Customers value advice, and “digital” is playing an increasingly important role in banking. These were just a few of the findings from the study on investment advice conducted by Simon-Kucher & Partners in Spring 2022. Where exactly do customers stand when it comes to advice and support when selecting securities? And how do they make decisions about specific securities? We summarize the results of the study.

As a result of the pandemic, the persisting low-interest-rate environment, and newly emerging low- and zero-cost providers, the securities business has become significantly more important over the past two years, and customer needs and demands for the securities business have also changed.

Simon-Kucher took a closer look at these aspects as part of the broad-based study it conducted in February and March 2022. The results show that hybrid advisory models are the future of retail investment advice services.

Analog to digital: Advice is still high on customers’ agenda

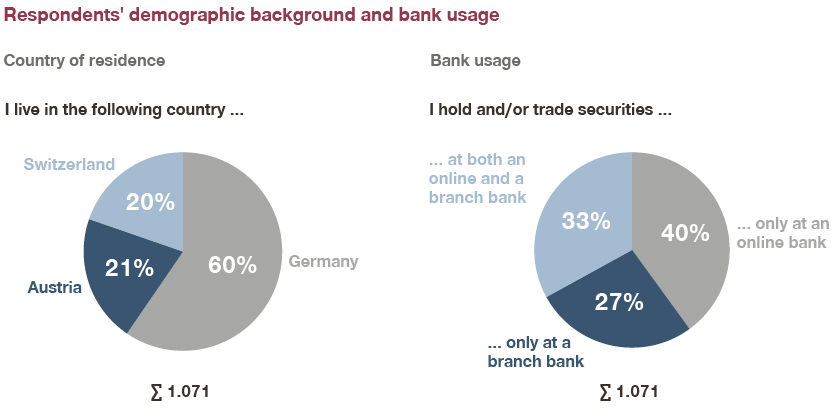

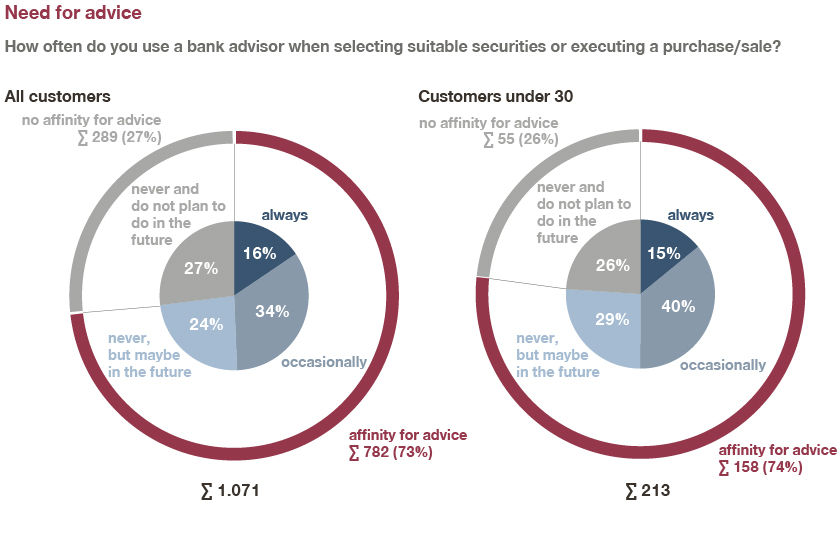

Of the 1,071 consumers surveyed from Germany, Austria, and Switzerland who currently own or trade securities, more than half have an affinity for advice. While 26 percent say they had never used investment advice and don’t plan to do so in the future, 49 percent make occasional or even constant use of advisory services when building their investment portfolio.

A further 24 percent say that, although they had never sought out investment advice before, they would certainly consider doing so in the future. The same applies to 29 percent of investors under 30 years of age. These figures show that there is significant potential for banks to win over this target group that supposedly favors purely digital by offering an attractive entry-level advisory service.

Support for securities customers: Gaps in advice services

At the same time, the findings reveal room for improvement in terms of overall advisory services and emphasize the need to use digital tools.

More proactivity

One problem is the “advice gap”: 65 percent of customers with an affinity for advice would like proactive investment advice from their financial services provider. However, due to face-to-face advice being unscalable, this service is rarely offered in the retail sector today.

According to Simon-Kucher, the answer is the digitization of investment advice. Portfolios must be monitored centrally. Banks should send their customers investment proposals automatically via an app or online banking platform on the basis of their individual risk profile or their individual investment goals. The investment suggestions should also include specific recommendations for buying and selling certain securities so that the customer can act immediately, and ideally, without any further back and forth with their advisor.

More user-friendliness and intuitive interfaces

Many major banks and larger private banks have already recognized the opportunities offered by digital investment advice and are working on appropriate solutions. Nonetheless, 49 percent of customers with an affinity for advice are still dissatisfied with the digital user experience of their investment advice.

However, banks can learn a few things from robo-advisors: ease of use, intuitive interfaces, and a conveyed feeling of customization. Robo-advisors’ strengths are banks’ weaknesses.

More digital tips

Even if not all respondents want to take investment advice, customers still want “digital guidance”. Of the customers who said they never want to use advisory services, 54 percent would nevertheless like to receive investment tips online.

But many banks get it wrong: 50 percent of customers with an affinity for advice say they hesitate when making investment decisions because they are overwhelmed by choice. This phenomenon, known as the “paradox of choice”, leads customers to ultimately take no decision at all when decision complexity is perceived as high. Therefore, banks and brokers need to implement smart, algorithm-based pre-selection.

