Today, sophisticated wealth management depends on financial inclusion. Leading financial institutions have already embraced this evolution. Now the wider market must adapt business models to more effectively meet the diverse needs of customers.

In the rapidly changing wealth management landscape, traditional approaches to segmentation are quickly becoming obsolete. The wealth market is no longer a monolith that can be compartmentalized by wealth bands alone; it now encompasses an assortment of genders, cultures, and professional backgrounds.

Leading financial institutions, including those advised by Simon-Kucher, are already ahead of the curve. Their service delivery models address the needs of fast-growing segments, enabling these institutions to tap into broader revenue pools. In a market of well-informed consumers, adaptation is a question of survival. The message is clear: Diversify your go-to-market approach — or prepare to become a case study in obsolescence.

Where is wealth growing?

Fast-growing segments in wealth emphasize the importance of a segmentation strategy. These segments not only present unique needs but also signify untapped market opportunities for those positioned to serve them.

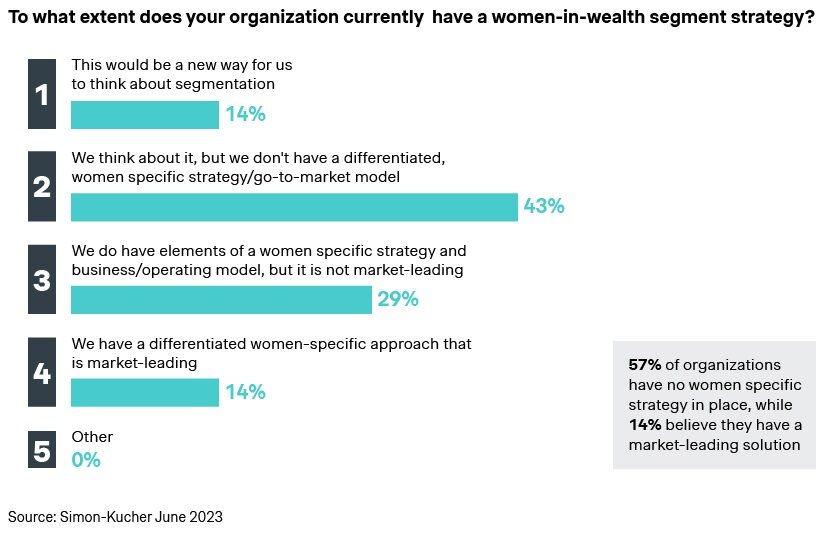

- Women investors: In the US and Canada, women’s wealth has been growing at a rate 180 percent faster than men’s over the last five years. However, a Simon-Kucher study (Building a Winning Client Experience for Women) reveals that high-net-worth women invest 22 percent less in investment assets. Our research indicates that financial institutions had the potential to generate an additional 14 billion US dollars in fee revenues in 2021 by better addressing the needs of this segment. However, leaders in the industry are starting to recognize the opportunity. According to our 2023 market poll, 14 percent of financial institutions showed they have a comprehensive, market-leading strategy for women (see Figure 1).

- Multicultural investors: Credit Suisse Research Institute’s 2022 Global Wealth Report reveals that wealth growth in the US has risen significantly among Hispanic and African American communities, reaching 22.2 percent and 19.9 percent, respectively, between 2019-2021, compared to 12.7 percent for white Americans. 1Despite this, up to 50 percent of high-net-worth individuals from these communities feel excluded by financial institutions.2

- Athletes and entertainers: The world’s top 50 athletes generated an estimated $3.44 billion between May 2022 and 2023, marking a 16 percent increase from the previous year.3 However, financial distress is prevalent. According to a UBS report, 80 percent of NFL players and 60 percent of NBA players face financial jeopardy within five years of retirement.4

Segment-specific strategies – where to start, where to go

In the competitive landscape of financial institutions, leaders can distinguish themselves by crafting segment-specific customer experiences. This strategic evolution unfolds across three pivotal stages:

Developing strategy

Segment-specific reach: Financial institutions initially reach target segments by leveraging campaigns and landing pages with a targeted web presence, and educational and insight-driven articles.

