Pricing expert Philip Daus shares 10 state-of-the-art negotiation tactics that key account managers can apply to get the best deals at the bargaining table.

Let’s start this article with a true story. Many years back, sat in the headquarters of a Fortune 500 company, I asked the head of strategic accounts about an upcoming deal with one of the world’s largest oil firms. Given we were discussing such a vital account, I expected them to walk me through their diligently prepared negotiation strategy. Instead, the regional sales director for the US was called in. “Hey, we have this annual price meeting. Call Jimmy and start planning.” It was the first time anyone had thought about preparing that negotiation.

Key account pricing is unique, with its own challenges. But, let’s be honest, most companies are not tremendously good at it either. How much time on average do you think senior executives spend preparing a team for a key account negotiation? One month? One week? One day? The actual answer is 43 minutes. That’s not a lot of time given what's at stake.

The importance of key account negotiations

What is at risk here? Why are key account negotiations so important? First, they matter in terms of transaction size, that's a no brainer. These are very large customers, and so are the associated deals, often with several rounds and top management involvement from both sides. Even more challenging, the number of transactions in a year is typically very low, there’s little room for error, and it’s difficult to learn from past mistakes.

A recent Simon-Kucher cross-industry survey on key account pricing asked companies to review their past negotiations. 46% felt that had there been an honest, upfront conversation, customers would have admitted a much higher willingness to pay, and bought a lot more. When we asked about profit impact, the numbers were even worse. Depending on deal size, respondents felt that roughly 10% of profitability was left on the table. Just dreadful!

You might say it's just this one-time deal Philip. It’s one exception, why the big fuss? Let me just remind you of contamination risk:

- You budge and grant a price cut in 2019. Your key account learns from that and expects similar reductions in 2020, 2021, etc.

- Likewise, a concession for one product group might spillover to other product groups.

- You don't operate in a vacuum. Your customers go to trade shows and talk to each other.

Poor performance in key account negotiations also puts immense pressure on the organization to achieve more with the remaining accounts. You typically need a 5% price increase with small customers to compensate for a failed 1% increase with key accounts. And, if you continue raising prices for smaller accounts without increases for key accounts, a big gap starts to form, creating industry inefficiencies, along with many damaging effects for your long-term strategy.

Finally, these negotiations are very account-specific. Time and time again I hear that every deal is a snowflake, every deal is different. “You don't know my business, nor my customers. You may have worked with similar clients in the industry but we are very different. There's no way you can improve my negotiation power”. True, you can’t create a blueprint for one account and transfer it to another. There are the specifics to your products, customer mix, and industry. But let me debunk a myth regarding the snowflake theory. While the characteristics of every key account negotiation are indeed unique and specific, there are some basic power mechanics, tools, and concepts that can be applied to improve your outcome. Here are 10 key success factors for big deal pricing, and I’ll already spoil the surprise: 7 are about preparation.

1. Do your homework and set the right targets

Every deal really is a snowflake. To quantify your potential, you must look at all the numbers, for every account and ideally every product. Imagine you sell a mix of innovations, commodities, and phase out products. The volumes, share-of-wallet, and margins differ greatly, and so should the negotiation targets. Share-of-wallet (SOW) in particular means very little unless you know your customer. With an innovative product, it may be possible to increase SOW from 85% to 100% by improving your value proposition. With a commodity, you might be restricted to 25% due to rules on the customer side, e.g. no more than 25% of volume goes to any supplier. Knowing where you can ask for volume and price upfront is crucial.

2. Understand the decision-making process.

Get to know the dynamics and stakeholders within your client's organization. You might only see the buyer in the negotiation room, but many others have a say. Map out the roles and interests before the call for bids so that you can systematically develop influencing strategies. Who are you currently in touch with? What type of interactions do you have? Are these your friends or your foes?

