Sustainability – although clearly being a desirable goal – will only gain a foothold in the logistics industry, if providers of logistics services are able to realize the full commercial potential a sustainable offering holds. A smart monetization strategy is the foundation for that – and it all rests on finding out customers’ willingness to pay.

What do companies in the logistics sector think about sustainability? To find out, we surveyed over 400 companies across the globe that use logistics service providers in our Green Logistics B2B study. We examined the key insights gathered in this four-part blog series, including why the increasing importance of sustainable logistics services needs to be addressed by logistics companies, how to develop a sustainable logistics product, and how to monetize those sustainable logistics products most effectively.

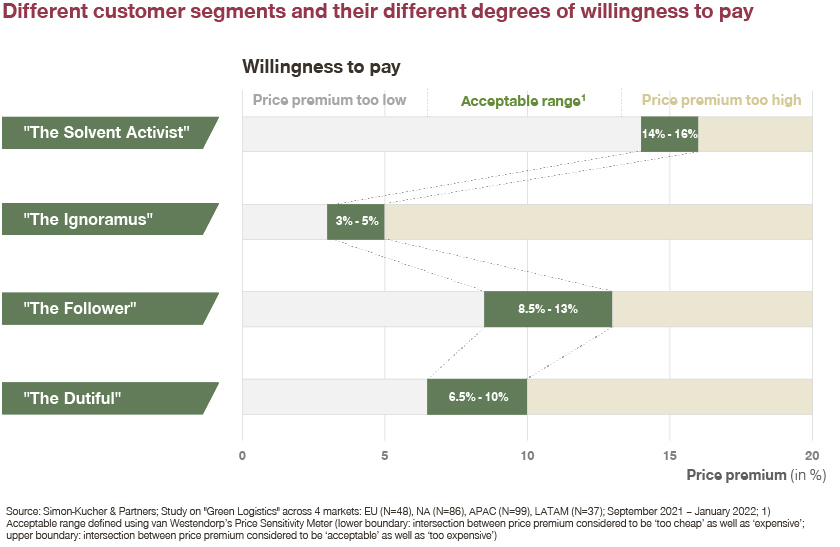

In this fourth and last part of the series, we now want to take a look at the core of every successful monetization model: customers’ willingness to pay (WTP). What kind of price premium are consumers of logistics services from different segments willing to pay for a more sustainable offering?

Different customer segments have varying levels of acceptance

As we found out, buyers of logistics services consider a price premium of 5 to 10 percent as acceptable. A premium below 4 percent is on average looked at as suspiciously cheap, resulting in companies doubting the authenticity of the offer. On the other hand, a premium of more than 15 percent is regarded as too expensive, and therefore wouldn’t be taken into consideration in a purchasing process anymore.

However, as we explained in our last article, different customer segments exist – remember the “Climate Activist”, the “Dutiful”, the “Follower”, and “Ignoramus”? All of them have different ambition levels when it comes to sustainability, request different products resp. services, need different marketing strategies, and ultimately also have different degrees of willingness to pay.

In detail:

- Unsurprisingly, the “Climate Activist” is willing to pay the highest price premium of 14 to 16 percent in exchange for sustainable logistics services.

- The “Follower” has the second highest WTP and is accepting premiums between 8.5 and 13 percent. They are motivated by a combination of environmental, marketing as well as compliance factors.

- The “Dutiful”, driven primarily by compliance goals, accepts a slightly lower premium between 6.5 and 10 percent.

- As expected, the “Ignoramus” finds itself on the lowest end and is only willing to pay a surplus of 3 to 5 percent. Their motivation is mainly to fulfill compliance as well as marketing and PR goals.

As it becomes clear, there is a distinct correlation between the amount of sustainability goals (environmental, compliance, PR, etc.) and willingness to pay.

Bigger companies ready to pay more for sustainability

Apart from logistics customers’ segment affiliation, there are other factors influencing their WTP. For example: company size. Large companies with a yearly revenue of more than 100 million US Dollars indicate a greater commitment to sustainability, which is reflected in their willingness to pay a roughly 20 percent higher price premium for sustainable logistics solutions than smaller companies. However, it is also imaginable that larger companies are facing more public pressure and media attention due to their overall bigger CO2 footprint, which results in a greater motivation to invest more in sustainability.

Smaller companies have a lower WTP; they consider a markup of 10 percent as expensive and 7 percent as acceptable, whereas figures for large companies are marginally higher with 12 percent being regarded as expensive and 8.5 percent as acceptable.

No clear regional differences

Regional differences in companies’ willingness to pay are much smaller than those by size: The Asian Pacific region (APAC) has the highest average WTP and Europe the lowest. However, since they closely correlate to the distribution shares of the different segments (i.e., Europe has the highest share of “Ignoramuses” and the lowest WTP, while APAC has the smallest share of them), we can’t draw any significant insights from regional discrepancies.

More than 50 percent usage rate with acceptable prices in some segments

What is equally as important as logistics customers willingness to pay, is the likelihood of them using sustainable logistics services for the aforementioned higher prices. More than half of the respondents classified as “Climate Activist” and “Follower” (58 respectively 57 percent) say it’s very likely that their company would opt for the climate-neutral transportation option at the price point deemed acceptable. In the segments of the “Dutiful” and especially the “Ignoramus” this number is significantly lower, namely only 49 and 36 percent believe they would take-up sustainable offerings at a price point they deemed earlier as acceptable.

Summary: Product development and pricing need to be a combined effort

These figures have interesting implications for logistics providers’ monetization strategies: There exists a willingness to pay of up to 16 percent more for sustainable products in the market – if they are approaching the right customer segments. However, with the differences between target groups being as significant as they are, marketing and monetization strategies need to be incredibly differentiated.

To find the perfect price premium, logistics companies need to also differentiate their relevant product offer so they can consequently justify their higher prices by pointing out the value-added. Before implementing these new products and prices, logistics providers have to make sure to do some proper research regarding customers’ willingness to pay, since even small product changes can lead to a significant modification of shippers’ WTP. Therefore, product offer development and price setting need to go “hand in hand” to ensure successful monetization.

Monetizing Green Logistics

How to design and price emission compensation measures in Logistics