Intermediate strategy

Specialized service delivery/Service model: Institutions elevate their game by offering tailored products, services, and dedicated advisory teams equipped to provide segment-specialized advice and experiences.

Best-in-class strategy

Community building/External advocacy: After establishing buy-in from the target segments, institutions foster a sense of community within these segments, turning them into natural advocates for the institution. This organic advocacy solidifies the institution’s position and amplifies its influence within the broader market.

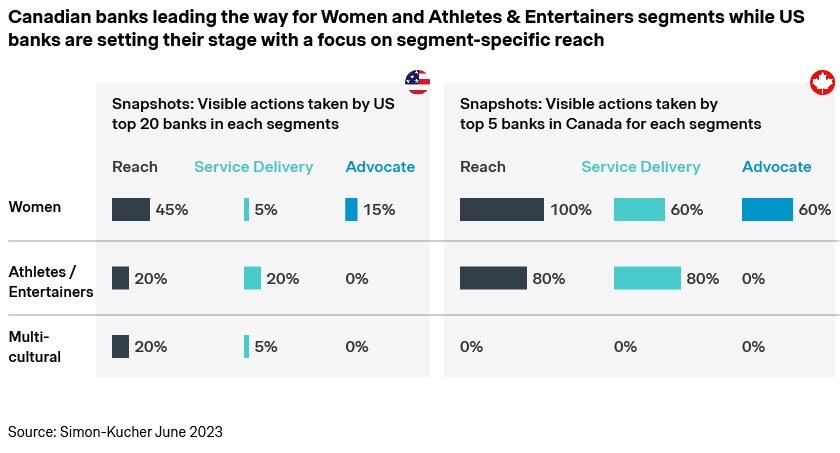

A recent Simon-Kucher market study focusing on value capture in fast-growing segments analyzed the online presence and wealth management strategies of major US and Canadian banks. We evaluated their existing go-to-market strategies for distinct customer segments. We particularly focused on “fast-growth segments” in wealth management, including women, multicultural communities, athletes, and entertainers.

This study reveals that Canadian financial institutions lead the way in prioritizing women in particular. Sixty percent of the top five banks examined are actively pursuing an “Advocate” strategy – consisting of best-in-class efforts to reach, serve and build a community for women clients in wealth management. This contrasts sharply with the top 20 US banks, where only 15 percent have reached an “Advocate” strategy for engaging women. Canadian institutions have similarly advanced strategies for athlete and entertainer segments.

However, for multi-cultural investors, both US and Canadian institutions are struggling to meet the “Reach” strategy stage. Canadian banks have effectively integrated multi-cultural segments into their everyday banking strategy for newcomers, but not in the wealth front. We expect more resources dedicated to this segment as institutions ramp-up segment-specific strategies.

Essentially, this evolution from reach to community building provides a blueprint for how financial institutions optimize the customer journey and gain a competitive edge.

Why should firms follow a segment-specific strategy?

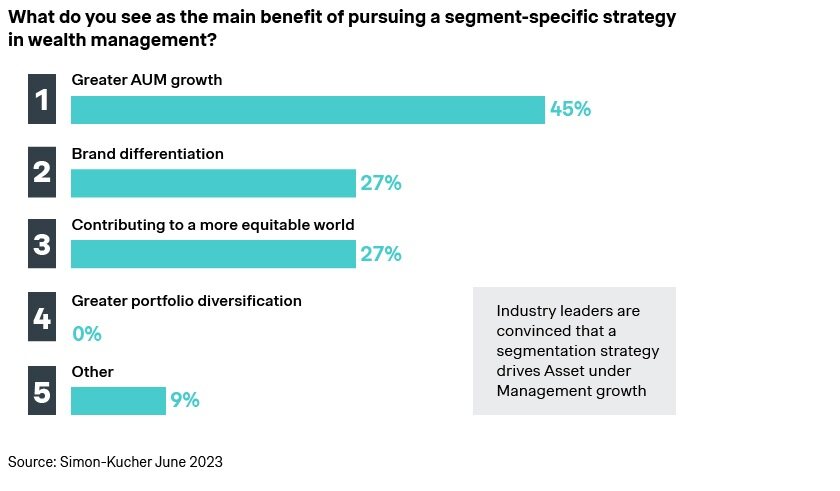

Tailored strategies for fast-growth segments pay off. Recent Simon-Kucher data indicates that 45 percent of industry leaders expect an increase in assets under management (AUM) after implementing advanced client segmentation strategies. Moreover, 27 percent anticipate enhanced brand differentiation compared to competitors lacking such targeted approaches (Figure 4).

