*The insights and recommendations shared in this article are based on the circumstances as of May 6, 2020

Physical space as a key safety, cost, AND value driver

The impact of COVID-19 and the measurements that governments have taken to curb the spread of the coronavirus are dramatically disrupting our society and economy. Although approaches differ across countries, physical distancing is at the core of the measures and is expected to last until large-scale vaccination or a revolutionary treatment is in place. Experts predict that this development and full-scale production might still take up to two years.

The six-feet economy, named after the distance between two persons that should be applied to prevent infection, will be the new normal for a longer period. For many industries, this will increase costs and lower capacity to deliver goods and services. The critical challenge for affected companies will be to what extent they are able to renovate their value propositions and pass on cost increases to customers.

This requires a clear company strategy and mindset shift. Aside from being a new cost driver, the six-feet economy also introduces new value drivers and potential sources of innovation.

In the modern society’s service economy, a vast majority of sectors will experience reduced capacity: from airlines, shops, and restaurants, to theaters, cinemas, hairdressers, and gyms. In today’s airplanes, it is hard enough to refrain from bumping knees with the person in the next seat, let alone staying six feet away from other passengers. The obvious solution to adhere to the physical distancing restrictions is to reduce airplane seating capacity. Cinemas in the Netherlands have been proactive in sharing their reduced seating plan in the hope of getting the green light to reopen. Gyms have proposed plans to reopen based on reduced capacity with fixed schedules.

Realistically, we can expect a drop in offered capacity of up to 70% across the board, which largely depends on the industry and the specific company characteristics. We could additionally expect that demand will resettle slowly, as consumers will initially shy away from social movement. In addition to these capacity restrictions, investments are required to meet new hygiene standards.

What does that mean for the bottom line of these companies? Most of the affected have fixed costs of around 80% of revenue. If volumes drop by 30%, these companies need to compensate the profit loss with a price increase of 30-40%. If the relative fixed costs are lower, the required price increase will be less.

It is clear that there is a burning platform for companies to prevent this enormous profit drop. Clearly simple cost-cutting measures are not enough and were already largely exhausted at the start of this crisis. International Air Transport Association (IATA) director general Alexandre de Juniac warned of the likelihood of higher airfares due to the empty middle seat requirement. That is a very careful phrasing of a pure necessity.

Over the past years, consumers have been educated to be volume and discount driven. The overall consumer sentiment has been to consistently buy more and at even better prices. Hard discounters, fast fashion companies, and web shops with “made in China” products have conquered a growing part of the consumer’s spend.

While we have seen that physical distancing leads to capacity constraints for companies, the flip side of the coin from a customer perspective is scarcity. In search for safety, customers will accept and understand that we cannot be all together at the same time for the same (lowest) price. In times of scarcity, quality prevails above quantity, and people will become more selective. For example in retail, stores are currently experiencing that traffic to their shops has obviously decreased. Remarkably, the conversion in-store has increased. Fun shopping becomes destination shopping.

Online grocery shopping is now in high demand due to changed consumer value perception on safety. The new Dutch online grocery store, Picnic, experienced a tremendous boost due to the capacity constraints of the traditional retail players such as Albert Heijn and Jumbo. Consumers from all segments are “fast track” educated to order online, severely accelerating the digitalization of retail.

Physical distancing also means that consumers are less willing to move around, making proximity a key value driver. Many of us will (re)discover great local leisure possibilities. Moreover, families will be much more together than before and, if they were not already, become the most important target group.

In a restricted society, people get less exposure to (physical) marketing and inspiration from early adopters of trends. The speed in which societal trends develop, from fashion to drinking and eating habits, will slow down. Giorgio Armani expects slow fashion to kick in: “We will have to certainly re-evaluate the overall value chain of our business model.” Consumers are more likely to respond to affirmative messages, and loyalty toward their usual shops and brands is higher.

These changing consumer behaviors and value perceptions require a mindset shift and strategic reconsideration for companies: Are we only doing what is necessary to implement the six-feet economy precautions, or do we do more to stand out from the competition and launch new innovations to meet changing customer demands?

