In our previous article, we talked about how embedding payments can benefit your business. In part two of this series, we share our six-step approach to tailoring embedded payments to your goals and customers.

Payment volumes have been increasing globally and will continue their trajectory for the foreseeable future. This trend has been fueled by both demand and supply factors, ranging from market gaps and technological advancements to reglulatory changes and more demanding customers and merchants.

Embedded payments have been growing in popularity as an answer to these changing dynamics. However, settling on the right format is no easy task.

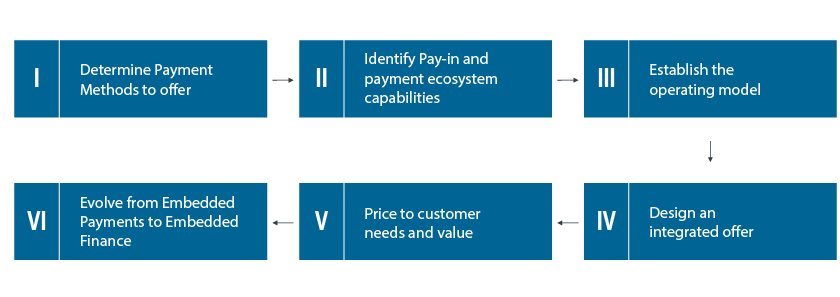

We’ve helped numerous companies navigate this decision-making process and identified the best practices along the way. Here’s our six-step approach:

Six steps for embedding payments

Determine the payment methods to offer

The first step is to figure out which payment methods to offer end customers, as these differ by geography and directly affect customer conversion and repeat usage. Adding the right option for the right country can have a powerful impact. After a few years of operating in a country, one of our clients was able to boost conversion by nearly 40 percent in one country by introducing a local payment method.

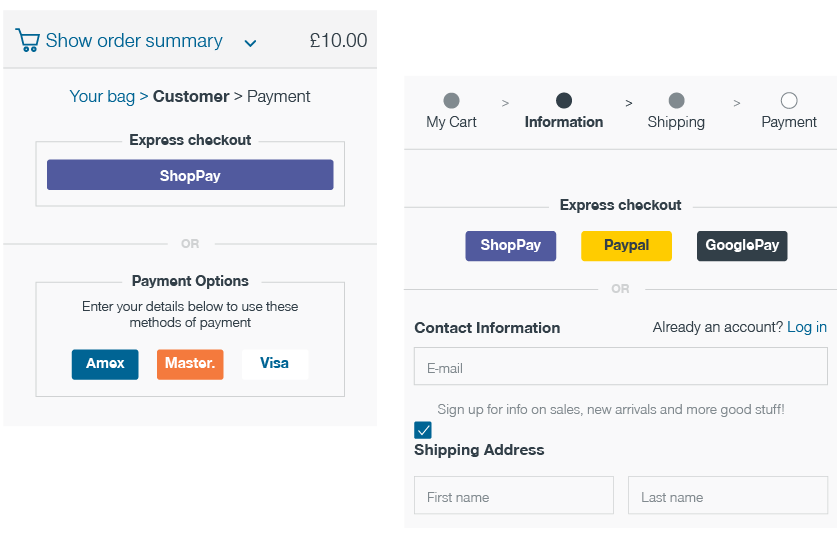

Once the payment methods on offer have been chosen, the next step is configuring them at the checkout. Too many options can be confusing and disrupt the customer experience. The order in which the payment methods are displayed is also important – customers are more likely to use the payment method listed first. It is therefore recommended to order the payment methods to optimize the conversion and the costs. Furthermore, a default payment method is often twice as likely to be used, resulting in better conversion and lowered costs. Developing a suitable order and anchoring customers with a default option nudges them toward an efficient outcome for the business.

Creating a seamless experience with check-out solutions

Express check-out solutions also strongly reduce purchase friction using already-saved payment, billing, and shopping information.

Identify the required pay-in and payment ecosystem capabilities

To select a winning proposition, businesses looking to embed payments need to know the underlying capability and service level requirements. These apply to both pay-ins and the wider payments ecosystem.