The implications are clear: wealth managers who establish a strong positioning through tailored value propositions for emerging segments stand to make significant gains in this growing market. Financial institutions must adopt and implement these strategic initiatives to stay competitive. Firms that neglect this evolution risk trailing behind in both asset accumulation and brand recognition.

How to initiate a segment-specific strategy

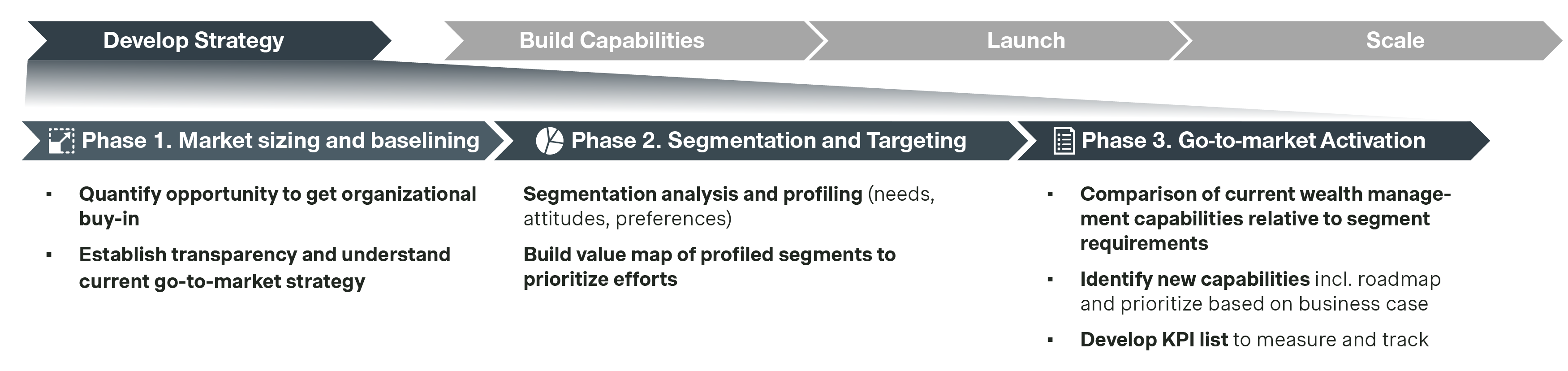

Understanding the unique needs of emerging segments isn’t just about inclusivity — it’s an economic imperative. Our proprietary three-step approach has a proven record in boosting revenue and profit margins for our wealth management clients. Before building, launching, and scaling a segment-focused model, you need a strategy that complements your organization’s strengths and goals.

Here is how we lead in strategies during this era of client diversification:

- Understand the market size: We establish a clear understanding of the market size and our client’s existing reach. This allows us to build a ‘value map’ which aligns organizational strengths to market needs.

- Data-driven segmentation and targeting: We conduct state-of-the-art market research that demystifies market needs. We work closely with our clients to develop strategies targeted to the preferences and habits of high-value segments.

- Activate go-to-market: We then enable clients to implement this go-to-market segmentation plan. By examining a client’s operational capabilities compared to market needs, we build a roadmap of necessary investments to technology, product offering, and service delivery to attain and sustain leadership status.

Act now to avoid the high cost of inaction

The longer financial institutions ignore these shifting demographics, the more revenue they leave on the table. Our Simon-Kucher specialist teams offers strategies and plans that drive results. If you’'re serious about adapting and seizing new revenue streams, please do reach out to us.

Your future bottom line will thank you.

Contributing Author:

Daniel Rowe, Consultant