3. Analyze your value position

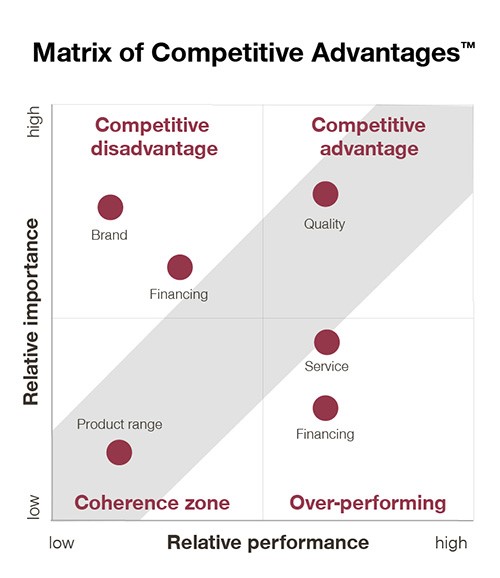

Often, communication around a product is internally driven by engineers, R&D, and product managers, rather than by market research or those who know the accounts. To succeed in negotiations, you need to understand the value drivers from a customer perspective and feed them into the value proposition. We recommend using the Matrix of Competitive Advantages™.

Here’s an example: Top right are factors that are very important for your customers and where you outperform competitors. Highlight these competitive advantages in negotiations. Bottom right are unimportant factors where you're over-performing and need to improve communication so customers recognize how important they really are.

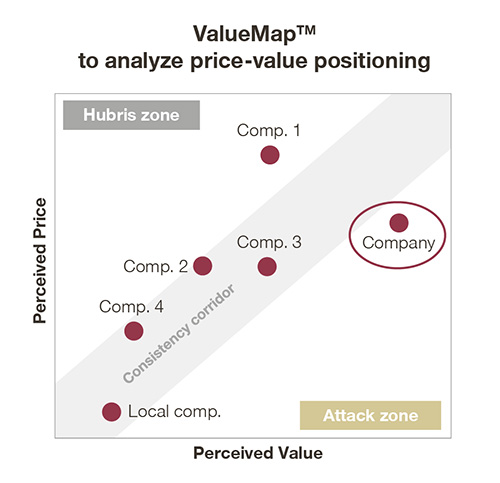

To measure the value drivers against the perceived price, we use the Value Map™. This is a great starting point to understand where you currently stand from an account perspective. Are you in the attack zone, delivering more value than expected for your price (aggressive positioning). Or are you in the Hubris zone and offer less value than what your price level reflects?

4. Understand the balance of power

The most frequent mistake committed by sellers is they underestimate their position of power. Avoid this trap by using tools and methodologies (e.g. Simon-Kucher’s Balance of Power™) to quantify your position, as well as that of your customers. Explicit elements to consider are e.g. available alternatives, switching costs, urgency, deal size, credibility of threats, etc. Then there are implicit elements, such as commitment, industry/product knowledge, risks, track record, and fairness. Would the customer risk moving to somebody they’ve never worked with before? Are they a risk-averse company or willing to gamble? Identifying your balance of power through a systematic and structured approach will often contradict your original gut-feeling.

5. Set the optimal target and walk-away prices

Identify your target price, then plan backward to determine the opening price. The more rounds, the higher your opening price will be. Rather than deal size, success is usually about how ambitiously you enter a negotiation. Then there’s your walk-away price. Let’s say everybody on all sides approves a walk-away price of $100k. What if your client comes back and says “I'm willing to close this deal, but for $99k”? If you agree to close, 100k is not your walk-away price. It really needs to be as low as you go, driven by the best alternative to negotiate an agreement (BETNA) and factoring in variable costs and price contamination.

6. Plan your concessions carefully

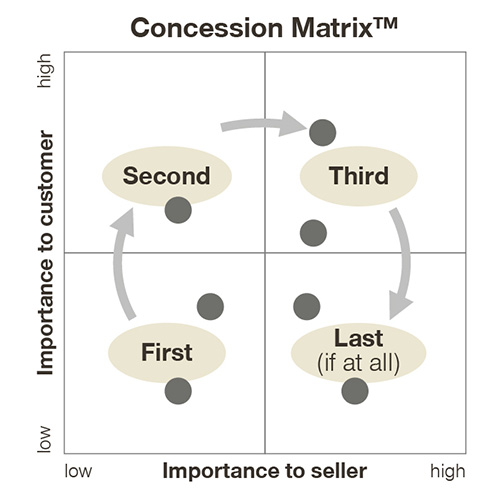

Negotiations don’t always have to be confrontational. Some elements are important to everyone. Map out how valuable concessions are for you and your customers using Simon-Kucher’s Concession Matrix™. It not only incorporates volume and price, but also contract duration, transport input, drones, packaging charges, and all of your additional services.