More transparency and tailored recommendations

Furthermore, 62 percent of the securities customers surveyed would like to see investment recommendations to be easier to understand, and 53 percent would like to see a better response to customer-specific preferences. These figures show that customers often perceive banks’ advisory programs as a kind of “black box”.

Customers want to know what they are doing and identify more closely with their investments. This development is reinforced by the fact that for 70 percent of customers who invest in ETFs and/or funds consider the theme in which a fund or ETF invests (e.g., technology, green energy, health) to be decisive for their purchase. The theme aspect is therefore more important than region or asset class.

Customer proximity through digitization: Use of hybrid consulting models

The solution that combines proactivity, intuitive interfaces, ease of use, digital tips, transparency, and customizability is known as “hybrid advice”. This involves digitizing the existing advisory process in such a way that customers can theoretically go through it online completely independently and without the support of a personal advisor.

45 percent of customers with an affinity for advice and 64 percent of those with normally low affinity for advice would like to see hybrid advisory approaches in which existing advisory processes are digitized in a customer-friendly front end and can be used across channels.

Tapping willingness to pay: Success factors for monetizing advice

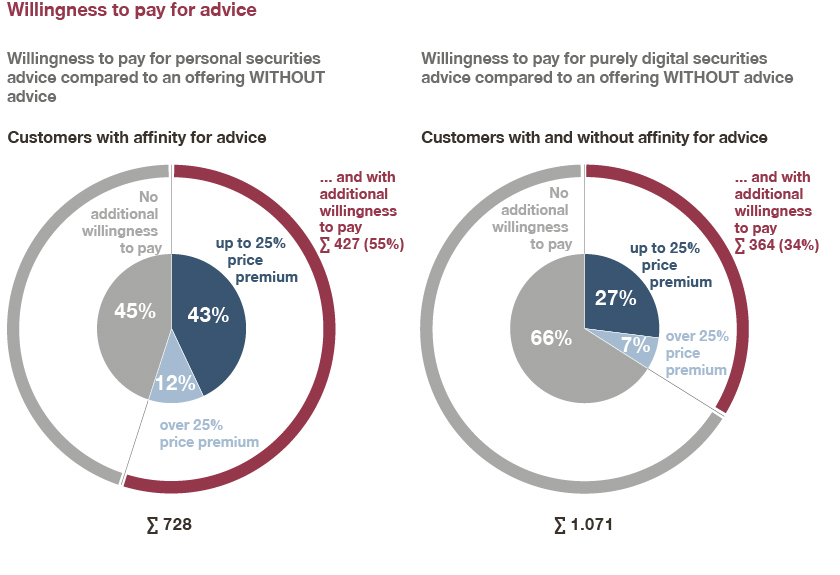

The desire for digital advice is also reflected in willingness to pay. While 34 percent of customers would be willing to pay a premium purely for the value of digital advice, up to 55 percent would pay more for in-person advice. In most cases, the surcharge is up to 25 percent higher than the price without advice. Intelligent packaging and differentiation as well as smart pricing structures are therefore key to successfully tapping the different ranges of willingness to pay.

Customers are also increasingly price sensitive when selecting ETFs and funds. Only those customers who said they already had experience with ETFs and/or funds or ETF and/or fund savings plans were surveyed.

Cost is the most important purchase criterion: 82 percent of respondents see running costs as a decision-relevant criterion when selecting ETFs and funds, and 79 percent perceive order fees as a key criterion. Running fund costs are also under regulatory pressure. Banks will need to shift toward recurring, visual fees to improve price perception while securing revenue.

Hybrid advice models: Threat to advisors?

Hybrid advisory models offer banks the opportunity to efficiently map the desire for proactivity, customizability, and transparency even in the mass of retail business.

But are these new models a threat to the traditional financial advisor? Our survey shows that half of customers with an affinity for advice would still want their advisor to walk them through a fully digitized advisory process. In addition, a certain degree of consistency creates trust: 59 percent of customers would like to always be supported by the same advisor. However, 41 percent can see themselves being helped by different advisors.

Fifty-three percent of respondents expect round-the-clock telephone support, and only just under a third of respondents would be satisfied with support via avatar or chatbot.

Advisors will still have a place in banking in the future, but their role will be different. In the world of hybrid advice, advisors are less and less concerned with finding individual solutions and increasingly focused on safeguarding decisions and eliminating potential concerns. The time saved in the advisory meeting by having all investment recommendations in one place can therefore be spent selling products.

Our project experience has shown that advisors who use hybrid advice solutions invest more than twice as much time in analyzing further customer needs and cross-selling. This creates customer proximity for traditional banks by means of digitalization.

Create added value with hybrid advice in the investment business

In summary, we can identify four key needs that customers want when it comes to investment advice, but banks and brokers today are only able to meet them to a limited extent:

- More proactivity in advising

- Intuitive interfaces and ease of use

- Simple, digital tips

- Transparency and customizability

Hybrid advisory models that are digitally supported and be deployed across channels enable traditional branch banks to meet these needs in the broad mass of retail business. They also enable purely digital banks to offer relevant added value to their customers.

By continuously making investment recommendations, hybrid advisory models offer recurring added value, which justifies the introduction of explicit, recurring fees to compensate for transaction fees and inducements, which have come under severe pressure.

Hybrid advisory services make a significant contribution to ensuring that retail banks can also offer investment advisory services profitably in the long term and prevent the opening of an “advice gap”.