New payment behaviors during the pandemic introduced fresh pain points for merchants. Payment service providers and acquirers have an opportunity to drive revenue growth by offering enhanced services that address these issues.

Payment trends have been given a strong boost by COVID-19-related disruption that has led to both customers and merchants changing the way they pay or accept payments. This has lasting implications for Payment Service Providers (PSPs) and Acquirers, who will need to adapt their proposition and pricing strategies if they want to retain their leadership positions and stay competitive.

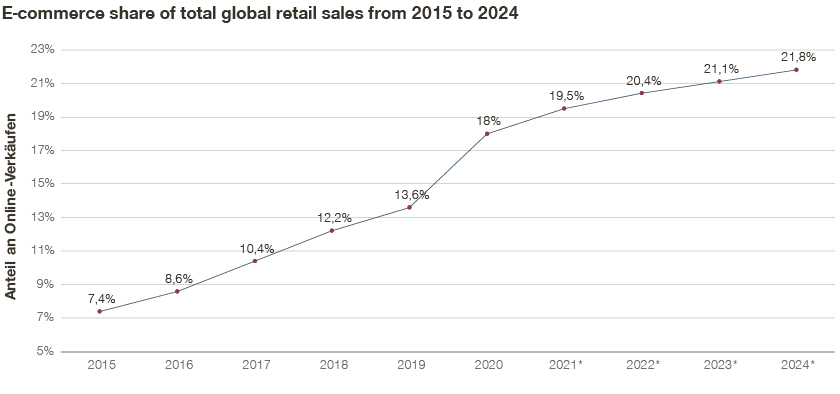

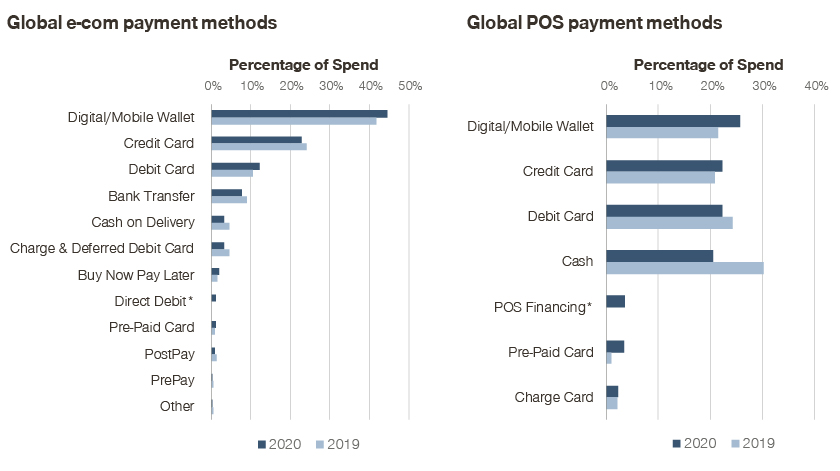

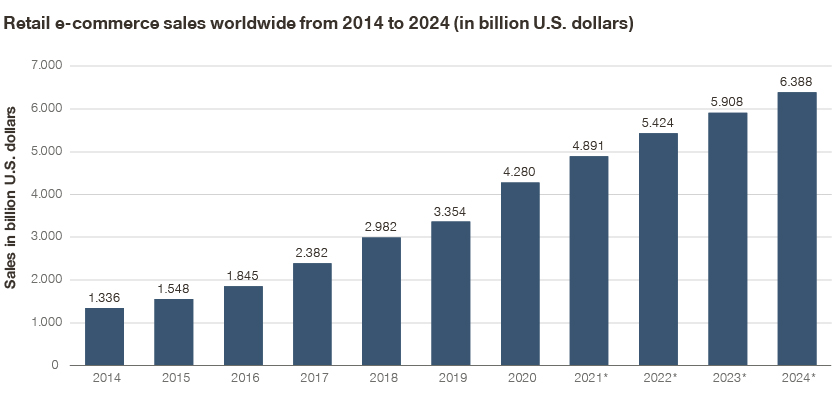

In the years preceding the COVID-19 outbreak, electronic payment methods had been on the rise worldwide. In traditional retail, electronic payments have been steadily replacing cash, hitting about 70% of global point-of-sale (POS) spending in 2019. However, the adoption of electronic payments varies across regions with cash still playing a significant role in a number of regions (e.g. EMEA (44%), LATAM (58%)) . E-commerce, where most transactions are conducted via card payments and digital wallets, grew at a 21% CAGR between 2015 and 2019, reaching over 13% of global retail sales in 2019. The pandemic has led to accelerated electronic payments adoption coupled with new trends significantly impacting the payments market, encompassing new users, new behavior/use cases, and new payment methods.

Once social distancing measures were introduced, even more consumers pivoted to the use of cards and mobile payments at POS. Globally electronic payments increased to a jaw-dropping 80% of spending at POS in 2020. Consumers are now generally more comfortable using contactless cards compared to a year ago. New payment behaviors have also emerged, and it is now commonplace for consumers to succumb to the convenience of tap-to-pay for low value, daily purchases like that morning cup of coffee. This trend does vary by region, but even in predominantly cash-heavy economies such as Germany, increased adoption of electronic and contactless payments are observed.

