Over the last decade, consumption of pay TV and over-the-top (OTT) media services increased significantly. As the market saturates and competition gets tougher, providers need to distinguish themselves through high-quality, exclusive content. Data-driven content valuation can contribute decisively to achieving this goal.

More and more consumers use pay TV and over-the-top (OTT) services, especially among the 18 to 44 age bracket. In Germany, for example, 65 percent are currently subscribed to OTT services. As a result, the trends that helped pay TV/on demand companies become successful are setting the pace for the whole industry – and continue to evolve it. Subscriptions and ads in exchange for not having to pay, track customers’ preferences, aligning new content to it. That’s the foundation of Netflix’s, Hulu’s, Disney+’s, etc., triumphant march.

Bigger market saturation triggers intensified competition and more spending

However, even those top dogs are experiencing mounting pressure. There is currently a growing saturation in the market. In the US, approximately 70 million homes subscribe to OTT services today. While in Germany, the market penetration rate for streaming providers is expected to slow down until 2026, from 8 percent annually (2017 to 2021) to roughly 2 percent.

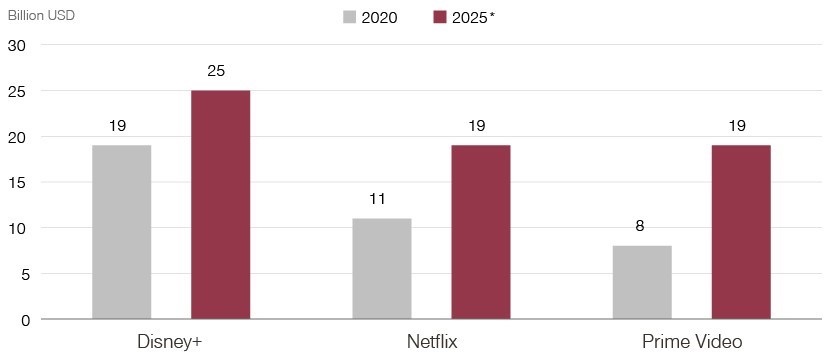

This results in an increasing competition for the same customers and therefore in a willingness to accept higher customer acquisition and customer retention costs. Quite often, this translates into companies spending more on producing exclusive, high-quality content:

Content spending (in billion USD, without sports content)

Source: Activate, Wells Fargo, 2020

Which factors determine high platform engagement?

But do higher investments automatically equal more revenue? The dynamic factors for OTT platform providers to measure financial success are customer acquisition, retention, and churn. And the underlying proxy for those is platform engagement.

To anticipate engagement shifts early and take optimal measures, managers have to optimize three influential dimensions on platform engagement: offer design & go-to-market models, user experience (UX), and content portfolio. They need to tailor their offer design to their targeted customer group and market conditions.

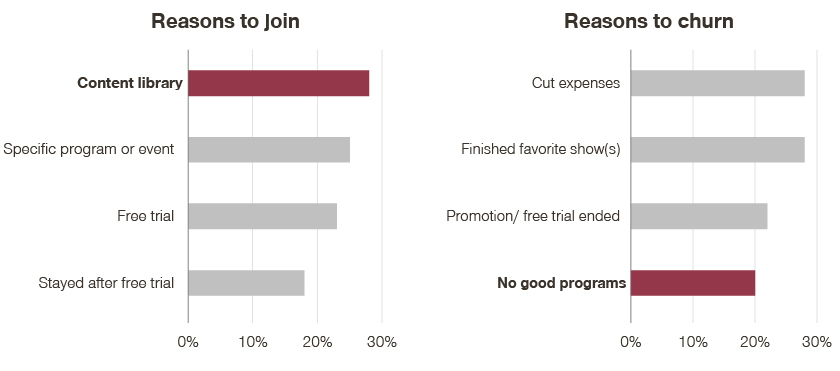

Their go-to-market model must address price differentiation and customer acquisition process (free trials, retention offers, etc.). Further, UX plays a critical part in user engagement as it determines how seamlessly the customer finds their way around the platform. However, the content portfolio is most decisive for the customer. After all, for consumers, it is both a reason to join and to churn:

