After an extended period of zero or sub-zero interest rates, central banks heralded the end of an era by starting to increase rates earlier this year. Deposits have been a loss-making or, at best, marginally profitable business for banks during this period despite zero percent or negative interest rate offers. This hasn’t only presented the market with economic problems but has also been a challenge in terms of communicating with end customers. The important question, however, remains: Where do we go from here?

From zero to credit interest – via new products

As soon as short-term deposits go beyond zero, banks have considerably more room to manoeuvre, allowing them to leverage a few basic design principles.

It’s particularly important to refrain from using a ‘scatter gun approach’, broadly increasing rates on existing products to the entire deposit base in a completely undifferentiated manner. This method isn’t only very expensive but also isn’t likely to prevent deposit outflows.

Instead, the entry into an attractive credit interest rate should essentially go via new deposit products. An example in the short-term deposit area would be accounts with a five-week notice period. This also has positive effects in the overall management of deposits (more on this later).

These new products work as "internal emergency exits" for price-sensitive customers. They effectively provide price-sensitive and, therefore, attentive customer segments with a new attractive offer at their current bank. This encourages them to actively move funds within their existing bank. Moving funds within their existing bank is significantly easier than transferring the funds to another bank ("external emergency exit"). This approach ensures that the deposits of these price-sensitive customers are kept within the bank.

It’s important to note that as these funds are neither transferred internally nor externally the large inert mass of less price-sensitive deposit balances remains in the existing low-interest-bearing products for the time being. Even if the interest rate level continues to rise, the interest rate gap between the ‘internal exit’ products and the existing deposit products will remain. When combined with rising interest rates, this dynamic will make the liability side more profitable than it has been for many years.

However, this only applies for as long as attractive and quite visible "internal emergency exits" are offered to the existing customer base. Should the interest rate become more of a decision criterion for individual customers, an outflow of deposits should be avoided after all. Furthermore, this will have a positive impact on brand perception, as the bank is viewed as one that offers attractive products.

The principle of price differentiation based on the price sensitivity of customer segments should therefore definitely be considered in the current interest rate turnaround. This relies on the self-selection of customers who either become active and transfer to new products (higher price sensitivity) or refrain from doing so (lower price sensitivity).

Creating a new portfolio of deposit products based on a comprehensive deposit strategy

Another important design principle in the implementation of the "internal emergency exit" approach is the creation of a larger deposit product portfolio in which customers have a choice between several options.

In recent years, banks have continued to downsize their portfolios and, to a large degree, have eliminated products such as time deposits, savings bonds, bearer bonds, or savings deposits with different notice periods. These became virtually redundant due to low and negative interest rates. However, as interest rates increase it’s now important to develop a comprehensive deposit strategy. The strategy should deliver on the funding requirements of the bank via a differentiated portfolio of deposit products.

The focus should be on a product portfolio that is beneficial to both the customer and the bank. Because the current yield curve is steep, especially at the shorter end, banks can already offer customers attractive conditions for relatively short maturities and still realize positive contributions from passive customers to relieve the net stable funding ratio. Short maturities can be in the range of one to two years, or include deposits redeemable at a notice of less than 365 days.

This strategy also works well in relation to Basel III liquidity ratios (LCR), where this kind of short-term product with more than 30 days' notice (e.g., five to six weeks) could comprise an important component of the new portfolio. This kind of product provides relief for the LCR ratio while simultaneously mitigating market risk via an increased pricing granularity of different maturities.

From a bank’s internal management perspective, it’s also important to highlight the crucial role that the amount thresholds for these short-term products will play.

One example is capping interest payments to a maximum amount (e.g., attractive interest rates apply only to the first 500,000 Swedish krona invested), as doing this will affect accounts with an indefinite capital commitment. This will help reduce the average deposit balance (granularity effect) and avoid large cash balances that may be transferred out of the product as soon as the appropriate opportunity arises. Portfolios with smaller deposit balances can be significantly more stable.

Implementing these strategies will increase the stickiness of the deposits by reducing the average balance and creating implicit levels of maturity. This will help stabilize the overall portfolio.