Similarly, during the pandemic, there was significant growth in e-commerce sales, boosting the use of digital payments. Even though this growth is estimated to stabilize from 28% in 2020 to a more moderate 8-10% annual growth rate by 2024, the effects of the pandemic will last. The pandemic triggered new consumer behaviors and use cases. We saw more high-value purchases online, as well as a boom in subscriptions for online services and day-to-day purchases. We also saw the growing importance of alternative payment methods. Digital/mobile wallets were used for 45% of e-commerce payments globally in 2020. For online merchants, these changes will have multiple implications such as increased cart abandonment and returns, the need to provide alternative payment methods and delayed payment options, and managing subscriptions and recurring payments.

As PSPs and Acquirers develop their future proposition and pricing strategies in response to these changes, there are four important considerations to keep in mind:

1. Provide the right mix of payment methods

The increase in digital spend, combined with the increasing complexity of customers’ payment preferences, means that merchants need to provide the right mix of payment methods to attract buyers – and PSPs and Acquirers need to be able to offer such payment methods. For example, payment methods from Klarna (bank transfer, installments, buy-now-pay-later) have recently seen increased popularity in various European countries and have been implemented by multiple merchants to address client needs. PSD2 regulation in the EU created a legal framework for third-party payment initiation services (PIS), meaning even more payment methods will be appearing in the market. Some PSPs have already kicked-off development of their own PIS that will give them a chance to offer more low-cost payments to merchants and increase their own margins.

The enhanced range of payment methods has implications for merchants, especially the smaller ones. Merchants typically find themselves wondering about the relevant payment methods for their business and how to balance customer needs/conversion with the varying and often complex costs of the payment methods.

PSPs/Acquirers that are able to make the purchase event a low-hassle process for merchants by tailoring the offer to be needs-based by geography, vertical, and merchant type will find themselves in a much stronger position. By setting up the offer to evolve with changes in merchant needs and introduction of new payment methods, PSPs/Acquirers will see long-term success in merchant satisfaction and lock-in.

Additionally, the offer needs to be accompanied by an appropriate pricing structure that reflects the value delivered through the payment methods. On the one hand, payment schemes need to set prices using metrics that capture value and models that accurately capture willingness to pay in the respective channels (direct vs. partners). On the other hand, Acquirers need to assimilate the pricing of individual schemes and create their own pricing for merchants. In both cases, understanding the value proposition vis-a-vis competitors is critical in setting the right price levels.

2. Develop an omni-channel proposition

Due to lockdown restrictions, traditional brick-and-mortar shops have been strengthening their online presence with many even entering the e-commerce space for the first time. However, today’s PSP/Acquirer setup is for the most part disjointed requiring among other things, different contracts and commercial agreements, as well as separate integrations and reporting. PSPs/Acquirers have an opportunity to differentiate themselves by improving the current experience by developing and offering truly omni-channel solutions.

3. Fully monetize value-added services

As more transactions shift online, merchants are hit with higher unauthorized transactions and fraud rates. As a result, they are willing to pay for enhanced services that provide additional value through improved authorization (e.g. Time-Based One-Time Password) and higher conversion rates. Similarly, cart abandonment has become an increased issue for omni-channel merchants that are losing sales offline and need to compensate for them online. In this instance, offering differentiated value-add solutions including flexible payment options, purchase finance, and payment reminders that allow merchants to increase cart conversion has become increasingly important.

There has also been an increased adoption of recurring payments (i.e. subscription) business models by merchants, a rise in the popularity of online marketplaces, and an increasing volume of cross-border e-commerce. This has been driving PSPs and Acquirers to expand their product offerings to support these additional services.

With the need to provide multiple value-added services, the challenge for PSPs and Acquirers is to identify which services to offer (e.g. check-out optimization, PCI compliance advisory, fraud prevention), as well as the best way to incorporate and monetize these services within their current propositions. Utilizing them to further differentiate their current product and pricing structure based on customers’ needs will allow PSPs and Acquirers to better capture the value they are creating and fully monetize willingness to pay.

4. Adapt to the price sensitivity of different merchant verticals

At POS, consumers increased preference for contactless payments methods for day-to-day low-value purchases has resulted in PSPs and Acquirers processing a lower average ticket size. On the other hand, with the increased adoption of e-commerce, consumers have become more comfortable making larger purchases online. This is driving up the average ticket size being processed by PSPs and Acquirers for certain merchant verticals (e.g. furniture or home appliances).

These trends require additional attention in terms of proposition and pricing that PSPs need to consider. First, to help increase conversion for high-value purchases, offering installment payments and buy-now-pay-later is absolutely crucial, the latter also being important for merchant verticals with many returns (e.g. fashion). Second, to ensure that all types of merchants with either high or low-value transactions are profitable in the future, it is critical that PSP’s and Acquirers identify the optimal pricing structure for them. Average ticket size as a price differentiator could be one of the ways to tackle this issue.

In addition to the average ticket size, there are also other factors that have an impact on the overall willingness to pay of merchants. In particular, higher-volume merchants are more inclined to seek a discount compared to low-volume merchants. There are also merchant verticals that tend to have lower margins (e.g. online fashion stores) which impacts their willingness to pay. These factors need to be considered in the development of any future price model, for example, in the form of volume/segment-based pricing tiers.

Conclusion: how to adapt to the future payments landscape

Through the creation of an omni-channel proposition that provides the right product mix and value add services, PSPs and Acquirers will be able to adapt to the evolving payments environment and better meet the needs of merchants. However, to fully maximize the return on such a proposition, they will also need to optimize their commercial offer. The right proposition and pricing structure will not only allow providers to adapt to the future payments landscape, but also ensure that they are capturing the full value they are creating for merchants.