Tough times make using resources efficiently essential. Our measures for optimizing sales processes have shown results: With our support through needs-focused guidance, relevant customer outreach, and goal-driven incentive models, banks and insurance providers can increase conversion rates by 18 percent and improve profits for the long term.

Sales challenges for banks and insurers

Banks and insurance providers are faced with many challenges, including regulations, new online competitors, and growing demands from customers. Having to meet these demands makes selling products and services more difficult. But, when inflation is high and prospects are generally uncertain, these institutions have no other option than to make their sales operations more efficient.

The simplest way to achieve this is by satisfying customer demands without using more sales resources. Based on surveys in Germany, Austria, and Switzerland, customers want banks and insurance providers to proactively provide them with product information tailored to their needs. Customers also expressed a desire for a simpler way of concluding contracts online and for loyalty bonuses if they purchase other products and services from the same provider.

Effective measures to increase sales efficiency

Many organizations are finding it harder than ever to deploy their resources more efficiently and ensure long-term success in sales.

A wide array of projects in Germany, Austria, and Switzerland over the past few years provide different examples of how banks and insurance providers can successfully optimize sales performance. The following selection of suggested changes show how banks and insurers have managed to improve their conversion rates and profits for the long-term using simple tools.

Needs-focused advisory services and straightforward online processes for concluding contracts

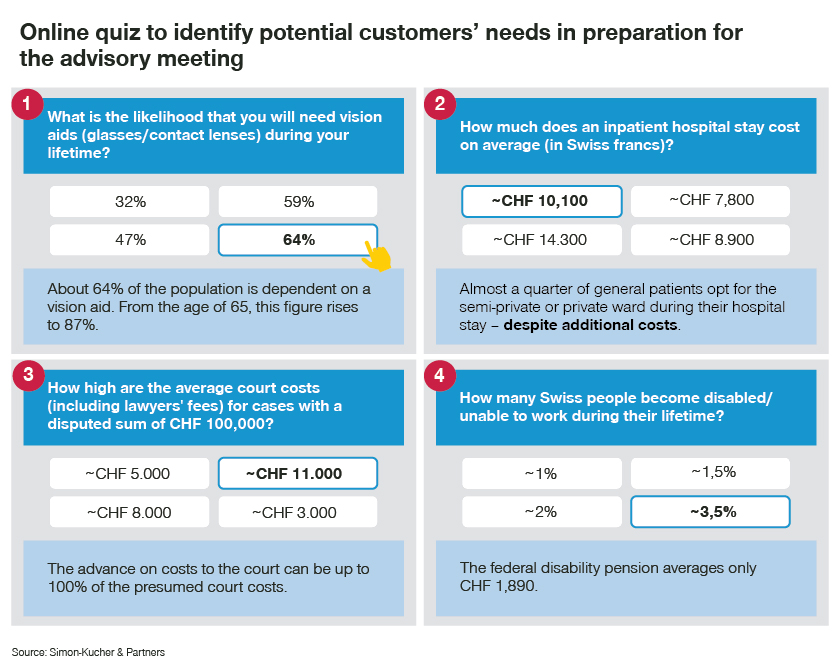

Digitalization is becoming an increasingly big part of financial advice. This means that companies need to reimagine how these services work from both their customers’ and advisors’ perspectives. In one of our projects with an international insurance provider, a questionnaire and an online quiz to identify customers’ needs produced a highly personalized, online experience of getting advice for customers. Sales-focused support using product booklets and “product bridges” optimized based on behavioral economics helped advisors improve cross-selling and upselling. What’s more, letting customers manage their financial matters digitally, a straightforward process for purchasing financial products online, particularly for products with low margins, proved essential. This process also gives sales representatives the chance to focus on products that require more advisory support. The result of these measures has been to increase the conversion rate by 18 percentage points and reduce the time needed to give customers advice by 12 percent.

Reaching out to customers with relevant product information

Selling additional products to existing customers is an obvious tool for growth, but few companies make full use of it. A silo mentality and a lack of transparency about customers’ use of products are just two of many problems they face. Banks and insurance providers should use the information about their customers that they already have so they can better meet their needs and offer them relevant services. Creating a customer-oriented marketing plan with predictive product suggestions from the CRM system can help increase the rate of cross-selling while also fostering customer loyalty. In some examples involving Swiss and German banks, customers were sent product offers, which data analyses classified as relevant to them, leading to an increase of the upselling rate by up to 19 percent.

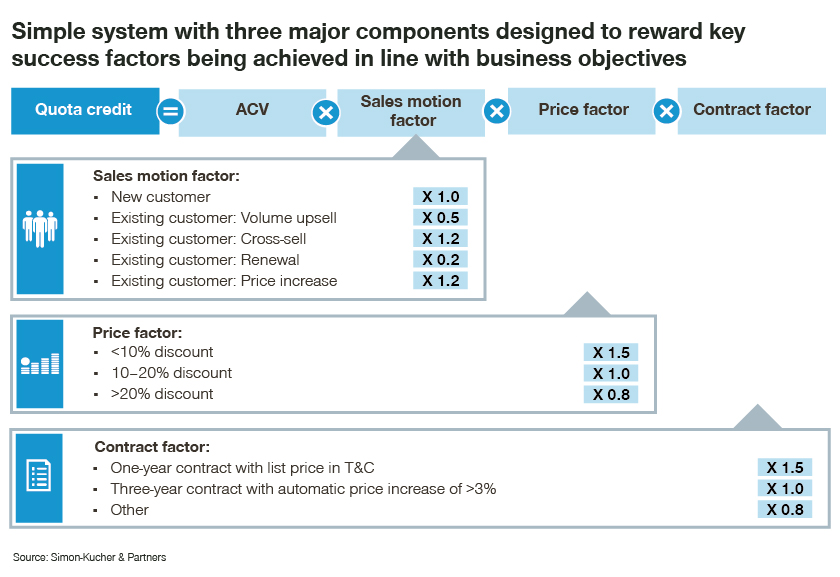

Targeted discount and incentive models

Banks and insurance providers often use incentive models for advisors. However, these models shouldn’t simply be aligned with overlapping corporate goals. When designing discount schedules, it’s important to organize and structure them so that they encourage customers to buy additional banking and insurance products. Bundle discounts are one common approach to this. There are multiple elements that can be adjusted to produce a balanced and goal-focused incentive system. For example, a system that awards bonuses to advisors for cross-selling successfully would provide a suitable incentive. Thanks to a data-driven analysis and an overhaul of its incentive structure, one Swiss insurer managed to increase the productivity of individual advisors by up to 15 percent.

Conclusion: Sales efficiency must be improved now

Insurance providers and banks are under more pressure than ever to keep up with the competition and customers’ increasing demands. Emails with irrelevant product offers and standardized scripts for advisors don’t motivate many customers to make a purchase. To find the best possible position on the market, banks and insurers have to optimize their sales efforts.

Management should devote its efforts to taking the measures needed to increase sales efficiency. Our expert teams have extensive skills and experience in customer journey optimization, behavioral economics in advisory processes, and efficient sales remuneration models. By implementing measures aimed at improving their sales procedures, we can help banks and insurance providers take on the latest challenges. Reach out to us to find out more!

Visit our BE Digital landing page to read more.