Selling digital solutions requires a different approach to selling traditional products. In one of the series, Grigori Bokeria and Daniel Bornemann classified digital solutions into six categories, and in part 2, they described how to prepare the salesforce for selling them. Now, in part 3, Simon-Kucher’s Sales Benchmarking Analysis for Digital Solutions provides an outside-in benchmark of sales organizations and processes.

Successfully selling digital products and services to customers has become a significant challenge for companies. Innovative products and services often generate relatively low turnover compared to hardware and service sales – a challenge which can often be tied back to the sales organization. However, with the right approach, companies can turn this around and enjoy equal, if not more revenue success with their digital solutions.

In Simon-Kucher’s Sales Benchmarking Analysis for Digital Solutions, we investigated the different sales approaches for 16 digital products and services in the logistics and manufacturing industries. While there is no one-size-fits-all approach for selling innovations, we’ve identified the main drivers behind a new digital sales setup, as well as the strengths and weaknesses of the resulting approaches. Here are the key takeaways for companies who are yet to reinvent the sales organization for winning with digital solutions.

First, we identified 5 main drivers for a new digital sales setup:

- Relation to conventional offering: The closer the digital solution is to the conventional product or service offering, the more synergies with the existing sales organization and channels.

- Target segments: The stronger the digital solution focuses on new customer segments and industries, the more likely a new sales set-up and channels are required.

- Value created and revenue potential: The higher the revenue potential of a digital solution, the more likely the digital offering is sold via a dedicated sales force.

- Complexity of the digital solution: The more complex the digital solution, the more likely a dedicated sales force is required.

- Intervention in conventional customer processes: The more the digital solution alters existing customer processes and interactions, the more likely a dedicated sales force is required.

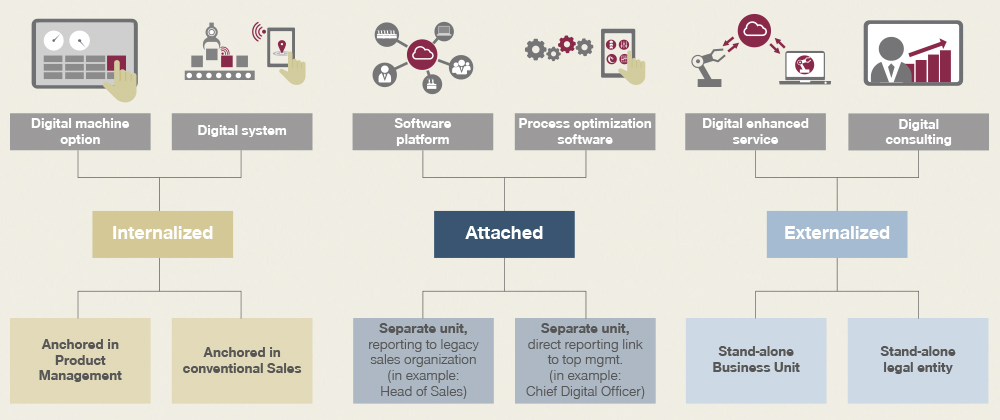

Digital solutions can be classified into six categories: Digital machine options, digital systems, software platforms, process optimization software, digitally enhanced services, and digital consulting. We analyzed multiple solutions from each category, along with the features, target segments, and customer benefits that shape the sales approach.

Depending on the category, a new digital solution will usually result in one of three types of sales setups:

- Integrated and non-dedicated

- Integrated and dedicated

- Segregated new unit or legal entity

To determine which setup is most suitable for which type of digital solution, our analysis investigated the strengths and weaknesses of each approach.

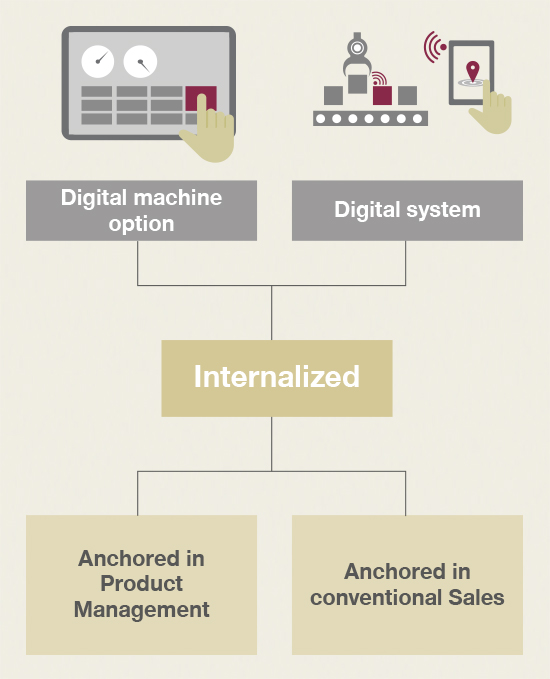

Digital machine options and digital systems typically require an integrated, non-dedicated setup

With hardware, software, and service bundles, as well as digital enhancements made to standalone hardware, a common approach is to sell digital solutions via the company’s existing channels and sales force. At early product lifecycle stages and with complex solutions, product management is often strongly involved in sales. They are supported by the conventional sales team who generate leads through their existing customer networks. This strong immersion of the product management team ensures detailed product expertise is anchored in the sales process and enables short feedback loops from the user to product engineer. However, one drawback of this approach is that product management are distracted from their core task. They can become a significant bottleneck at later PLC/scaling stages due to their lack of commercial expertise.

