To acquire and retain strategic clients, as well as to deepen client relationships, discounting management is key. Yet, this isn’t a simple task. Industry experts Petra Knuesel and Enrico Costenaro reveal the top three discount management challenges, and how banks can overcome them.

Private banks and wealth managers rely heavily on discounts when it comes to adapting prices to an increasingly diverse and demanding clientele. The services offered, the client’s behavior, or the client's asset structure are just a few of the drivers that influence negotiations.

Those drivers mixed with pricing complexity make it exceedingly difficult to effectively manage and maintain discounts, and take informed decisions. Moreover, once a decision is taken it is often a challenge to efficiently process the discount request.

With this premise it is clear that discount management is a prime topic for private banks. A good discount management strategy would ensure that negotiated discounts are in line with a bank’s strategy and serve their intended purpose.

Here, we present the top three challenges with discount management, and how private banks can effectively respond to them.

Top 3 challenges with discount management

1 – Lack of transparency

Relationship managers and management have often limited transparency on revenue and pricing KPIs both on a detailed and on an aggregated view. Only some banks have periodic reporting of financial KPIs but very few include and consider pricing KPIs such as price enforcement (PE). |

Not only is reporting limited but its frequency is quarterly (at best), in most cases – otherwise it is conducted on a yearly basis. This is not enough to effectively steer a book of clients, a team, a region, and the bank as a whole.

Finally, wherever some sort of monitoring exists, it is often done manually. Yet, since it is difficult to tailor it for each recipient (team head, region head, etc.), it is usually only shared with senior management.

2 – Lack of guidance

Software tools that allows the analysis of pricing and discount for existing and prospective clients are common in many industries, but still have to penetrate wealth management. The same applies to techniques like peer pricing or smart segmentation. This is often due to the challenge that implementing these solutions represents.

Despite pricing complexity, very few banks equip their relationship managers with software tools, which enable the analysis of the economic impact of discounts, and provide guidance in terms of target RoA or PE.

Therefore, throughout the preparation, negotiation, and discount decision process, new pricing conditions are, in most cases, granted without prior knowledge of the resulting revenue leakage.

Also, due to this lack of transparency, most discount decisions are not “informed”, which results in an average discount request approval rate of more than 97 percent (observed industry average). Moreover, the lack of guidance, other than revenue leakage, can lead to unstructured pricing, and unfair client treatment.

3 – Lack of structure

Workflow software is a widely adopted solution (also by private banks and wealth managers) to orchestrate business processes, such as client onboarding and account opening.

However, discount approval processes are not usually formalized with a tool, and still rely on email exchanges and/or paperwork. Even in banks where this process is done through a workflow tool, the implementation of approved pricing conditions in the core banking system is done manually by a dedicated team.

In both cases, the overall process is far from optimal:

- The lack of structure can be highly inefficient, as the approval hierarchy might not be properly involved (and can have compliance repercussions)

- The manual implantation of approved pricing conditions can be a complex operation prone to errors, which can result in a wrongful fee

- The lack of proper discount documentation makes activities such as discount reviews more challenging, which is why they are often neglected. The result is that discounts that were granted to serve a specific purpose (e.g. portfolio rebalancing) are not checked and become “permanent”

One solution: End-2-End Discount Management

The challenges discussed in the previous paragraphs are, unfortunately, often neglected by banks, until margins visibly shrink. At this point, a bank’s usual first instinct is to perform a strategic pricing review.

This will increase revenue in the short-term, but won’t do any good to the underlining – discount management – issue. Time and time again performing such a review has failed to make any long-term changes, as, after a while, “old habits” creep back in.

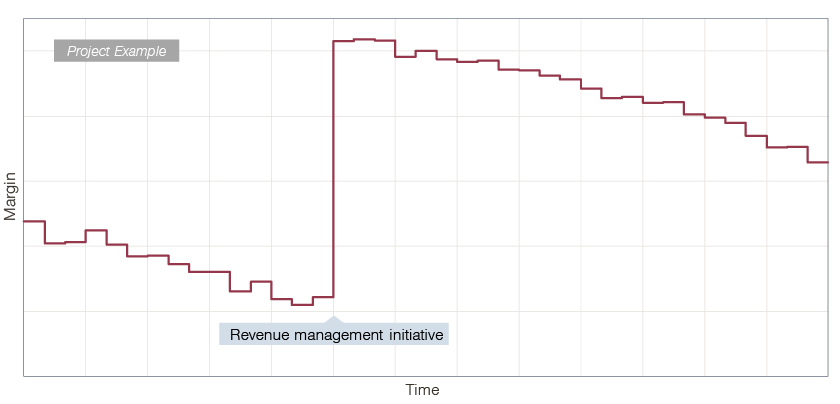

The graph below demonstrates what can happen after conducting a revenue management initiative, such as a pricing review. Margins promptly increase but resume shortly after, following the previous trend.

We have developed PricePro Run, a comprehensive revenue and discount management solution that integrates multiple Simon-Kucher & Partners’ banking pricing methodologies.

To prevent this from happening – and to tackle the challenges described previously – private banks and wealth managers should prioritize the creation of optimal pricing and discounting strategies, as well as implement a proper end-to-end discount management solution.

Simon-Kucher’s PricePro Run

PricePro Run’s functions cover several modules, which are shown in the picture below.

These modules enable relationship managers to effectively steer their book of clients. With these tools clients can simulate new pricing and products (e.g. a new advisory mandate) for existing and prospective clients.

The modules also provide information on how different discounts will affect a client’s KPIs, and, ultimately, bank revenues. The simulation results allow management to set clear objectives and limits – such as a target RoA – and to steer the bank accordingly.

The workflow management module, in particular, allows banks to digitalize their discount management process. Discount requests are dispatched to the right approver, and the approval chain adapts based on the discount type and level.

In addition, PricePro Run has advanced data management capabilities. It enables monitoring of pricing and discount KPIs by summarizing and aggregating data from multiple data sources and its internal pricing database at different levels (e.g. books, teams, regions, etc.).

Finally, PricePro Run interfaces with third-party systems to retrieve data and to implement approved new pricing conditions in the core banking system. The tool can be implemented as a standalone solution, or integrated in existing dashboards or CRM.

PricePro Run is the one solution to discount management challenges.