind of sport practiced globally, the fitness market has a highly heterogeneous customer base. The Fulfilling the wishes of the most lucrative customer group is vital to stay relevant in the industry. Apart from that, companies also have to fight off strong competition, fulfill ever-more sophisticated customer needs, and participate or even set the pace with ever-changing trends.

- Solution: To stay competitive, fitness companies can learn a lot from the fashion industry, where effective segmentation and constant product innovation are necessities to serve diverse customer needs. Fitness companies should launch new products and brands every season to cater to consumers who ask for constant improvement. Being able to provide the “next” product, which is even better than the last, creates a competitive advantage.

- Best practice example: A real pace setter in this regard is the RSG Group, which owns 17 brands in total, including gym chains Gold's Gym and John Reed, digital fitness solutions, nutrition suppliers, model agencies, and fashion labels. Starting out with the discount gym chain McFit, which had an unknown business model at the time, the company constantly evolved into different market segments through product extensions and acquisitions. Today, RSG is the leader in the European gym market with more than six million members in its 1,000 locations.

Winning strategy #6: Join forces to grow – the ecosystem wins!

- Challenge: Fitness is only one segment within the large spheres of health, leisure, and wellness. In this widespread market, there are many different players with overlapping goals, which can lead to strenuous competitive struggles.

- Solution: The smarter way is to combine forces and form partnerships that benefit every participant. For instance, health insurance companies and fitness vendors both have an interest in their customers staying fit. If they align, they can reach this objective more easily and profitably.

- Best practice example: Italian insurance group Generali and health and wellness company the Vitality Group show how it’s done. In cooperation, they developed the fitness rewards system Generali Vitality for Generali insurance customers, which subsidizes and rewards an active lifestyle, regular health checks, and trainings that are logged through fitness trackers from other cooperation partners. With this product, Generali aligns manufacturers of sporting equipment and apparel, providers of fitness services, and health specialists all within its own insurance product. All partners benefit from additional revenue, and Generali both increases customer satisfaction within its insurance product and decreases costs due to its customers’ active lifestyles and subsequently lower health expenditures.

Winning strategy #7: M&A strikes – now is the time to consolidate the market!

- Challenge: Throughout the COVID-19 crisis, customer acquisition costs remain high due to an oversupply of vendors and new dominant players emerging in the market. To secure long-term success, fitness companies need to increase their customer base and broaden their scope of services to be resilient in challenging times.

- Solution: Besides growing the customer base organically, which can be expensive, there are other strategies to acquire customers, for example strategic acquisitions. As the COVID-19 crisis has caused many companies substantial losses, potential targets are relatively inexpensive. Therefore, active market consolidation becomes a viable growth strategy that broadens fitness providers’ customer base, lowers their customer acquisition costs, and creates additional value for customers. Acquisitions with this goal can happen within the own vertical as well as across verticals and include both forward and backward integrations of the value chain.

- Best practice example: How well this works demonstrates Hansefit, a German B2B fitness aggregator that offers employees of its corporate customers access to various sports facilities. The company strategically acquired Fitbase, a vendor of digital B2B health prevention services, in order to grow its customer base and improve its value proposition. This acquisition allows Hansefit to turn into a one stop shop and offer an even broader selection of digital services to its customers and enables the firm to further evolve its holistic health and fitness products as a highly trusted partner for both German corporations and studio owners.

Summary: 7 winning strategies – find the one that’s perfect for your company

As shown above, the fitness industry is being significantly affected by the ongoing COVID-19 lockdowns, changing customer needs, and the increasingly rapid pace of digitalization. Through our industry knowledge, we identified seven winning strategies that give companies competitive advantages in these circumstances. It’s time to act now and find out which of these strategies makes sense for your company. After all, the market won’t stop evolving; to pave the way to a sustainably successful future, you’ll need to evolve, too.