For existing solutions that require a full roll-out with a high number of dedicated sales reps, a more sustainable solution can be for the setup to be driven by the conventional sales force. This works particularly well when the digital solutions are closely related to existing offerings and customer segments, with synergies from the sales team’s strong networks and current sales channel setup. Still, sales professionals should be closely supported by product management to ensure they are equipped with the right knowledge and expertise to sell the solution. In addition, great care should be taken to avoid cannibalization of conventional offerings.

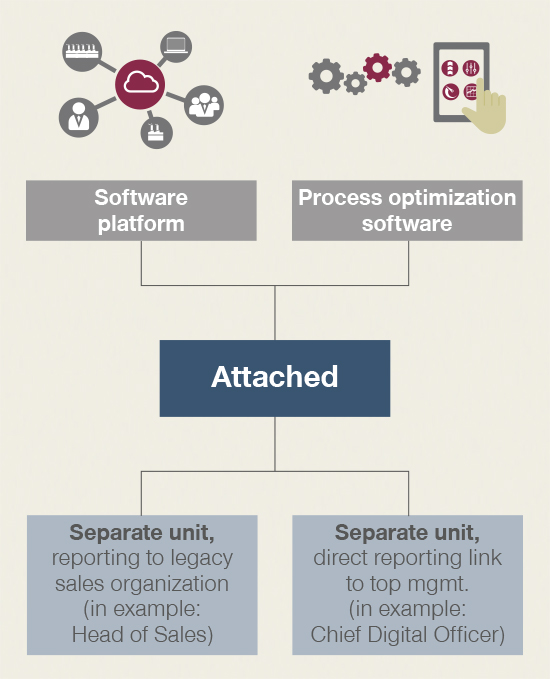

Platforms and process optimization software typically require an integrated and dedicated setup

For software and platforms, it is usual for new channels and a dedicated digital sales force to be set up within the existing organization. This is either subordinated, where new digital sales reps report to the conventional sales unit, or non-subordinated, where they report to e.g. a Chief Digital Officer (CDO). The subordinated approach is most common for complex digital solutions that require a specialist focus but target existing customer segments. Under the supervision of the legacy organization, the new specialized salesforce is able to combine their product knowledge with access to existing customer networks. However, the lack of a single head function to coordinate the digital business may result in misalignment between sales and product management. With relatively low digital revenue potential compared to conventional sales, there is the risk that the head of sales neglects the digital offering.

For this reason, the non-subordinated approach is usually more suitable for digital solutions with high customer value and revenue potential. Here a dedicated digital head function ensures strategic alignment and coordination of digital entities, as well as future scaling of the offerings and accounts. However, being embedded in the conventional business unit can impose organizational and processual constraints on the digital business and impede innovation. Often this is also a relatively cost-intensive approach as digital solutions need to be offered via new sales channels.

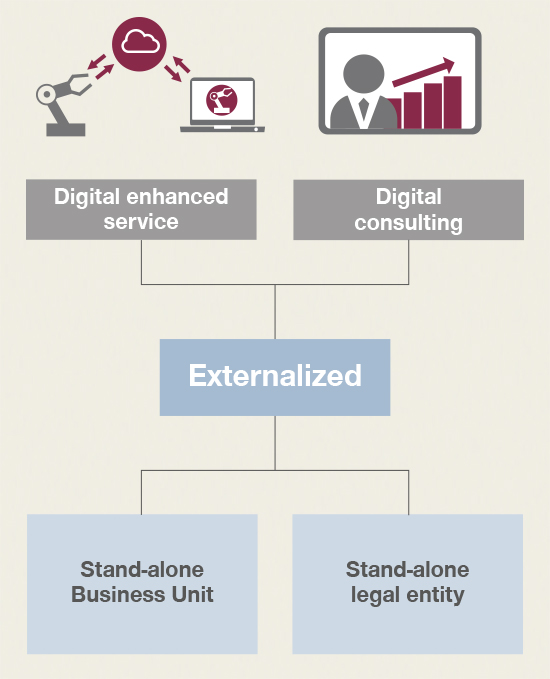

Segregated new unit or legal entity for digitally enhanced services and consulting

If companies add a digital component to their service contract, or set up autonomous units to provide digital consulting, then it can make sense to set up a new digital business unit or legal entity with independent sales responsibility. This segregated approach is particularly effective with highly innovative digital solutions, which benefit from organizational agility. Moreover, a separate business unit or entity with digital solutions offered via new sales channels prevents cannibalization among conventional and digital products and supports effective monetization.

Creating a standalone business unit would likely make more sense when the aim is to establish your own company as a key digital player. However, it can also be very cost-intensive as the customer base, sales channels etc. must be built from scratch. This is also the case with a new legal entity, where a purely digital player is linked to your legacy organization. The autonomy of a new digital entity facilitates organizational alignment with digital business and promotes innovation. However, there is also the gate keeping risk that the existing salesforce does not sufficiently comply with the digital unit to tackle existing customers.

These were are some of the general findings of Simon-Kucher’s Sales Benchmarking Analysis for Digital Solutions. Companies can apply these insights when reviewing their own sales setup for successfully selling digital solutions. Still, as companies often deal with portfolios that include various solution types, it is always important to discuss and define an individual (cross-product) setup.

Want to learn more about the challenges and benefits of a new sales setup for selling digital products and services? Stay tuned for part 4 of our series where we will share a detailed case study from our benchmarking analysis.

For more details on the Sales Benchmarking Analysis for Digital Solutions, reach out to Daniel Bornemann or Grigori Bokeria

Read more from our Sales Excellence for Digital Solutions series:

Part 1: Sales Excellence For Digital Solutions: The 6 Key Solution Categories

Part 2: How to Sell Your Digital Products and Services

Part 3: Caterpillar’s Integrated Sales Approach for Digital Solutions