Despite their rising economic status, women in Northern America are underserved as a client segment in wealth management, according to a recent Simon-Kucher study. How can financial institutions better reach and support women in their financial planning and investing needs? What initiatives would help level the playing field and encourage women to invest a similar share of their wealth in investments as men?

The good news is that women are getting richer, faster in the US and Canada.

According to the Simon-Kucher study, Wealth Management: Building a Winning Client Experience for Women, women's wealth in the US and Canada grew at a pace that was 180 percent faster than men’s between 2016 and 2021.

Several demographic, economic, and societal factors played a part in this phenomenon. The share of US businesses that are at least 51 percent women-owned has skyrocketed. Women are also reaching exceptional levels of success in greater numbers. Forbes estimates the number of self-made American women with a net worth of 250 million US dollars or more has increased from 50 in 2015, to 92 in 2022. Reflecting the societal trend of women outliving men by 6 to 9 years in the US and Canada, an increasing number of more mature women are also inheriting wealth from their spouses.

Efforts to address the wage disparity between women and men have also yielded results. While there is still a gender-wage gap, that discrepancy is narrowing, especially among younger workers. American women aged 25 to 34 earned 93 cents for every dollar their male counterpart earned in 2020, compared to 67 cents for every dollar earned by men in the same age group in 1980, according to research from The Pew Research Center. In 22 US metropolitan areas including New York, Washington, D.C., and Los Angeles, young women under the age of 30 are earning the same as or even more than men.

Despite the vast amount of household financial assets coming under the control of women, financial institutions have not kept up with meeting women’s financial planning and investing needs. What's particularly concerning is that almost one-third more women than men felt that their financial institutions' offerings are not meeting their needs. Women investors exhibit different preferences than men investors. Women also have a longer life expectancy, higher medical expenses, and earlier retirement timelines. The study found a lack of women-specific experiences, inadequately tailored financial enablement programs, and mismatched products and services.

According to the Simon-Kucher study, American and Canadian women invest 22 percent less of their wealth in investment assets compared to their counterparts. If women had actually invested a similar share of their wealth in investment assets as men, up to 14 billion dollars in additional fee revenues could have been available to financial institutions in 2021, according to Simon-Kucher analysis.

How can financial institutions better reach and support women in their financial planning and investing needs? What initiatives would help level the playing field and encourage women to invest a similar share of their wealth in investments as men?

Identifying and understanding what this growing client segment wants from their financial institution is key. A differentiated and tailored value proposition will be required to acquire, retain, and engage women. Three priorities stand out.

First, financial institutions need to get personal.

Women clients place higher value on attentive service, personal relationships, and access to a trusted financial advisor. Therefore, a dedicated and compatible financial advisor is a critical enabler to engaging meaningfully with this client segment. Compared to men, women prefer to use human advisors more and online brokerages less, according to the Simon-Kucher study. For example, 30 percent more women than men want to receive financial advice in-person. Similarly, 25 percent more women than men saw unique value in personal, one-on-one interactions.

Women's preference for high-touch advisory services has important implications for financial institutions' future growth and profitability. Nearly two-thirds (65 percent) of women investors are willing to pay a 20 percent premium for in-person advice, according to Simon-Kucher analysis.

Second, financial institutions need to tailor enablement programs.

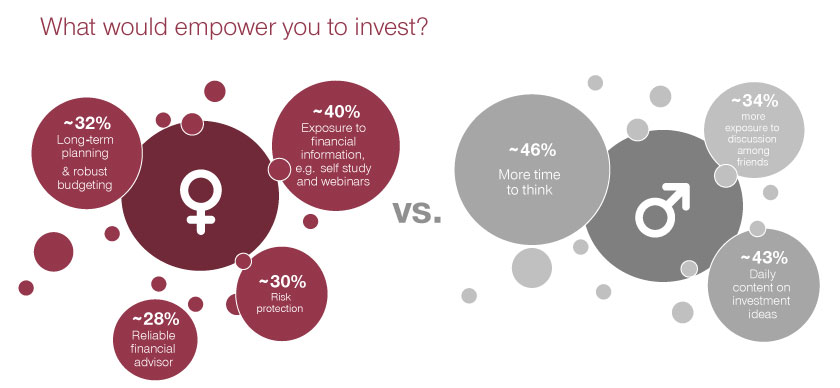

Gender differences are striking when it comes to how women and men prefer to source and consume financial advice. In contrast to men, women are interested in expanding their knowledge base through education and training. They also want access to long-term financial planning and budgeting tools (Figure 1). Financial institutions need to start designing wealth management experiences that resonate with women if they want them to invest at the same rate as their men counterparts.

A number of operating models can be considered when it comes to delivering world-class enablement programs tailored specifically for women. Financial institutions can form collaborative partnerships with an influencer or trusted authority to provide educational content in digestible and approachable ways. Another approach is to embed a segment-specific wealth academy or learning curriculum into the client experience. Launching a stand-alone venture offering coaching, investing tools, and a robust investment platform for women is also a great option.

Figure 1

Finally, financial institutions need to find ways to provide holistic, long-term financial advice.

Comprehensive, long-term financial planning and advice matter to an overwhelming majority of women. In the Simon-Kucher study, 89 percent of women said they wanted to receive strategic, holistic financial advice. Financial institutions are presented with a valuable opportunity to establish a deeper relationship with women clients through comprehensive wealth management. In this approach, the financial advisor takes a strategic, 360-degree view that considers all aspects of the client's financial accounts including illiquid and non-bankable assets.

By shifting to a more strategic engagement model, advisor-client interactions take on the form of a partnership, which deliver a more seamless and comprehensive end-to-end experience across product lines and in collaboration with third-party providers and experts.

To learn more about unlocking this segment's revenue potential, reach out to the authors.