Did you find last two year’s negotiations tough? Then brace yourself for the next round. So far, the direction has been clear: prices needed to increase to absorb the costs of disruptions in global supply chains. Guarantee of supply was the most important value-driver for many customers, which meant that sellers could successfully pass on their cost increases. However, as a second wave of cost increases has hit the markets in the form of rising energy cost, and as consumers are demanding higher wages as a result, a wage-price spiral is beginning to take shape. This means high inflation rates will be with us for some time and companies should prepare their commercial strategy accordingly.

Purchasing power of consumers is being hit, and consumers are increasingly feeling the economic pain. The Dutch CBS recorded a new inflation record in September of 17.1% annually. Additionally, the shift from raw materials to energy- and wage costs results in a broader range of affected industries. In July only 20% of the observed products recorded a price increase below 2% compared 50% pre-corona. Meanwhile, the economy is heading toward a recession, depending on definition and region, with many consumer goods categories observing a decrease in consumer spending or a shift towards cheaper alternatives. Even sectors like tourism, hospitality and gyms, who are on the rise after being hit hard by the lockdowns, will eventually have to face these changes.

To battle the loss of consumer purchasing power, European governments are announcing big purchasing power repair programs, such as the price-ceiling on energy introduced by the Dutch government which will cost an estimated €23.5B. While repairing consumer purchasing power on the short-term, the underlying mechanics causing inflation are not remedied, potentially driving up inflation even further.

A complicating factor is the current shortage on the job market which is driving up wages. Adding this to the already high demand for increased compensation due to sustained high inflation, this can result in a wage-price spiral. Good news is effectively turned into bad news: the prominent job rapport in the US in August showed an increase of 528.000 jobs, where only 250.000 were expected. This resulted in a decreasing stock market, since a tight job market could nudge the central banks to further increase interest rates in an attempt to counter high inflation and cool down the economy. A recession appears to be the only instrument to counter inflation.

The pain of economic downturn has been delayed for consumers due to build-up savings from the corona crisis in combination with long-term energy contracts and mortgages. That effect will be over soon, making it harder for companies to pass on increasing costs without putting pressure on volume. Customers’ resistance towards price increases will be higher depending on the proximity of the customer to the consumer in the value chain and will increase in general as the effects of a recession become more apparent.

To remain profitable in these unprecedented times, most companies will need to raise prices and future proof their commercial strategy. In the current situation, holding off and waiting for indexation of prices at the end of the year is no longer an option. Over the past 2,5 years, most companies have developed a ‘muscle’ for price increases but the need to think about topics like portfolio, go-to-market strategies, and sales efficiencies was less apparent however, as keeping up with market demand was challenging enough in itself. With turbulent times ahead, this new, complex challenge requires not only timely commercial action on margin management, but also the development of tailored strategic growth scenarios.

Even though sector- and company dynamics differ, it is possible to create an inspirational set of pillars to make a commercial strategy future proof. Below we mention eight such pillars for margin management and a sustainable growth strategy.

1. Manage for profitability and proactively take control

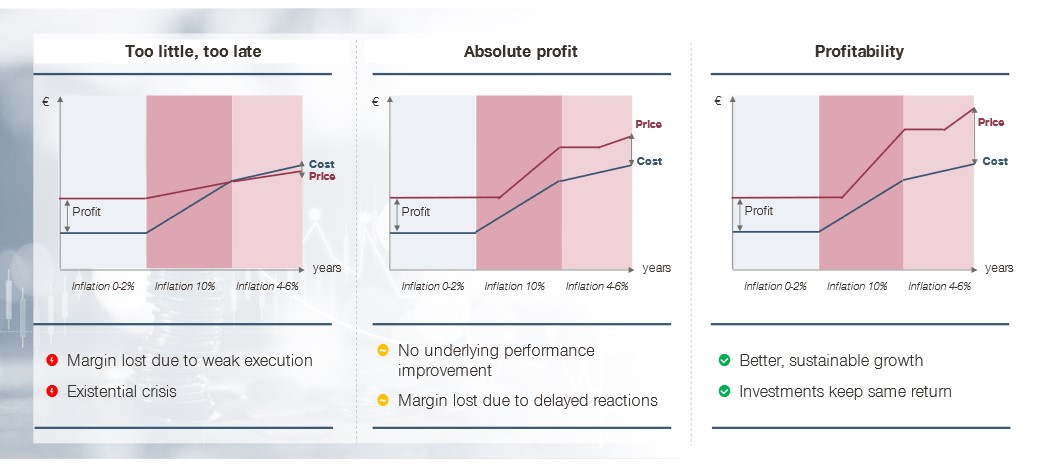

As inflation peaks, looking at increasing revenue gives a false sense of growth. In essence, a revenue growth by less than the rate of inflation signifies a decrease in size. To truly assess performance of a company one must look at the profit and profitability margins. Additionally, companies need to move from setting targets on revenue to setting targets on profitability.

Subsequently, when managing for profitability in an inflationary environment, it is important to act proactively and substantially. When raising prices ‘too little too late’, or when solely aiming to maintain equal absolute profit, one risks destroying margins.

2. Steer optimization of client & product portfolio based on factual data

Fact based scenarios for market developments help retain growth in a difficult market. Soon companies will have to think about their go-to-market strategy. Which client relations to invest in? Which channels and customer segments offer the most opportunities? Is the product portfolio in line with needs of (good performing) clients?

Companies must focus on their best performing customers (winning with the winners) and assure their product portfolio matches their needs. However, the product portfolio must also be judged on profitability. Understanding value drivers from a customer perspective is a starting point here. Which aspects of our product or service actually improve the client’s perception? Sustainability offers specific opportunities with conscious customer groups, similar to alternative revenue models like lease and subscription models. Data (external and internal) are key enablers to set up these strategies.

