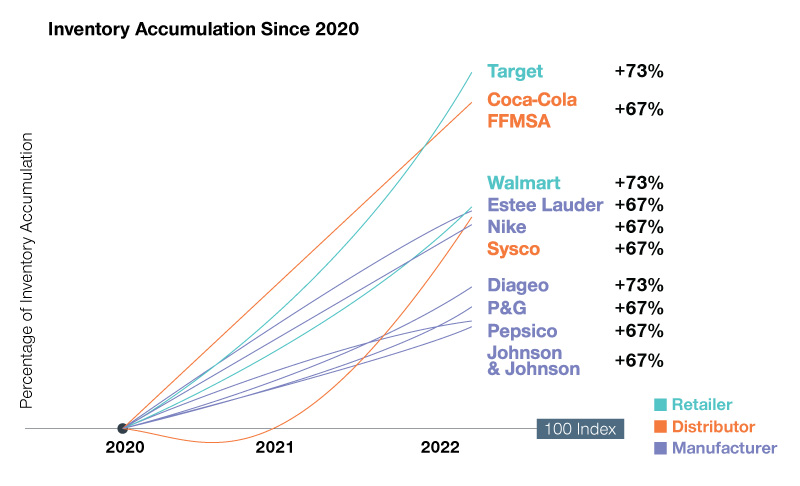

Many companies are facing an extended period of unprecedented inventory risk. For those with complex Routes-to-Market (RTM), inventory accumulation among distributors and retailers presents a challenge for both your organization’s stability and its commercial performance – and it can be a problem that remains unseen until it’s too late to react.

While some RTMs are already emerging from a period of excess inventory, others appear to still be very much in the thick of it.

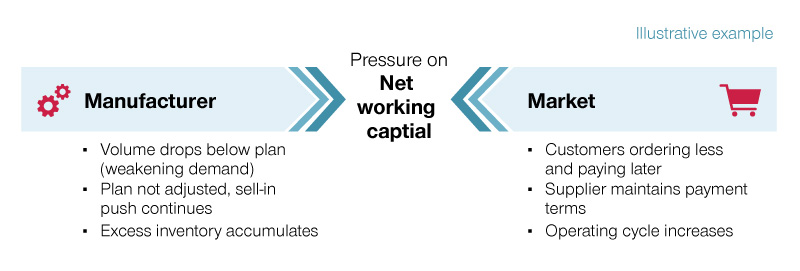

The challenge for distributors and retailers is the inverse relationship between inventory size and free cash flow: as inventory accumulates, the channel partner has less free cash flow available to invest in operations.

This relationship is particularly challenging in high interest rate environments, because the natural reaction to increased interest rates is to then increase the cost of working capital (which further tightens free cash flow).

Many manufacturers lack the controls needed to measure the inventory positions of their channel partners. Therefore, the free cash flow constraints slowly tighten throughout the RTM. The result is a systematic issue that limits the number of routes a distributor can run. This in turn limits the size of their teams in the field, and that further constrains their ability to invest for performance and growth. A similar story plays out for retailers feeling the squeeze: staffing levels are reduced, operations capacity suffers, store expansion is postponed, and in extreme cases, store consolidation occurs.

The end results? This reduction of free cash flow means that manufacturers suffer.

Limits to a manufacturer’s coverage and execution will damage its share growth, but lowering standards in the retail space can subject the manufacturer to brand damage. If retailers try to implement aggressive promotions aimed at shifting inventories, the fallout can be that consumer price strategies become contaminated.

In extreme cases, downstream RTM partners are at risk of failure. However, it is more likely that high performing distributors and retailers will simply shed any suppliers that are driving these inventory issues, which limits market access for brands.

The first challenge for manufacturers (particularly global players) is to determine the size of the inventory challenge in their RTM. In many cases, obvious indicators go unnoticed, and it is not until performance issues are measured in their markets that alarm bells begin to ring back at headquarters.

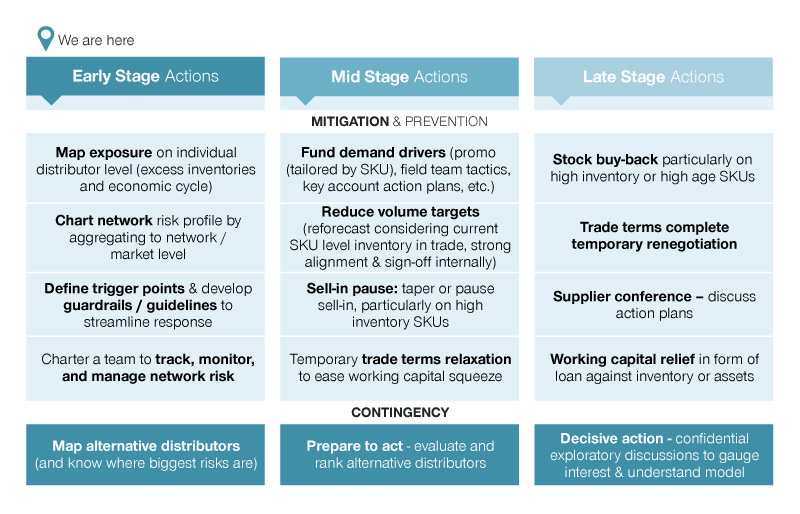

This does not need to be the case. Manufacturers are capable of mapping lead indicators of free cash flow squeeze (such as inventory accumulation) and taking action to protect themselves.

With clear visibility of the size and location of the issue, there are early, mid and late-stage actions that can be implemented to mitigate any challenges and prevent share decline.

At a global level, not every market will experience the same level of pressure. A global response can be coordinated with the help of a high-level scan done in each region.

Manufacturers that coordinate with their RTM partners to identify and resolve free cash flow challenges before they become operational constraints (and especially before they become market share challenges) are well positioned to outperform their competition during periods of market turbulence. In fact, establishing a close partnership and working in unison with key distributors and retailers will strengthen those long-term relationships, and will position the manufacturer to better win with high performing partners.

The first step to mitigating the risk of excess inventory (and turning it into an advantage) is to systematically map the level of exposure, understand it’s location and size, and to devise a framework that enables teams to alleviate these challenges locally.

Already experiencing inventory accumulation? Simon-Kucher's Route-to-Market specialists can utilize their years of expertise to prevent market share decreases, and help you implement strategies to create a competitive advantage and long-term growth. Contact us today.