The road to successful dynamic pricing can be a bumpy one. Automotive expert Patrick Valentin explains when it makes sense to pursue dynamic pricing strategies, and how auto manufacturers can make them work.

OEMs are moving toward direct (online) sales, spare parts are increasingly being sold online, and new business models are popping up on a daily basis. It’s safe to say that the automotive industry has embraced digitalization and the associated developments, paving the way for new technological trends such as big data analytics, Machine Learning, and dynamic pricing.

Dynamic pricing is nothing new, and airlines and other travel providers have been using these models as early as the 70’s. Thanks to new technological developments, however, it has never been more viable, and the last decade has seen a wide range of industries experimenting with dynamic product prices, from energy to retail. These success stories across industries are also sparking the growth of new concepts and products in the automotive industry. However, before rushing in at full speed, automotive manufacturers should be aware of the bumpy road ahead. Dynamic pricing isn’t always appropriate in every situation, and can backfire if not backed by a clear strategic direction.

Dynamic pricing: the opportunities and risks

When applied correctly, dynamic pricing has several key benefits, such as maximized profits and revenue growth. Prices can be used to manage demand against supply and differentiated to better represent customer willingness to pay. Plus, it leads to increased efficiency, as the same number of FTEs are able to handle a larger number of price changes, and automation means you can react to market changes (e.g. competitor prices, customer behavior, etc.) in real time.

However, without structured, accurate, and complete data, dynamic pricing can also lead to harmful price changes. Sudden and drastic moves can cause customer backlash, negatively impacting your price image when too high, and triggering price wars when too low. And while dynamic pricing increases the chances of price crawlers matching the prices of your best products, it can create a black box within your own organization. If pricing algorithms are not fully understood, salespeople are unable to explain the reasons for price changes, and planning and budgeting becomes challenging due to ambiguous prices and volume forecasts.

Dynamic pricing affects many different areas of the organization that need to be prepared in advance, and requires careful consideration. However, once you are sure that the pros of dynamic pricing outweigh the cons, there are many areas where can be applied. Let’s look at three main use-cases for dynamic pricing across the automotive industry:

As manufacturers move closer toward direct-to-customer sales models, the opportunities for direct price steering are widened. A key decision for this potential new distribution structure is whether to use dynamic or personalized pricing.

- Vehicle pricing: Dynamic or personalized?

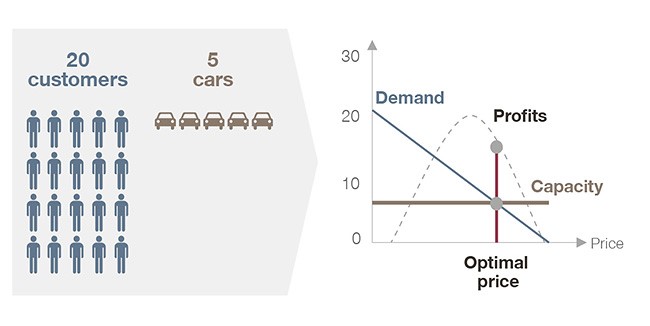

Dynamic pricing: Imagine your factory is only able to produce 5 cars for every 20 interested customers. In a constrained period like this, the optimal price is where demand matches capacity. Dynamically optimized discount levels, promotions, and prices steer sales teams toward the best deal, but this also requires the right data. Letting the factory decide requires an accurate demand and fleet forecast and a detailed evaluation of customer price sensitivity, your sales funnel, rep performance, and competitor behavior.![customer price sensitivity]()

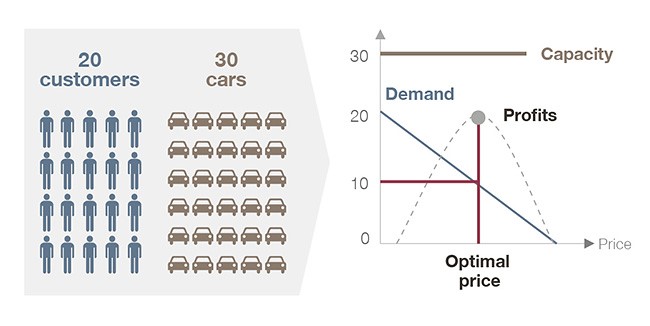

Personalized pricing: Let’s say instead you have 20 customers interested in 30 cars. In this case, pricing needs to stimulate demand. The optimal price doesn’t depend on stock, but on each customer’s price sensitivity. By adapting messages, promotions, discounts, and omnichannel practices, there is a major opportunity here to boost conversion and average basket value. Personalized pricing should be based on individual visitation patterns, the customer’s search behavior, and customer lifecycle.![customer price sensitivity]()