- Start with the things that are neither significant to you, nor the customer. Inflate the importance, explaining to the buyer that “this is a tremendous concession!” to open the negotiation with a feeling of goodwill.

- Next are the things that are important to customers, but not so much for you. Don’t give anything away for free. Request some type of counter concession before moving to the really tough battles.

- Avoid topics that are unimportant to your customer but very important to you. Best not even mention them (just include them in the final agreement).

- Always combine a reduced price with reduced performance e.g. for products, logistical performance, or payment terms.

7. Conduct mock negotiations

As Mike Tyson said, “everyone has a plan until they get punched in the mouth.” To avoid this fate, you need to practice your negotiations before walking into the room with your customers. Set up two teams where your KAMs face your own purchasing department, with someone observing and taking notes. Go and have fun negotiating with your own folks! You might find these are negotiations are very realistic.

8. Use persuasion techniques

Sending your KAMs to key account negotiations can feel like heading with a knife to a gunfight, but there are techniques and cheats you can apply – your customers do. They’ve made extreme demands, used tricks, false complaints, threats, and tested you with “I don't have to buy from you”. They alter the course of the negotiation and weaken your position. They're trained to do this, that's their job. So why not test some of these techniques with your own team? Ever negotiated the price of a carpet in Marrakech? Then you know that reductions get smaller and smaller as you get closer to the true price. But why anchor with the walk-away price? Start offering concessions as you approach your target price, signalizing the room to negotiate is getting smaller. Get more precise with your numbers, take longer in coming back with an answer, involve senior executives in your emails etc. All of these things should be done around the target price, not the walk-away price. This is just one of many examples of a technique to sway the negotiation in your favor.

9. Use customized cheat sheets

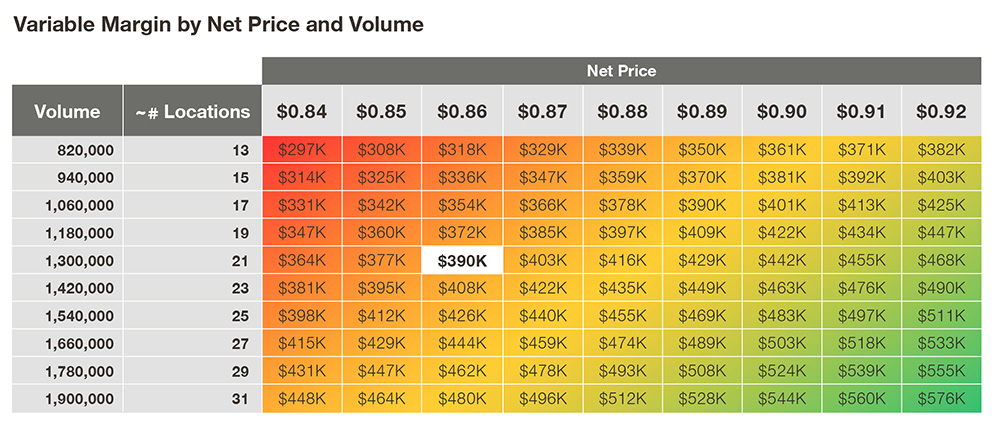

Prepare the different outcomes for different product net prices and volumes in advance, factoring in how this relates to the number of stores where your product would be sold. When your customer throws price points into the room, they know very well where they stand in terms of negotiation success. Cheat sheets give you the confidence to be more flexible in the negotiation and offer alternatives.

10. Monitor results and learn from the best

After the negotiation, have a look what happened. What went well? What didn't? Make a habit of learning from experience and using past deals as a starting point for preparing next year’s negotiations. If you don't want to do this holistically for all your talents and key accounts, then start with a pilot. Take one account, analyze and prepare it very diligently in all areas, and see how it alters next year’s outcome.

Executives spend 43 minutes preparing negotiations. How much do you spend? Do you think it’s enough? Why not ask Philip Daus.