Successful hospital pricing is becoming increasingly important for life sciences companies. We highlight five common pitfalls encountered by manufacturers when implementing hospital pricing structures and share our proven approach to achieving top-line impact.

Hospital pricing is a highly important aspect for life sciences companies. However, our experience shows that it is often not optimally managed. When speaking about hospital pricing in the context of this article, we refer to the commercialization and more specifically the pricing of products from life sciences companies in the hospital setting.

Developing and setting pricing structures for offerings can differ widely from company to company. Especially depending on the type of product, manufacturers have multiple options to do this most effectively. Current models range from simple on-invoice discounts for individual products to sophisticated rebate and discounting schemes covering the entire product portfolio. While the level of complexity certainly differs between these pricing structures, they are commonly used by life sciences companies in order to gain access to hospital formularies, increase revenues, and incentivize and steer desired account behavior.

Despite the importance of determining overall discount levels, in this article we focus on the more holistic optimization of the overall pricing structure, often referred to as gross-to-net optimization.

In hospitals, these pricing structures frequently include multiple levers such as channel discounts, volume-related invoice discounts, and bonus agreements. To add to the complexity, the different levers can be directly negotiated on an individual account level and/or with purchasing groups (GPOs) and wholesalers. In addition to the increasing complexity of these pricing structures, numerous market trends lead to a situation in which getting hospital pricing right is becoming increasingly important for many companies. These trends and challenges include:

- Hospitals facing increasing budget constraints

Financial pressure on hospital budgets is an ever recurring topic and at the top of mind of hospital management. Budget constraints and financial controls in healthcare are resulting in reduced willingness to pay levels as well as a lower acceptance of products that are “just good enough”. In order to compete in such an environment, while at the same time protecting margins, life science companies will need to get their pricing and reward structures right in the first place.

- The influence and growing impact of GPOs

Third-party intermediaries (e.g. GPOs) are increasing their bargaining power by acting as gatekeepers and dictating prices, terms, and conditions. In Germany, for example, over 90 percent of hospitals are currently part of a purchasing group with similar numbers observed across European markets. As if this were not enough, a lot of hospitals are now also organizing themselves within these larger groups to form additional sub-groups. Their goal is to increase their bargaining power. By systematically identifying and including levers that go beyond the management fee typically paid to GPOs, manufacturers can gain advantages over the competition and eventually capture larger market shares.

- Increase in competitive dynamics

Highly price-driven competitors are trying to win installed customer bases and grow market share, thereby destroying market value and margin potential. While this challenge might not seem new, it remains a pressing issue, especially in the context of hospital pricing. In addition, it increases the necessity of an optimized approach in order to stay ahead of the competition.

- Higher pricing transparency for hospitals

Across the globe, pricing transparency is increasing by means of better price intelligence and referencing, making it more and more difficult for manufacturers to defend price differentials. Proactively utilizing transparency in such an environment, for example by communicating fair pricing structures and volume thresholds, can be an option for companies to not only win trust from accounts but also improve customer relationships and compliance with implemented pricing structures.

- Increase in sales and marketing costs

Increasing customer demand for sales attention, service levels, and financing solutions without suppliers being able to monetize the incremental value and costs, is another major challenge for life sciences companies. Again, this trend is driving the necessity of a holistic pricing structure that not only considers and incorporates discounts and rebates, but also reflects factors such as sales personnel, training costs, logistics, and services to assess account profitability.