Source: Parks Associates, Salesforce, 2020

Identify a content portfolio’s value drivers to improve investment decisions

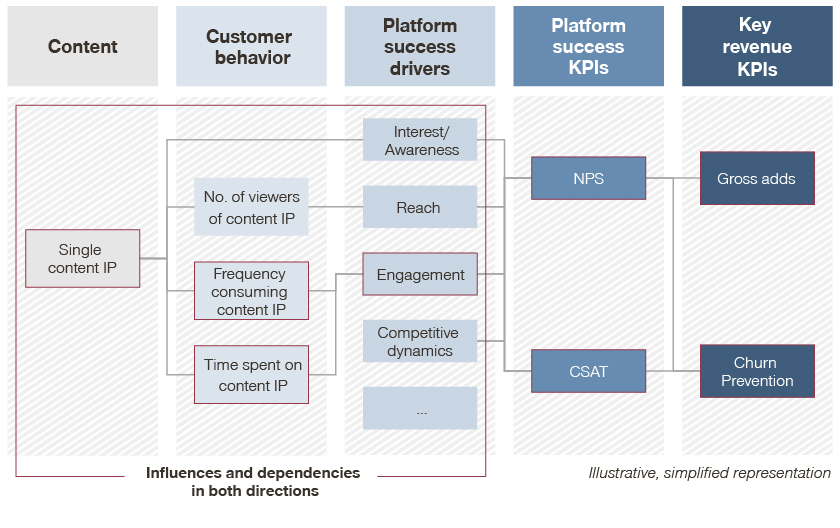

Looking at providers’ content portfolio and its success regarding customer attraction and retention, we are able to observe a clear dynamic: The frequency with which customers consume a single content IP, as well as their time spent on this content, determine customer engagement and therefore significantly influence a platform’s success. KPIs like net promoter score (NPS) and customer satisfaction score (CSAT) reflect this as well, and eventually increase revenue growth margin goals through gross adds and churn prevention.

Therefore, to ensure sustainable profits, improving content needs to be top priority for pay TV and OTT providers. Currently, they tend to rely on assumed interest and featured actors or (sport-)stars to spark interest. In our opinion, a more systematic approach is required.

Enormous potential lies in achieving a continuous, data-based transparency regarding the value of individual content. It is important to identify if a piece of content is a value driver or should only be part of a bundle. Content IPs in the bundle must be understood by decision-makers as a financial asset. The questions you need to answer are:

- What do paying customers come to the platform for and why do they stay?

- Which content IP creates value not only through the retention of paying members?

- Which content IP generates attention and, consequently, increases the acquisition rate of new customers?

Focusing on value-creating content IPs and avoiding investment in irrelevant ones frees up capital, which in turn can be targeted to better fulfill customer needs. In the recent example of a data-driven content portfolio approach, Netflix disclosed the value contribution of the Korean hit show Squid Game, which amounted to 891 million US dollars, while production costs were only 21.4 million dollars.

The backbone of this success is the full transparency on value contribution on content IP level which allows Netflix to adapt its content investment strategy accordingly and shows that the most expensive content in production is not necessarily the most valuable one for customer retention and acquisition.

How to quantify content value

How can other pay TV/OTT market players follow this example? They must become more involved with customer needs in terms of the content IP bundle. This requires a systematic approach in data acquisition and processing to create transparency in terms of customer behavior (for example: around 80 percent of US homes own connected devices, these enable pay TV companies to track customer behavior). Acquiring data needs to be followed by an approach to extract meaningful insights though, to form an effective content IP strategy.

To identify value drivers in the content library, three key pillars need to be quantified:

- How much does a content IP contribute to new customer acquisition?

- How much does a content IP contribute to churn prevention and retaining customers?

- How much does a content IP contribute to possible up-/cross-selling?

The answers to these questions enable pay TV/OTT providers to increase customer attraction and customer retention based on their KPIs regarding content IPs.

Analyze key metrics to enhance value contribution transparency

Monitoring these KPIs over time allows to improve key actions. Take, for example, social listening: it can be used to track the intensity and duration of a target audience's interest over time. Coupled with the same target groups interest in specific content types and their respective importance (visible in the likelihood that a loss of a content IP would result in customer churn), these factors can be used to track value contribution.

Reach and engagement are two of the most critical factors assigning value to a specific content IP. While reach measures the number of customers reached by one content IP during a certain period, engagement measures the intensity of viewership. OTT providers should furthermore consider so-called icebreaker content IPs (for sports content providers e.g., a new license for a specific sport or league), which entice customers to join a platform in the first place.

The Simon-Kucher approach: A fully integrated content valuation tool

Sounds complicated? We have developed a 3-step approach that makes sure that pay TV/OTT providers do not miss any important steps in creating a valuable content portfolio to increase platform engagement:

Improve overall content management

Overall, the advantage of implementing a continuous measurement of content value is that companies are now able to quantitatively evaluate a content IP’s value. Therefore, they can move away from a purely (qualitative) interest-based approach. With automated data extraction, pay TV/OTT providers can continuously achieve transparency on value contribution, based on reach and engagement data as well as other external quantitative data points.

Lastly, it also provides an indication of how much value and how many customers (subscriptions, buys) are at risk in case of changes in a content IP (characteristics, rights), since content valuation implies monitoring customer engagement. Furthermore, the content management can transfer changes in content value into marketing actions, adjust the content strategy, and improve financial decisions. Continuously evaluating and treating content as a financial asset, therefore, not only improves investment decisions, but also optimizes content management and marketing.