As demand for alternatives to animal-based proteins increases, more and more innovation in food technology is being created, with significant value delivered across the entire value chain. However, in the current climate of inflation and cost pressures, capturing the value of new ingredients technologies in the market is a major challenge. This article outlines the optimal approach how to set-up licensing agreements and to monetize the full potential.

In recent years, there have been substantial inflows of capital in companies creating sustainable alternatives to conventional animal-based foods. In the US, almost six billion in capital was raised by alternative protein companies in the last decade, and half of that in 2020. This trend is only expected to increase as consumers want healthier and more sustainable, climate-friendly proteins.

Innovation in food technology is often driven by companies at the front of the value chain, with the value then enhanced by their customers, or even their customers’ customers, through new and existing products. However, often left untapped is the significant monetization and growth potential for the technology company themselves.

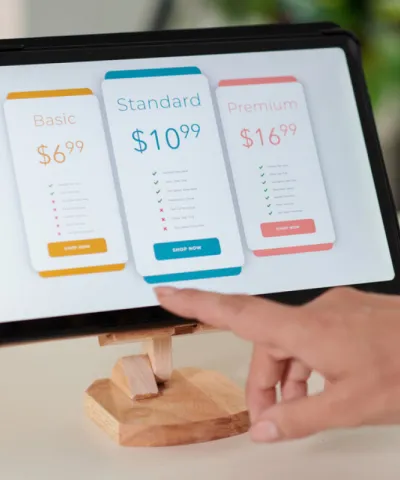

Creative structures, such as licensing, enable innovators to capture the pools of value that they create for suppliers and end customers.

Advantages and disadvantages of licensing structures

Moving from a technology company to a production company is a huge change and comes with its own risks. A faster way to revenue is to license your technology, allowing you to jointly share the value of your innovation while you scale your business. You focus on your core competence as a technology developer, while leveraging the manufacturing facilities and your customers’ go-to-market infrastructure to approach the market faster. For the licensee, the primary benefit is the avoidance of the R&D cost.

There are some drawbacks to this strategy. Primary concerns include protecting your IP, not becoming too dependent on the skills of your partner, and ensuring that you are able to fence the license in a way that does not cannibalize your future sales.

Advantages | Disadvantages | |

| Licensor |

|

|

| Licensee |

|

|

How to develop a winning licensing structure

If you determine that a licensing structure is appropriate, the next step is to develop the financial arrangements. Here, it may be tempting to look at the development and production costs and then simply add a base margin on top. However, although this approach may initially ensure you cover your costs, it does not capture value from an end market perspective. Another issue is that the innovation cost that you incurred to develop the product is irrelevant to your customer and becomes difficult to justify as you try to defend or increase prices, especially once the initial anchor has been set.

Other companies may consider a market approach, benchmarking against comparable products. But while looking at existing royalty ranges in similar transactions may provide rough guidelines on contracting strategies and commercial terms, for a true innovation, there will seldom be a sufficiently equivalent technology to provide the relevant data and insights.

So how do you develop a licensing structure for an innovation? We recommend a value-based approach:

Succeed with a value-based approach to licensing

- Understand the additional benefit and willingness to pay

The starting point of monetizing any new technology is identifying where the innovation is driving value and how much of that value is experienced by the end customer, understanding the profit increase potential resulting from the customer’s use of the technology. Based on this assessment, you can determine how the benefit can best be split. In practice, we often see approximately 25 to 33 percent of benefits accruing to the licensee, depending on the technology company’s situation and strategy. - Capture the value through the right metric and price level

Through licensing, you can generate revenues from your technology through multiple financial components – commonly structured as lump sum or royalty payments. This structure must be in a mutually beneficial format and reflect the strength of both you and your customers, as well as the nature of your commercial aspirations and relationship. You may choose to begin with a standard status quo transaction when the technology is first made available. Then, as the technology gains traction in sales and is proven to scale appropriately, you can deepen your customer relationship beyond the transactional with more sophisticated structures, such as recurring payments reflecting how the technology is used. - Align contract terms with your strategy

Determining the specific elements of the contract, such as duration, exclusivity, liability, etc., can be one of the most critical aspects of licensing. These terms provide opportunities to differentiate price, creatively fence your offer, and encourage specific market behavior. The agreement should also factor in protections against risk areas. How do you account for improvements on your IP that stem from joint optimization of the product? How can you stave off anticompetitive behavior if multiple licenses are within the same market, or even if you choose to then enter the market directly? Contract terms can be the hardest part to get right and require you to find the best balance between reaping the full commercial benefits while setting the right tone for a successful relationship with your customers.

Does your innovation radically transform your customer’s product?

If so, then you need to ensure you are profiting from the advantages that your product creates.

Rather than merely selling your product as a transaction, licensing can help you capture the full benefits delivered across the value chain and alleviate the cost pressures associated with launching an innovation. The key is to always quantify the value add of the technology from a customer or consumer perspective while considering multiple price metrics and fencing mechanisms.

Want to find out more about how a licensing structure could capture the value of your innovation? Reach out to Arjen Brasz, Bjoern Dahmen , or Bhavin Manjee today!