For pay-ins, once the payment methods are identified, the focus should turn to maximizing authorization rates. This can be achieved through functionalities such as tokenization, account updates, smart retries, orchestration, and advanced fraud prevention. Tokenization, for example, streamlines the customer experience by storing data for future visits, making transactions more secure, and enabling transactions through phone wallets such as ApplePay and GooglePay.

Before funds are paid to a seller on a marketplace or platform, a KYC or KYB check is required to ensure compliance with regulatory requirements. What’s more, for a seller to receive the funds, the platform must have the capability to pay into the relevant bank or card account quickly while still conducting fraud prevention checks.

These capabilities depend on a combination of a ledger system, wallet infrastructure, closed-loop payments, KYC/KYB checks, and a pay-out network. Inaccuracies, delays, and other shortcomings in the process create a negative experience for the sellers, risking churn and breaking down the network effect the marketplace relies on.

Regarding service-level needs, factors such as uptime and resolution time for critical incidents need to be considered. The difference between uptimes of 99.9 percent and 99.8 percent may seem small, but if the 0.1-percent difference comes at peak business hours, the business could lose significant sales, and its reputation would be damaged. For larger companies, it’s essential to keep response times to critical failures under 15 minutes and offer dedicated points of contact for technical support.

Establish the operating model

Once the offer and capabilities have been ascertained, the next question is how to take them to market. Is it better to build, buy, or partner?

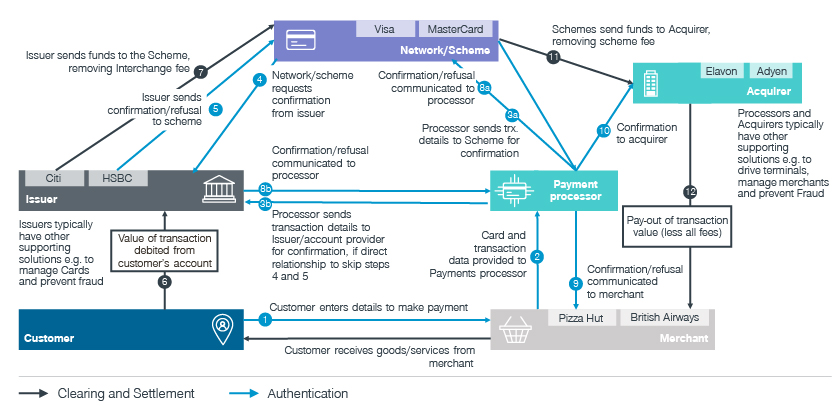

A single payment transaction depends on multiple parties while also taking regulatory (e.g., license, data protection) and compliance (e.g., anti-money laundering, sanction checks) elements into consideration. As a result, building a compliant infrastructure with the appropriate service levels in-house is extremely time and resource intensive.

A seemingly simple card payment from a customer requires multiple players from the value chain (simplified illustration)

Given the complexity and expertise required for the underlying infrastructure, partnering with players from the value chain is potentially an even faster and more cost-effective approach. Partnership models can involve referrals to prospective customers, revenue or profit shares, or a buy rate, all of which also help keep the cost to customers and sellers low.

Partnering comes with the drawback that multiple vendors are typically required to cover the needed functions. This complexity increases even more for companies operating across multiple countries. Identifying the partners with the right capabilities and service levels across functions and regions is therefore critical. As the scale of operations increases, it may become preferable to build capabilities for certain tasks in-house or even buy solutions in. However, companies often prefer to negotiate lower prices with their partners so that they can focus on their core business instead.

Buying may often be preferable to building, but it requires capital and has similar drawbacks to partnering. Furthermore, resources must be dedicated to the purchase, and the solutions must be adapted over time to remain relevant. Companies therefore primarily consider partnerships the best route to market.

Design an integrated offer for customers

Embedded payments deliver results when they are fully integrated into the core offer. Providing them as an optional solution vastly diminishes the benefits. Consider whether to package payment features and functionalities as part of the existing core platform, as a tiered offering (e.g., good/better/best), or as an à la carte add-on.

