Owing to major factors such as supply chain shortages, inflation, Russia’s invasion of Ukraine, the energy crisis, and the continued COVID-19 pandemic in some regions of the world, 2022 marked the end of a bull run that had lasted over a decade. However, the imminent downturn can be a time for private banks and wealth managers to reevaluate and strengthen their commercial agenda. Learn more about five key commercial initiatives to realize short- and long-term impact.

The uncertainty brought on by the major crises from recent years has resulted in stock selloffs, causing major indices such as the S&P 500 and MSCI World to fall by more than 25 percent and 27 percent respectively from their peak in early 2022. These developments have had a huge negative impact on investor confidence.

While the potential for an economic slowdown has been on the horizon for a while, recently we have seen reductions in asset values and significantly reduced transaction behavior among private investors. These developments have harmed the income and profitability of private banks and wealth managers, which are greatly exposed to asset-based and transactional revenue sources.

Unlike the temporary shock seen during the COVID-19 outbreak, this economic slowdown is expected to have a longer-lasting adverse impact, as the uncertainties mentioned above are not expected to end any time soon. As interest rates continue to increase, the prospect of a global recession will grow.

Continuing to grow through challenging times

Private banks, wealth managers, and other investment service providers should see these challenging times as a moment to review their commercial practices so they come out of the crisis stronger. In this blog, we outline five commercial initiatives that the industry should focus on in 2023 to achieve both top- and bottom-line growth in times of uncertainty.

Five key initiatives for your 2023 commercial agenda

In the first installment of our six-part blog series, we will give you an introduction to the five commercial initiatives, of which the first three are tactical and the other two are more strategic.

1. Reduce discounts to correct underpriced client relationships

Our experience shows that private banks and wealth managers’ discounting guidelines are rarely aligned with their overall strategic objectives. Decisions around discounts are often linked to individual products or even individual fee types, rather than considering the full client relationships and profitability.

Furthermore, special conditions are often granted on premises that aren’t valid anymore, on requirements that were never met, or simply not in accordance with set discounting principles. This results in a large proportion of underpriced clients and significant revenue leakage. Re-pricing of underpriced clients is the most impactful initiative available to private banks and wealth managers to unlock margin growth during times of uncertainty.

In short, the challenge is to identify underpriced clients compared to similar peer clients and define and execute target price increases. Price increases should be differentiated based on client segments and products to achieve satisfactory enforcement rates to drive revenues, and profitability, and to reduce compliance risks by better aligning with “treat clients fairly” (TCF) principles.

2. Focus sales relationship manager resources on deepening existing relationships

It is widely known that the cost of winning a new client is higher than that of deepening (and retaining) relationships with existing clients. In times of uncertainty when resources need to be prioritized, it can be challenging to find the right balance between cultivating existing relationships and bringing in new leads. The simplest tactic to realize short-term margin potential, may be cross-selling, as in many cases high-value services such as advisory and discretionary mandates tend to have relatively low client penetration.

Growth buckets and customer lifetime value (CLV) should be assessed by evaluating clients’ current profitability, tenure with their bank, potential future business opportunities, and strategic importance. It is important to identify and evaluate benefits and services for retaining clients.

Relationships should be deepened via upselling toward higher-value mandates, redistributing assets across mandates, cross-selling relevant additional banking services, and growing assets via asset consolidation or increasing share of wallet (SoW).

The challenge is to identify good candidates for up- and cross-selling and to prepare strong sales arguments for relationship management (RM) team members. Furthermore, since the initiative can be long lasting (nine months or longer), it is key to have an effective reporting mechanism in place to constantly track the initiatives impact and steer it where necessary.

3. Differentiate investment mandates to better control costs and monetize high-value services

Private banks and wealth managers commonly don’t differentiate between services offered within mandates in clear and structured ways. This one-size-fits-all approach where relatively expensive service elements are offered across the client- base leads to difficulties controlling costs, results in a long- tail of unprofitable clients (e.g., clients not using/needing high- cost services), and limits what banks are able to effectively charge for these high-cost services. During times of uncertainty, it is even more important to be able to control costs and improve profitability across the client base.