Major challenges in hospital pricing (selected examples)

Key pitfalls that companies face when implementing hospital pricing structures

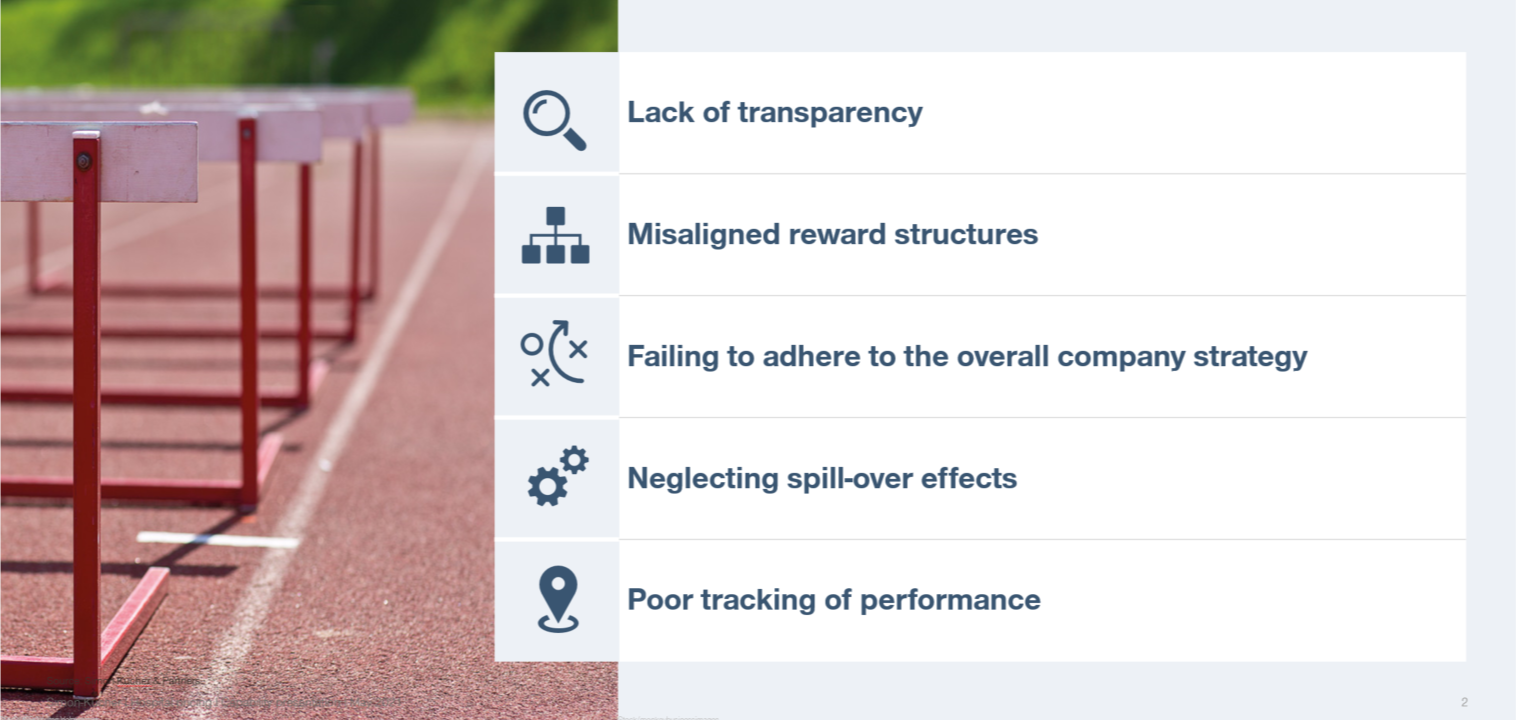

Despite a market consensus on the increasing importance and financial impact of hospital pricing, manufacturers that have decided to implement new or optimize their current schemes often face a number of obstacles in the process. This does not seem surprising when considering the large number of involved stakeholders along with the high complexity and wide range of potential pricing levers that can be utilized. By looking at the overall market, a number of common pitfalls can be observed across life sciences companies. Here we list a few of the challenges that manufacturers run into. Maybe you recognize your company in one of the described scenarios:

Key pitfalls that life sciences companies are facing (selected examples)

Pitfall 1 - Lack of transparency:

One common pitfall of hospital pricing is the lack of transparency. While this may sound straight forward, many life sciences manufacturers do not have full transparency including missing insights into the return on investment associated with different pricing levers. Understanding which levers work and which do not work in different situations is key for successful hospital pricing.

