The current growth opportunities in the investment services space are undeniable. However, increasing competition from digital players is putting banks under pressure to serve retail investors in an equally customer-centric and scalable way. Integrating digital advisory into traditional service offerings will therefore be the key response for banks to continue winning in the market.

Since the start of the pandemic, retail investors worldwide have been opening a record number of investment accounts. 2020 will go down in history as a year during which the number of retail investors boomed. It is especially noteworthy that the boom is being driven by younger, more digitally savvy age groups. For example, in Germany approximately one million individuals under the age of 40 became investors in 2020, increasing the number in this segment by almost 50 percent. Similar trends are also being seen in other countries.

Stable trend among younger, digital-savvy investors

In spring of 2020, the assumption of a temporary phenomenon prevailed, with retail investors devoting lockdown driven excess capital and time to the stock market, buying the dip. However, it has since become clear that this development is a fundamental shift in financial behavior that is still ongoing. In 2021, the young digital segment continues to lead the way in terms of growth. The reasons for increased investments among retail investors are in plain sight:

- External market conditions – traditional savings instruments are losing their appeal: Traditional savings accounts offer limited advantages. In many European countries, average households have been affected by balance fees or negative interest rates. Low-risk fixed-income securities have ceased to be promising due to long-standing low interest rates. The big interest rate turnaround is anticipated for the current year. However, the impact on retail investors so far is minimal.

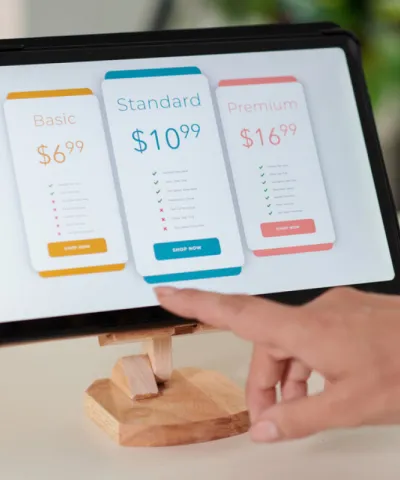

- Product development – participating in the stock market has never been easier: In the past two years, product development has found a new target segment in retail investors. Digital investment solutions’ intuitive user experience and simple functionalities have lowered entry barriers significantly. Low-cost ETF savings plans and wealth management offerings with low entry volumes have also driven the democratization of the stock market. In addition, new players, including Trade Republic, Robinhood, and eToro, are diversifying the financial landscape with innovative offerings and app solutions.

- Mindset shift – investing is cool: Social media and financial influencers have made managing and growing personal wealth a popular topic. Attractive entry prices from March 2020 and subsequent success stories were natural conversation starters for regular media coverage. By turning a challenging topic into easily digestible pieces of content and promoting financial wellness, influencers have shifted mainstream mindset and made investing trendy.

Understanding customer needs is crucial

In 2020 and 2021, all players in the financial market, from neobrokers and robo-providers to regional and large banks, benefited from the influx of retail investors. This influx presents two future opportunities for banks: sustained growth and effective customer retention. The key to both is understanding customers’ various needs to develop successful offerings. According to a recent study by Simon-Kucher, 47 percent of retail investors see themselves as “validators”. They are digitally savvy customers who seek support with investment decisions in the form of advice, nonetheless, retain the ability to confirm or override decisions.

Given current developments, banks should rethink how they can efficiently engage with “validators” to futureproof their business. A “validator” expects investment solutions to be innovative and convenient. If customers can’t find previous at their current banks, they can easily find alternatives in the market with a few clicks.

Adopting an innovative and efficient advisory model is therefore key for banks to maintain existing investor pools and at the same time achieve further growth through customer-centric advice.

The ideal customer journey is hybrid and end-to-end digital

Our project experience shows that hybrid advisory models, which offer both digital and human interaction, have proven to be a best practice in addressing “validator” needs. At the heart of this approach is a digital advisory tool with a separate user interface for investors and client advisors. The tool offers investors digital investment advice without eliminating the option of scheduling in-person consultations with advisors. The content and quality of the customer journey is the same. However, customers can easily switch their point of access – either through a mobile device or an in-person visit to their local branch. This flexibility allows banks to design a seamless omnichannel customer journey.

PostFinance project example

Simon-Kucher collaborated with PostFinance, one of the largest banks in Switzerland, to design and successfully implement a hybrid advisory offering. A customer’s first point of contact with the bank and its investment solutions is generally digital. However, around 75 percent choose a physical location to conclude an investment solution and experience the digital user interface for the first time with their client advisor. During the in-person consultation, customers go through the same screens they would see on a personal device and familiarize themselves with the digital tool navigation. The high percentile (75 percent) shows that in-person interactions are still highly relevant, especially for the first consultation.

The consequent product usage as well as the ongoing funding of the investment account is primarily carried out by investors on their personal devices independent of their client advisor, nonetheless, navigating the same digital front end introduced by their advisor. In spring 2022, PostFinance’s hybrid advisory offering celebrates two years of successfully serving retail investors. The success speaks for itself when looking at the Swiss market; in a span of two years, PostFinance’s assets under management (AUM), through the hybrid offering, are greater than any individual robo-advisors’ AUM growth in a span of six plus years. “The secret lies in the smart combination of simple digital solutions and easy access to in-person advice,” says Daniel Mewes, Chief Investment Officer and Head of Asset Management Solutions at PostFinance.

Five success factors of hybrid advice from a bank’s perspective

We know from extensive client interactions and past projects that banks truly benefit from adopting a hybrid advisory approach. The following five success factors speak for the future success of hybrid investment advice:

- Scalable services thanks to tool-supported advice and digital customer empowerment: The digital customer interface unlocks new growth potential for the investment services business by helping customers manage their needs independently online and efficiently supporting advisors during in-person meetings.

- Strengthening omnichannel capabilities thanks to channel-permeable interactions between clients and banks: A seamless cross-channel offering for online and branch operations meet the demands of the modern consumer. Especially since customers’ needs for channel flexibility have continued to increase in times of social distancing.

- Investing in technical capabilities as a sustainable way to support a bank’s own client advisors: A tool-supported advisory process not only offers training and development opportunities for a bank’s advisors, it also guarantees consistent, customer-centric advice during in-person consultations.

- Customer needs assessment and demand creation thanks to a tool-supported process: Having tool-based methods to determine a customer’s financial needs and risk tolerance brings transparency and objectivity to the consultation. This form of digital support effectively increases customer trust. Furthermore, leveraging customer information gleaned from the tool-based process enables enhanced service quality and establishes a foundation for long term relationships.

- Powerful response in the face of increasing digital competitive pressure: Compared to purely digital competitors, banks’ in-person customer relationships continue to be their competitive advantage. Adopting a hybrid advisory model will strengthen a bank’s existing position and make it more competitive.

Banks need to start developing their hybrid advisory model today!

Following a hybrid advisory approach isn’t just the most progressive and innovative approach to successfully place in-demand products in front of customers. It also helps banks improve customer relationships and loyalty, empower client advisors, and strengthen competitive advantages. Banks need to transform their sales organization now to position themselves for success in the future.