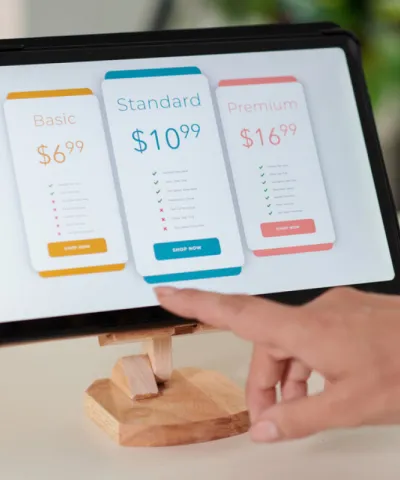

If private banks and wealth managers clearly understand the needs of different client segments, they will be able to better manage costs by carving out certain high-cost items from new, less expensive alternative service levels. They can then capitalize on intelligent price differentiation via higher list prices for more premium mandates to tap into greater willingness to pay.

Satisfactory profitability across all client cohorts will be achieved by setting clear ROA targets for each service level and steering asset requirements and discount levels across client cohorts.

The challenge is to define an attractive offering for a bank’s current and target clients. Good fencing between service levels is necessary, and it is also important to introduce the right behavioral effects to steer clients’ decision-making and perform an effective client migration.

4. Move the commercial operating model toward hybrid servicing

Private banks and wealth managers should refine their commercial operating models by doubling down on improving digital channels to reduce the cost to serve (strip out logical cost factors), while still offering value-adding advice (hybrid advisory model).

Improving digital services doesn’t just mean introducing a robo-advisor (delegated solution)., It’s about applying digital elements across the entire client journey, from onboarding to investment selection (including advised and self-directed mandates), support, and retention efforts.

A refined commercial operating model, including digital applications, allows banks to effectively scale advisory services across the client base, while making more effective and focused use of human advisors with higher-value clients in premium propositions.

The challenge is to deliver digital-first advisory platforms to facilitate a high level of client engagement and activity. What’s more, it is important to shift from an advisor-led to a self-serviced model to offer client access 24/7 at a lower cost- to- serve while still having the option to contact an advisor. Another challenge is to enable clients to perform trade executions in an easy way at their convenience and to provide up-to-date financial news that is relevant to clients’ investment preferences and portfolios.

5. Offer holistic advice to meet the needs of the next generation of wealth clients

By 2050, baby boomers are expected to have transferred 30 trillion US dollars (USD) of their wealth to the next generation of wealth clients (“future affluents”). Today, future affluents already represent more than 50 percent of the global workforce and therefore a significant portion of newly created wealth.

The wealth of future affluents will come from more sources than what has historically been the case, meaning wealth succession will play a diminishing role for in banks’ future client and asset growth.

To meet the needs of future affluents, private banks and wealth managers need to begin looking at their clients more holistically and design value propositions with this in mind, including offering advice on broader financial needs and assets managed by other banks.

The main challenge for banks is to define what core competences to focus on in-house and what products and services clients should get access to via partnerships as part of a wealth ecosystem model. This new holistic advisory and wealth management approach will require a change in mindset from banks, but those that do can gain a competitive edge with future affluents and will be ideally prepared for this looming recession.

Revamping your 2023 commercial agenda: Realizing short- and long-term impact

By placing these five initiatives high up the commercial agenda for 2023, private banks and wealth managers will be able not just to achieve short-term impact during the downturn, but also realize long-lasting, sustainable growth that will scale with number of clients and assets into the next bull market period.

Want to know more about ways to ensure growth in times of uncertainty? Get in touch with us and find out more about the topics we discuss in this series.

Stay tuned for the next five installments coming in 2023!