The cost structure of payments in most businesses scales with volume, unlike the underlying business. What this means for these firms is that they typically include payments as part of the core offering to facilitate greater volume and better monetize sales. They can then decide whether to offer a separate package for a premium that includes payment features only a smaller portion of customers would benefit from.

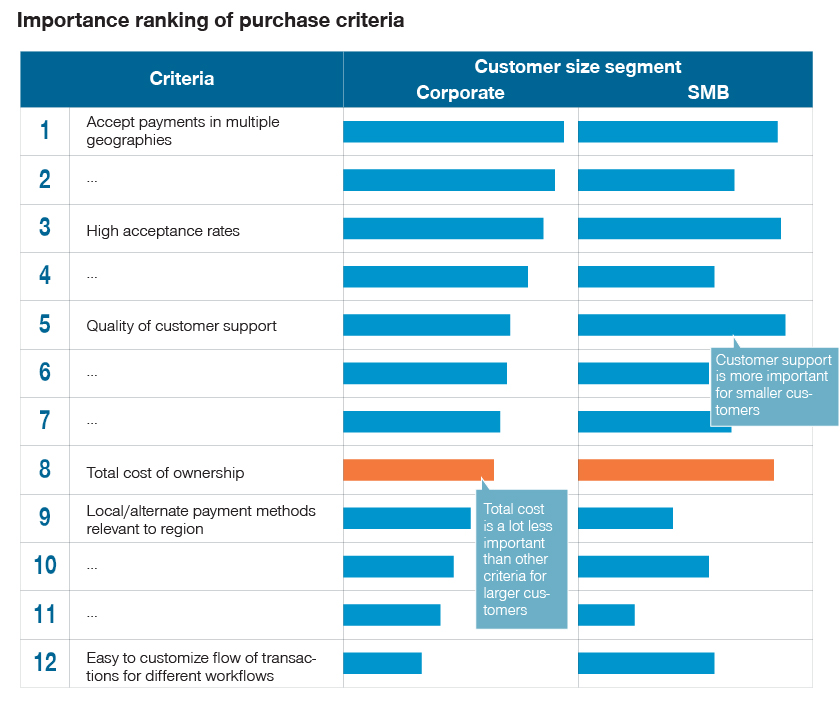

Another key consideration is customer segments. In both retail and SME segments, offer simplicity is crucial for success. When catering to larger customers/sellers, a more sophisticated approach would align with the need for a competitive offer and transparency for managing costs.

In our recent survey, we asked respondents what is important for them when choosing a payment solution for their marketplace/platform. We found that value-based components are more important for both large and small customers than cost. Furthermore, what large customers value often differs from small customers. The implications for success are clear: when embedding payments, make sure to understand what your target customers value, focus on delivering their needs, and set prices accordingly.

Ultimately, the packaging of the full service should drive payment volumes while also promoting adoption of the core product or service.

Ensure pricing is aligned with customer value and needs

How you price is often more important than the price levels. The underlying metric (the basis on which you charge your customer) and model (how the metric scales) need to be chosen carefully. The metric and model should both be aligned with the value of the solution and the cost. The value may differ by customer segment – the needs and preferences of the target customers should form the foundation of pricing metrics and models that can accommodate negotiated deals. This applies to both payments and the core solution of the business.

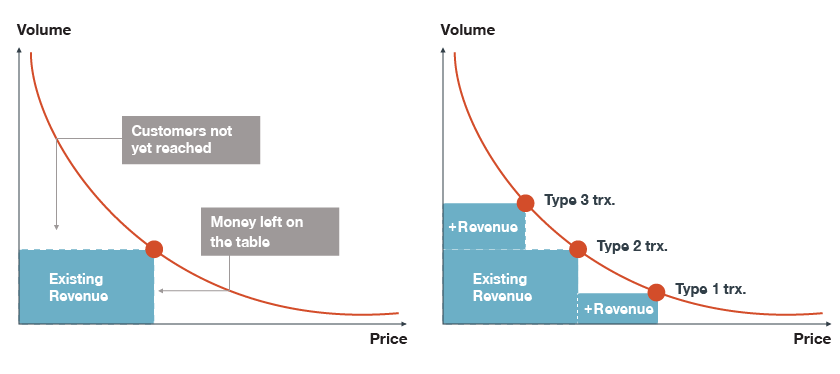

Smart differentiation has multiple benefits

A single price point for all leaves money on the table and neglects customers with unmet needs. Smart differentiation can reach additional customers and achieve higher revenues while limiting cannibalization.

