The pandemic created a class of super savers. Now, as vaccinations gather steam and some economies start to reopen, bank executives are wondering if new financial behaviors acquired over the past year and a half will stick. Will consumers loosen their purse strings to splurge on travel and dining out? How will financial priorities change and what new types of banking services will consumers need?

A flow-of-funds data model can provide accurate and real-time insights into how customer banking, savings, spending, and borrowing behaviors are evolving and changing. A flow-of-funds model tracks fund movements internally in the banking organization between various deposit, lending, and investment accounts, as well as externally involving accounts held outside the institution.

By mapping money movement trends between various deposits, investment, and lending accounts, banks can acquire a 360-degree view of their customers and understand the nature of the customer’s relationship with the bank. This understanding can be applied to support acquisition, retention, and engagement initiatives.

For example, at the peak of Canada’s lockdowns last year, a large Canadian bank employing a flow-of-funds model was able to detect distinct differences in cash management behaviors among its customers. Younger customers were more likely to “‘park”‘ funds in checking accounts, compared to older customers who preferred savings accounts. The bank also noticed that its high-value customers preferred more liquid, shorter-term savings products. The bank responded quickly to this emerging demand by introducing savings products with more flexible terms.

The bank’s flow-of-funds model also uncovered some surprising ways customers were responding to the pandemic. Between the months of August and November 2020, the bank saw an unusually high aversion to debt amongst bank customers with as much as nine percent of deposit outflows going to pay off debt. During that same period, there was also a marked decline in bank switching behaviors with less than five percent of time deposit outflows going to competitor financial institutions. The coronavirus pandemic has dramatically reshaped banking behaviors.

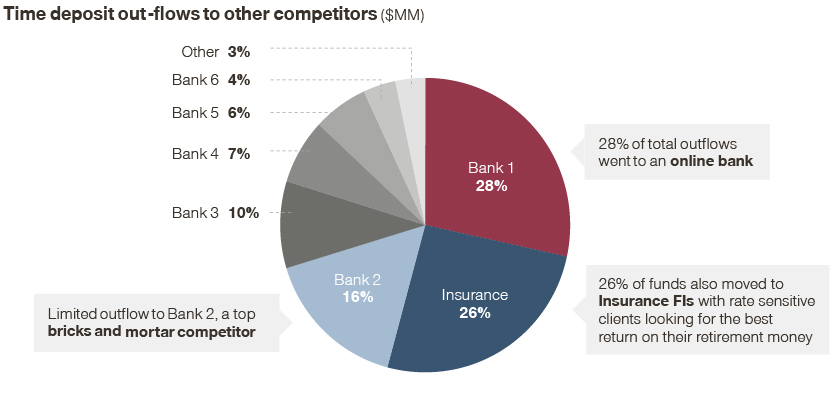

A bank was able to track their time deposit redemptions to other FIs, prevent knee-jerk reactions, and plan targeted promotions

Only approximately five percent of total out-flows from the time deposit book went to other FIs

The bank was also able to identify that nine percent of total time deposit outflows were used to pay off debt during the pandemic

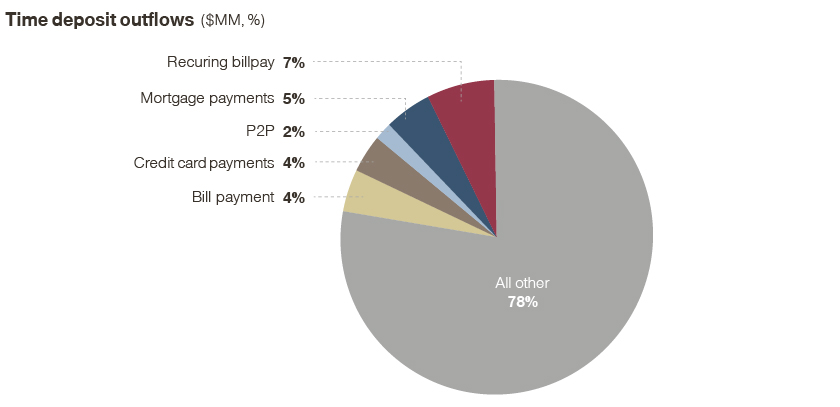

78% were spent through cash, check withdrawals, debit card transactions, and transferred to OFIs

4% were used for credit card payments, 5% to pay off mortgages, and about 7% for recurring bill payments

Deepen engagement with bank customers

The flow-of-funds data model can also help banks identify critical points of conversion to deepen engagement with single-product holders.

One bank noticed that bank customers who have been with the bank for one year or less are more likely to move money externally when a deposit instrument’s term ends. At this juncture, the bank was able to orchestrate a timely multiproduct bundle offer featuring lucrative rewards, including a complimentary Netflix subscription to convince these customers to consolidate their financial accounts with the bank.

Analyzing daily and weekly fund movements at the customer level can reveal patterns and enhance a bank’s ability to identify customers with a high risk of attrition. This gives the bank an opportunity to deploy personalized retention campaigns designed to improve value perception.

Accurate measurement of customer behavior

Another important application for the flow-of-funds data model is to support better decision-making.

One bank was alarmed to see a steady loss in market share for long-term deposits. They questioned whether they needed to price these high-yield products more aggressively. On closer examination of the flow-of-funds analytics, the bank discovered that customer funds were actually moving into investment products within the bank as opposed to competitor banks. Having insights into the fact that funds are not moving out of the bank in search of higher rates helped this bank preserve net interest margins.

Improved segmentation and product innovation

Close analysis of customers’ spending, savings, investment and other borrowing patterns can uncover opportunities for product innovation. For example, a focused flow-of-funds trends analysis might reveal that there is a large segment of high-earning bank customers struggling to save. The bank can consider introducing an AI-based auto-savings feature.

Banks can also easily and more accurately segment their deposit customer base based on key variables such as life-stage, the degree of complexity in the customers’ financial lives, savings, and financial behaviors. A well-timed deposit, credit card, or buy-now-pay-later promotion appropriately targeted at the right customer at the right time might be just the thing to keep them from transferring a large sum to a Fintech.

A flow of funds analysis can also help banks refine customer segmentation efforts and improve outreach efforts. By observing banking and fund-movement behaviors of newly acquired customers over time, banks can distinguish between loyal customers versus rate-chasers who move money in and out of institutions in search of better deals. These observations can be used to develop more targeted and precise acquisition strategies.

Data-driven approaches are within reach

Most banks mistakenly think that data-driven approaches require huge outlays to acquire AI, advanced analytics, or alternative data sets. When in fact it just comes down to leveraging capabilities that in many cases they possess.

Many banks already possess data analytics capabilities that support deposit pricing. Often, these same tools also afford them the ability to translate the bank’s existing storehouse of transactions and funds-movement into intelligence that can be used to support product innovation, retention, and engagement initiatives.

The retail banking landscape is changing in dramatic and unexpected ways due to new technologies, increased competition from Fintechs, and macroeconomic forces. It is critical that banks start to exercise greater precision and speed in how they acquire, retain, and engage customers.