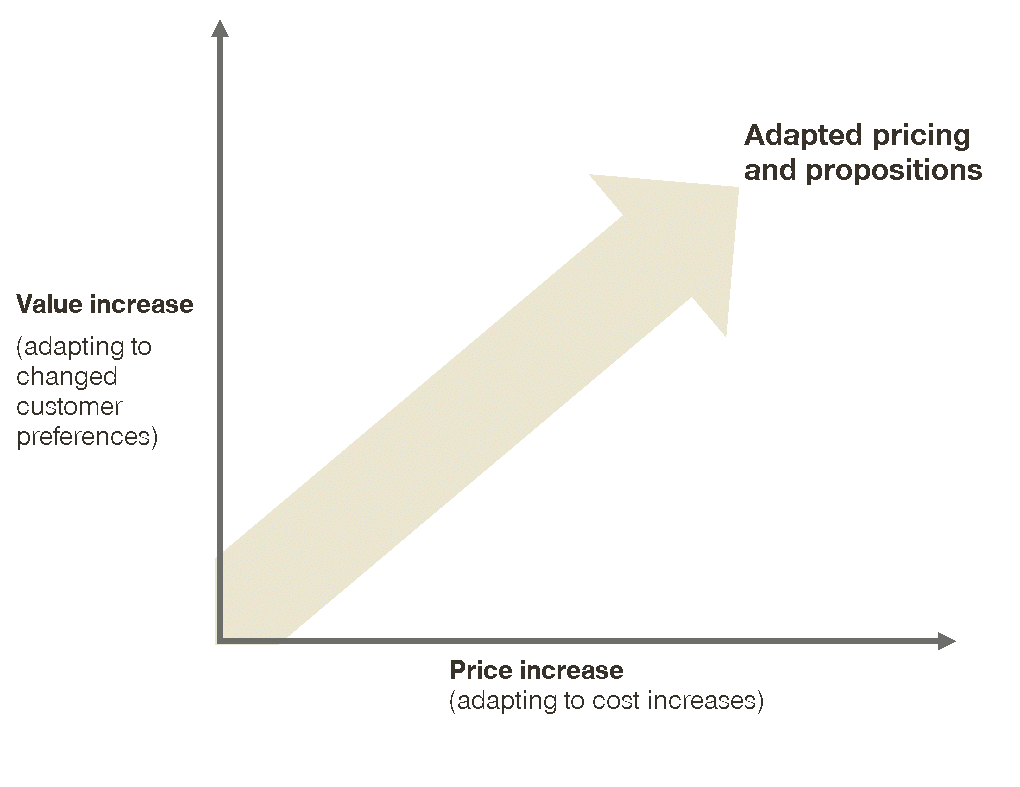

As physical space becomes a new key cost driver (but likewise, a key value driver for customers), affected companies will have to think about opportunities to offset the profit pressure through better propositions and pricing. Space, safety, quality, proximity, family time, and affirmation are the value drivers on the rise. Companies who are more explicitly able to offer these value drivers will therefore gain a competitive position compared to companies who are less successful in doing so.

Do these new value drivers also go hand-in-hand with a higher willingness to pay? There is clearly a signaling role for companies to educate in that regard, to prevent the customer perception that these new costs and values are realized for “free”. Capacity decreases and scarcity is explicitly known to customers. The logical effect would be that prices go up. How actionable price increases are in the six-feet economy and what mechanism works best depends on the extent to which digital alternatives are in place and whether a new proposition and price increase is perceived as fair.

Airlines have been extremely hard-hit by the current lockdowns and there is no reason to envy them at the moment. Yet the advantage they have when travel slowly picks up again is that their customers are already used to dynamic pricing. When booking a ticket, we know that we pay a price that is based on the amount of seats left in the airplane and the actual timing of the purchase. The belief that flying becomes a luxury business with higher prices due to less available seats is already widespread.

Instead of raising prices, companies can also renovate their proposition. In the face of uncertainty, the Seattle restaurant Canlis thought strategically and adjusted to the new environment and its demands. The restaurant transformed into three pop-up restaurants: a drive-through burger joint, a bagel shop, and a “family meal” delivery service.

Entertainment and leisure industries such as hotels, theaters, cinemas, and gyms are thinking about innovating their model in the same direction. Obviously, prices will need to go up, but combined with an explicitly enhanced value proposition. For services with physical contact to customers, such as hair salons, there is a clear need to take all preventive measures possible. People will need to continue to make use of these services, although it is seen as a risk. Innovating the proposition in a defensible way is rather difficult, and the same goes for digitalization. A moderate increase in price or a defendable surcharge would be possible here.

Just like groceries, slower-moving consumer products such as fashion and home furniture are directed to online. Nevertheless, there is an everlasting value in the service delivered in store, such as advice, touching, and trying the actual product. Here the proposition needs to be innovated to defensibly increase prices. Fashion companies are already offering time slots for private shopping with full-time personal attention. Of course, it is possible to put a price tag on this, yet it is probably the high conversion and the larger number of items purchased that will make up the numbers. Restaurants would also fit into this category. Many restaurants have taken short-term measures to deliver food at home, and of course that is the right move. But once they (are allowed to) open up their facilities, they could create a more intimate setting or even move toward private dining.

The impact of the six-feet economy will be mid- to long-term for many industries and companies. It is essential for companies to not only consider this as source of cost increases, but also to take the customer perspective into account: To which extent does the six-feet economy allow for new value, propositions, competitive edge, and willingness to pay?

Herein lies the key to severe volume drops and cost increases: Companies must combine value thinking with smart, customer-centric propositions, and pricing strategies. With that, companies will be able to contribute to these challenging and unprecedented times with enriched experiences – and protect margins at the same time.