Leveraging the principle of differentiation in product pricing

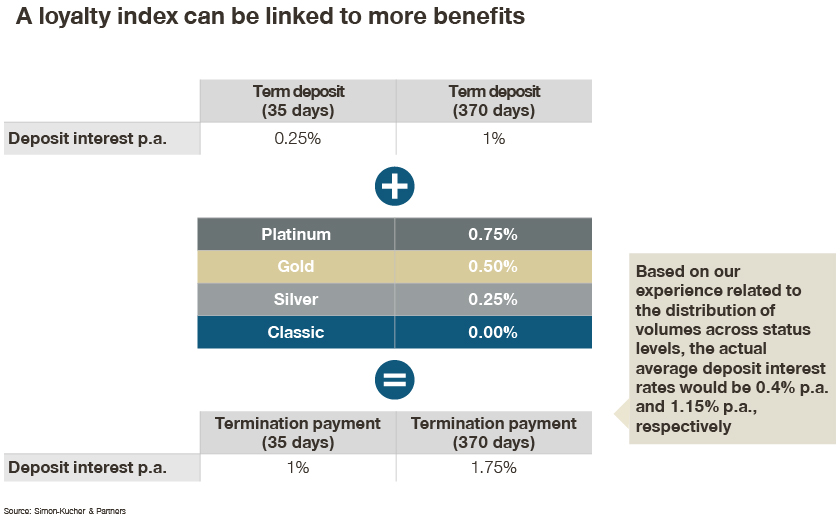

In addition to diversification, another design principle that should be considered is price differentiation between products. For example, in line with the principle "those who do a lot with us get better terms", loyal customers with a broad range of products could receive an interest rate premium. The depth of the client’s relationship could be reflected via a loyalty index which could be linked to further benefits (refer to image below).

In this way, attractive interest rates can be communicated, but only to the relatively small group of most loyal customers. Our experience demonstrates that this improves the price perception of products among all customers. This, in turn, allows for lower introductory interest rates in lower loyalty tranches where most customers and deposit volumes can be found. In this respect, the average interest rate paid is significantly lower than the communicated maximum achievable interest rate.

Customers can virtually "earn" a better interest rate by deepening their relationship with the bank (quid pro quo). The resulting cross-selling income with these customers can then be added to the contribution margin per customer. At the same time, customers become more loyal.

This differentiation logic can be implemented consistently across all products, allowing for very attractive interest rates to be communicated across the entire deposit portfolio without driving up the average rate too much.

Offering customers the right mix of interest and terms

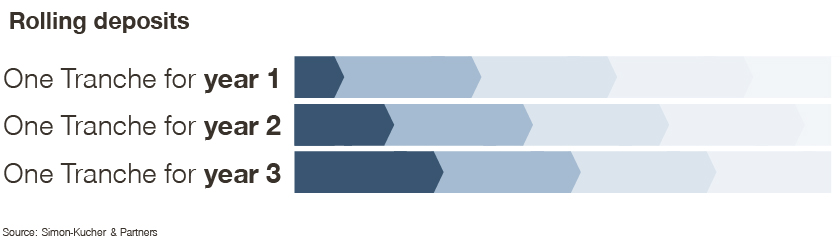

From the customer's point of view, it’s important to have a good mix of different interest rates and terms. To leverage the benefits of longer-term products and simultaneously offer customers flexible products with high availability of funds, banks could consider the concept of rolling deposits. This concept works very well in a steep yield curve environment.

A product that has a rolling deposit enables each customer to invest an amount in three tranches:

After one year, the first tranche expires and is automatically extended by three years (if no other order is placed). After two years, the second tranche expires and is automatically extended by three years (if no other order is placed). The same happens with the three-year tranche, so that after three years there is a combination of three three-year investments.

In this way, the client benefits from the high three-year interest rate. Though, at the same time, has a third of their volume available at the end of every year during the three-year period, with no disadvantages to the bank.

We’ve also designed such products with four and five-year terms. The steeper the yield curve in the one to five-year maturity range, the more attractive the products become in the respective maturities. The current premiums of 15 to 20 basis points per year offer a good base for price differentiation.

Furthermore, the interest rate availability mix should always be designed via a combination of short-term and longer-term deposits. Innovative digital deposit configurators provide good advisory support for this purpose.

Developing a diversified portfolio of deposits to realize growth opportunities

We’re seeing the end of the era of zero to low interest bearing accounts. The return to higher interest rates on the liabilities side requires a differentiated product strategy. The current rate changes in the market create an excellent opportunity to design and implement a differentiated, successful, and profitable deposit product strategy.

It will be critical to develop a deposit portfolio that’s optimally differentiated both from a bank and a customer perspective to capitalize on this overall change in the market.