- Mobility services: Prime candidates for dynamic pricing

Beyond traditional new vehicle sales, a large number of traditional and rising industry players are entering the mobility space. They’re pushing hard with modern offers such as ride sharing or hailing services, which by nature have a constantly changing supply and demand. This makes them prime candidates for dynamic pricing. A well-known example is Uber, which balances demand through price increases in surge situations. What’s particularly impressive here is that Uber actually solves a user experience challenge through its dynamic pricing solution. Any user unable to find an available vehicle would be disappointed with the service. But, by increasing prices in high demand situations, Uber makes sure enough drivers are available to customers. This provides customers with an enhanced user experience while boosting profitability. Other companies, in comparison, make the strategic decision to not use dynamic pricing. For example, Addison Lee communicates very openly about its fixed prices and uses it as a USP. The taxi firm differentiates itself from the competition through price consistency and improving the customers’ ability to plan. - Cutting through the complexity of spare parts pricing

Large SKU pricing has long required advanced methodologies and large teams to manage and steer prices across the globe. Now with an increasing number of manufacturers investigating and expanding omnichannel pricing efforts (ecommerce, direct-to-wholesale, etc.) spare parts pricing has become even more complex. This is a prime application for dynamic pricing systems and, to a certain extent, adaptive systems (e.g. price crawlers). A dynamic pricing system can more easily adapt to changes in competitive price levels, steer prices across channels, react to demand developments, and factor in value drivers such as seasonality (e.g. for car batteries in the winter). However, in this complex environment, it is even more essential to carefully monitor the effects of dynamic pricing to avoid damage to your business, such as through grey market streams or price wars.

Succeed with dynamic pricing in four stages!

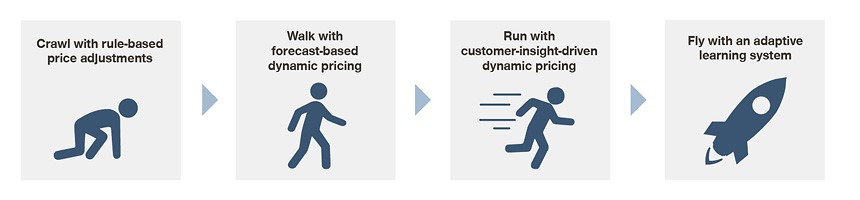

Despite its technological underpinnings and obvious application areas in the automotive and mobility space, dynamic pricing requires strong human oversight directed by a clear strategy. Based on our extensive experience of dynamic pricing in other industries, we always recommend a crawl, walk, run, fly approach to establish dynamic pricing systems.

- Crawl with rule-based price adjustments

On the way to establishing a dynamic pricing system, it makes sense to start with an initial rule-based pricing approach. This requires a review of existing market data and an understanding of the level of acceptance among your customers before establishing a hypotheses-driven set of differentiation rules. These should be displayed in a tool-based frontend application such as a Digital Sales Assistant (DSA), while prices are calculated offline using the pre-defined ruleset as well as capacity and historical sales data. This will enable you to generate your first set of win/loss data and indicate where you need to improve over time. - Walk with forecast-based dynamic pricing

The next stage is to fine-tune the established pricing rules and build the pricing algorithm based on the win/loss data and pricing feedback from stage 1. Using advanced analytical modeling, you can predict demand, sales, and supply, and adjust prices with more granular rules. These supply and demand forecasting routines are displayed in a pricing engine with an approval frontend, a dashboard, and database connected to the DSA. Ideally, website and configurator data are also integrated into calculations. - Run with customer-insight-driven dynamic pricing

Once forecast-based dynamic pricing has been established, the next step is to learn more about different customer segments in the market. These insights should then be used to build a segment-specific pricing strategy with more forward-looking predictions. Potentially combined with supporting conjoint mechanisms, a Machine Learning model is then connected to the pricing engine. Ideally, this requires lead data from the DSA, web configurator data, and website data. The output is price elasticity data as well as conjoint utility data or the creation of a “virtual customer” that can be used to simulate pricing decisions. - Fly with an adaptive learning system

The final stage is to develop a Machine Learning model that independently optimizes pricing based on predefined success criteria. Pricing rules are replaced with an optimization logic based on price elasticity and a direct feedback loop is established from the generated data to the pricing engine. In addition, an online learning model feeds the results of decisions back into the decision model.

Enjoyed reading our article? You may also find this interesting:

Advanced pricing: 3 ways to accelerate your pricing power in the automotive space

3 Steps to Increase Electric Vehicle Sales With Customization