3. Differentiate price increases

Using customer insights to understand where prices can be increased is becoming more important. Companies should take care to not interpret old price elasticity studies as truth, since these are quickly losing their value in the current environment. Price elasticity changes as consumers reshuffle their priorities, and elasticities can also increasingly vary over customer and consumer segments. For example, younger segments more easily change jobs and will be able to keep up their purchasing power while older segments might change their behavior more drastically. Designing different pricing scenarios is essential in making the right decision on volume, revenue, and profit.

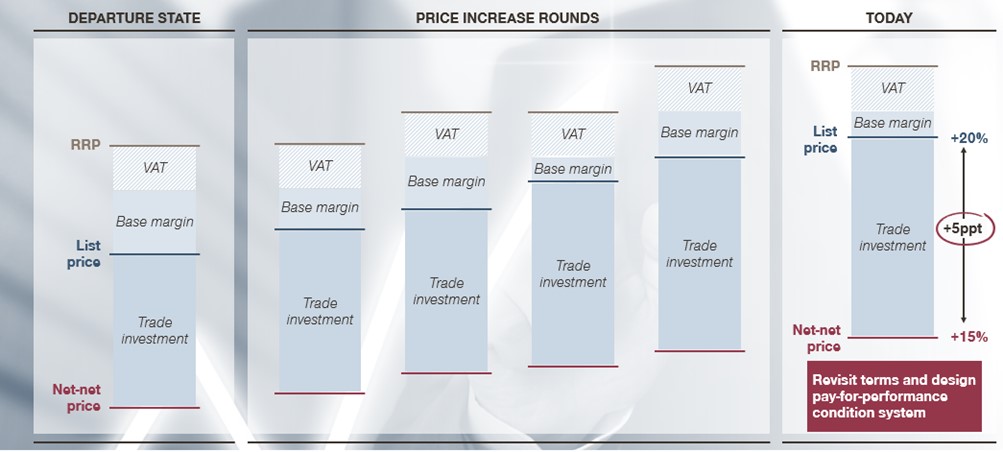

4. Focus on trade term management

Many price increases have indirectly strengthened the margins of the customers more than those of the producers, because retail prices are adjusted proportionally. Revising trade terms, i.e., ensuring a tight distribution of the profit pool and steering customer behavior through conditional conditions, is one of the most important tools in keeping margin levels up.

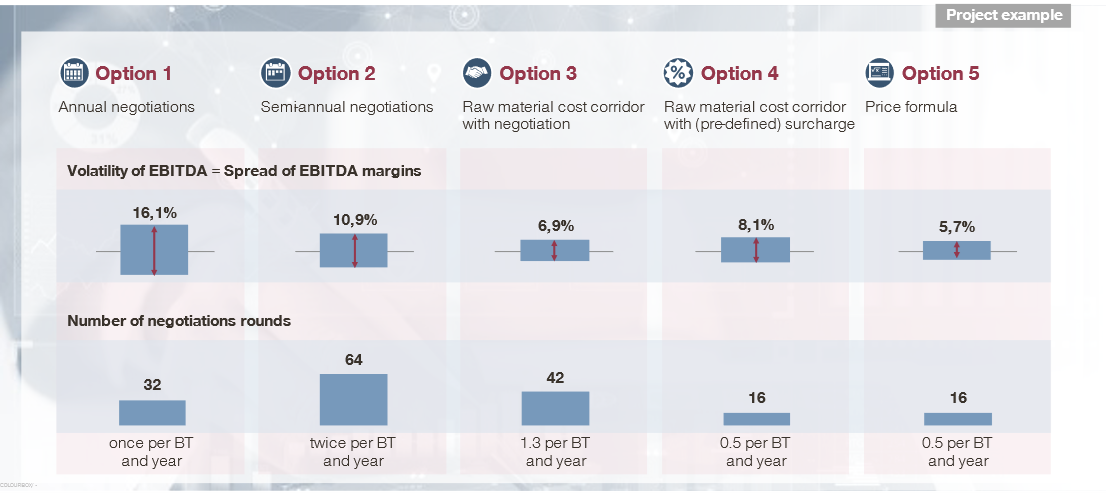

5. Redistribute risk in contracts

A great way to deal with uncertain times is to redistribute risks in contracts with customers. In the current standard contract where prices are indexed maybe once per year the risk of inflation and other market dynamics lies disproportionally on the side of the distributor. By increasing the frequency of negotiations or defining specific conditional indexing clauses in the contract, this risk is mitigated. Ideally, clauses in the contract contain a price formula; this decreases potential spread of EBITDA margins and reduces the need for time wasting price negotiations.

6. Create insights in cost-to-serve and monetize services that are offered for free

The cost-to-serve at a client level has mostly changed and is often not mapped out enough. Sales, production, and logistics need to collaborate closely to tailor pricing and negotiation tactics based on customer specific complexities. An important aspect here is service monetization: creating alternative revenue streams based on delivered services that are not (sufficiently) included in the base price.

7. Prepare your negotiations and determine the balance of power

In negotiations preparation is key. Analysis by Simon-Kucher shows that suppliers are often afraid of losing a customer, whilst the consequences of discontinuing a collaboration are often more impactful for the customer side. It is therefore important to carefully assess the balance of power between supplier and customer; more often than not suppliers have more pricing power than they realize.

8. Stay alert for M&A opportunities

There will be consolidations in some markets to better face the challenges that the recession poses. Decreasing multiples on company valuations will offer opportunities. The most attractive opportunities are those that contribute to the purchasing scale, strengthen the product portfolio and expand the business to adjacent categories or segments.