Pitfall 2 - Misaligned reward structures:

A misalignment between the implemented reward structure and customer performance represents another common pitfall. This often results from situations where previous pricing structures have not been adjusted over time, and no longer incentivize the right customer behavior. When for example linking discounts to unrealistic volume thresholds (which individual accounts are not able to realize) manufacturers should not expect to see an increase in their product uptake as a result of the discount structure.

Pitfall 3 - Failing to adhere to the overall company strategy:

Not considering the company’s strategic objectives for individual products is yet another major pitfall we frequently observe when analyzing current hospital pricing strategies. In order to consider the strategic importance of specific products or product lines, these could for example be excluded from current portfolio agreements or additional, dedicated agreements could be implemented to position strategic products outside of the legacy business.

Pitfall 4 - Neglecting spill-over effects:

Beyond that, when implementing their pricing structures, companies often forget to consider spill-over effects from the hospital to follow-up (retail) business. While there might be situations where companies should try to improve top-line performance in the hospital setting, there are also others where it would be a better strategy to win business in the hospital (at marginal to no profits) in order to realize a higher uptake in the subsequent pharmacy business. These considerations should at least be part of the development process and be included in every hospital pricing discussion.

Pitfall 5 - Poor tracking of performance:

Finally, a successful monitoring and tracking system for hospital pricing is a must-have and an area where most manufacturers are underperforming. By implementing a continuous monitoring system, companies can proactively support and guide hospitals on reaching higher reward thresholds throughout the year and thereby create a win-win situation for them and their customers. Beyond that, not tracking performance-related commitments (e.g. volume commitments) can have a significant financial impact as companies can miss out claiming back or adjusting bonus payments in case hospitals do not reach their agreed targets.

How to develop/optimize hospital pricing and increase overall performance

In order to account for all these challenges, avoid the mentioned pitfalls, and ultimately develop or optimize existing hospital pricing structures that really make an impact on your top-line performance, we suggest the same proven 3-step approach that we recommend to our clients: As-is assessment, solution development, and implementation

Simon-Kucher’s approach to hospital pricing

- Assessment of current hospital pricing structure

In this first crucial step, the key activity is to analyze and understand the current situation and approach to hospital pricing. Therefore a detailed assessment of the existing pricing structure, implemented reward schemes, and transactional data on an account level as well as the implemented governance systems should be performed. As a result of this activity, a detailed gap analysis can be conducted in which the current pricing structure is mapped against internal and industry best practices. In this initial step, we identify quick-wins for our clients that typically result in an immediate financial impact and set the basis for the development of long-term initiatives and pricing structures.

Development of tailored solutions

After having assessed the current status quo, the second phase is used to close all identified gaps. In this process, pricing levers and tiers are optimized or developed through a holistic shortlisting and weighting approach. At the same time, the newly defined or optimized pricing structure is extensively pressure tested, simulated, and multiple sanity checks are performed. By doing so, the financial consequences of the pricing structure for existing accounts as well as for future new accounts is estimated. Here, it is important to incorporate all involved stakeholder groups that have been mentioned at the beginning of this article (i.e. also GPOs and distributors) in order to account for the increasing impact of intermediaries.

- Implementation and monitoring of (optimized) pricing structure

Implementing the pricing structure is the final step of our recommended, sequential approach. Here, it is crucial to clearly define roles and responsibilities for the hospital pricing structure and to outline tasks to ensure a successful launch of the developed strategy. In addition, a holistic monitoring system needs to be implemented and linked to pre-defined KPIs in order to track customer performance and ensure future success of the pricing structure.

Conclusion: Achieving top-line impact in 3 steps

As you can see, making a positive impact on your revenues by optimizing your pricing structure is possible, provided you have a systematic approach. Many players in the industry are still lacking knowledge and capabilities when it comes to structured and methodic pricing strategy. So, be sure to set yourself apart from the competition by assessing the status quo, closing all the identified gaps, and making sure your implemented measures continue to be successful. With an approach like this, you should be well equipped to avoid any pricing pitfalls and master the current challenges in hospital pricing.