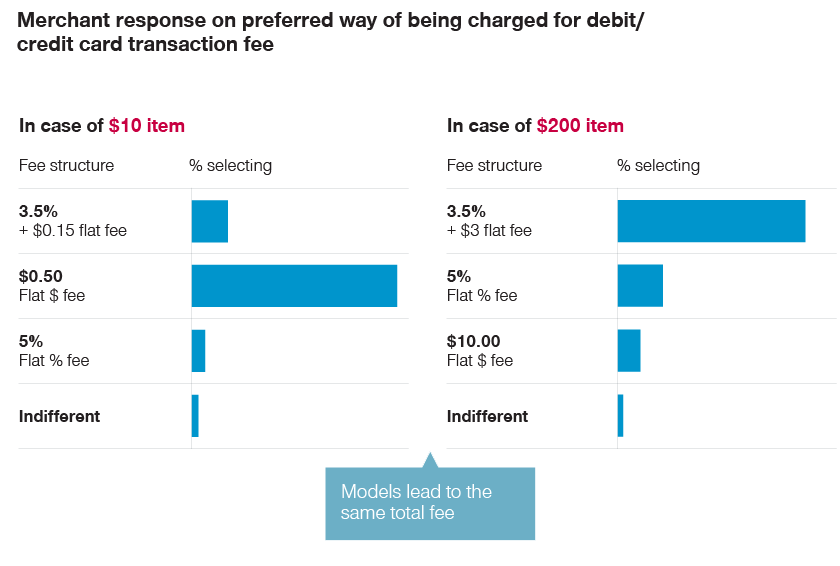

Our research indicates stark differences in customer preferences. We find that merchants with different transaction profiles chose varying price metrics even though they all led to the same outcome. These differences indicate that pricing fit is critical.

Merchant responses on preferred way of being charged for debit/credit card transaction fees

Evolve from embedded payments to embedded finance

Embedded payments are often the first step to incorporating embedded finance, which includes an array of financial services from credit cards to insurance.

Embedded finance provides a host of opportunities for businesses. With direct access to information on turnover and payment flows, businesses can provide turnover-based financing to sellers and merchants.The ability to lend also extends to the other end of the transaction – the consumers. Buy-now-pay-later options have mushroomed in recent years, providing easy financing and increasing sales.

As another example, travel companies including airlines, hotels, and aggregators have been offering insurance as an add-on service, while others such as Uber and BlaBlaCar have included it in their core proposition to give drivers and riders peace of mind.

Further opportunities can be found with co-branded cards, investments, and current accounts. The principles we covered earlier in this series on the value proposition, operating model, and pricing also apply to the wider range of services with embedded payments if they are adapted to the underlying financial service.

How we can help: Unlocking better growth

With over three decades of experience working across financial services, Simon-Kucher supports payment providers across the financial services sector. We work with fintech disruptors, disintermediators, B2B service and technology providers, established banks, and financial institutions, helping them to innovate and adapt across the entire commercial value chain. Together with our digital consulting team, Simon-Kucher Elevate, we bring together the right strategy, creativity, and digital competence to accompany you with technology strategy, vendor selection and implementation.

Let’s talk more about embedded payments. Reach out to Abhimanyu Julaniya today.

Contributor: Luke Gowers

Read more:

Embedded Payments: What are they and what are the benefits?

How NOT to develop an embedded payments offer

Embedded payments: monetization framework

Before establishing an embedded payments framework, it is crucial to thoroughly consider the following topics in your go-to-market strategy.