As inflation continues its upward trajectory and consumer confidence plummets, US banks must keep a close eye on their retail relationships, while working to understand and address evolving customer sentiments. Segmentation along demographic dimensions may have been sufficient in the past but will not be enough to win over customers in the face of sharpening economic headwinds.

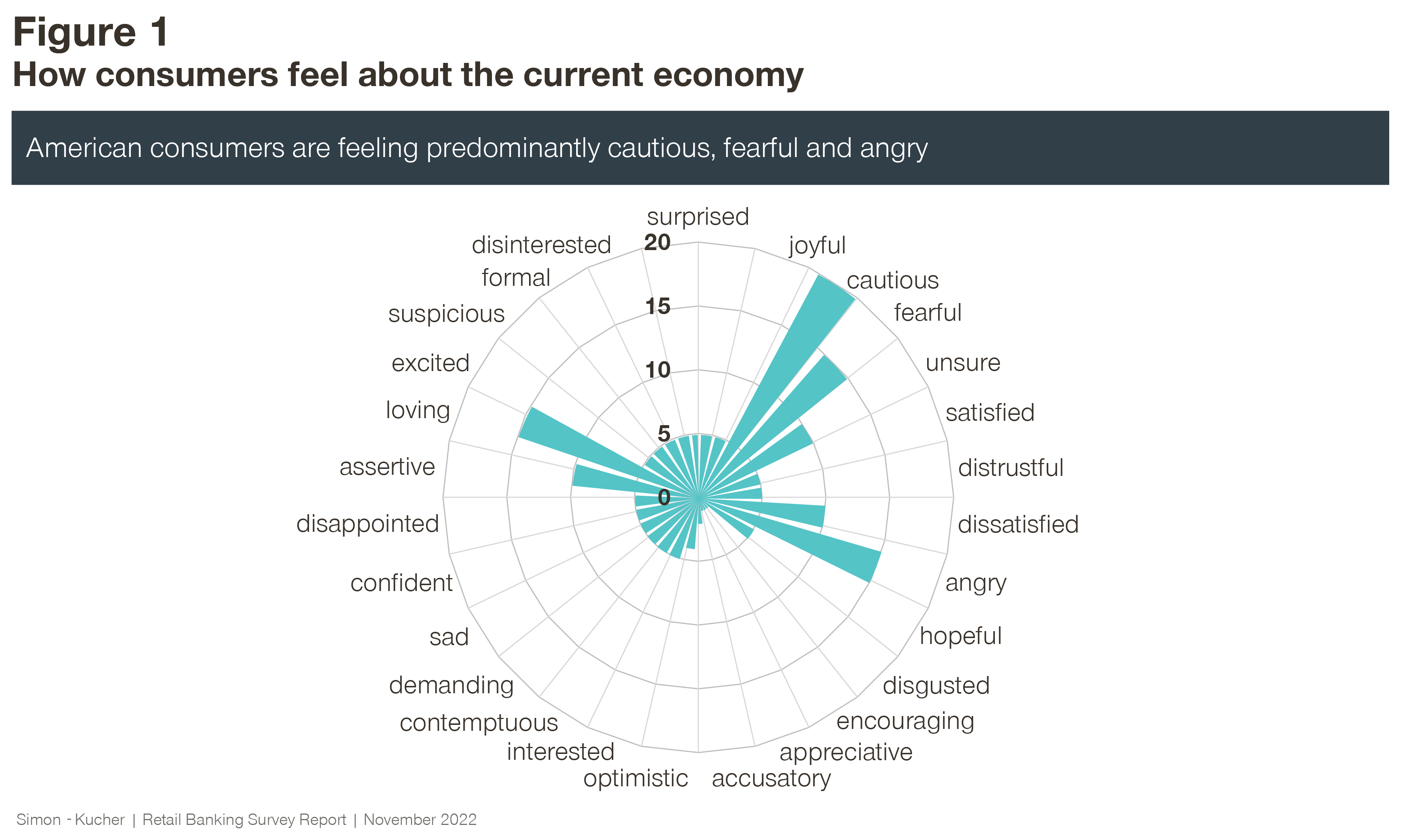

Inflation is unsettling American consumers, leaving them wary, unsure, and dissatisfied (Figure 1). Consumers are concerned about their declining purchasing power, capacity to maintain their existing lifestyle, and ability to meet savings and investment goals, according to a recent Simon-Kucher study. However, despite these setbacks, a group of financially-savvy consumers have managed to find a silver lining.These optimists, who reported feeling buoyant and upbeat, were found to possess more practical experience in money matters and have been able to maintain a healthier financial position than before.

These observations based on a recent Simon-Kucher study have important implications for retail banks in the US. Segment-specific lines can be drawn around how people feel about the current inflationary environment, and that track to specific and predictable banking behaviors, needs, and preferences. For example, Americans who said they feel positive and good about the current state of the economy (optimists) were consistently found to be more price sensitive or responsive to interest rates changes compared to respondents who described themselves as feeling negative (pessimists). The study also found pessimists, who think the economy is bad and that we're in for a long winter, had a greater need for financial guidance and support to help them navigate the challenging inflationary environment.

Relying on demographic segmentation alone is no longer enough if banks want to deliver meaningful experiences that resonate with customers and protect market share. Banks with the ability to reframe marketing (e.g., finding affiliates), sales, and growth strategies to mirror their customers’ new priorities, pain points, and attitudes will be better positioned for future success.

In this first installment of the article series, we share key findings from the Simon-Kucher Consumer Sentiment Study, which included a survey conducted in October 2022 of US-based individuals with annual household incomes above 75,000 US dollars and currently holding a savings account. In the second installment of this series, we will tackle how banks can leverage these findings to prioritize sales and marketing resources to optimize acquisition, retention, and engagement initiatives.

Consumer sentiments are overwhelmingly negative

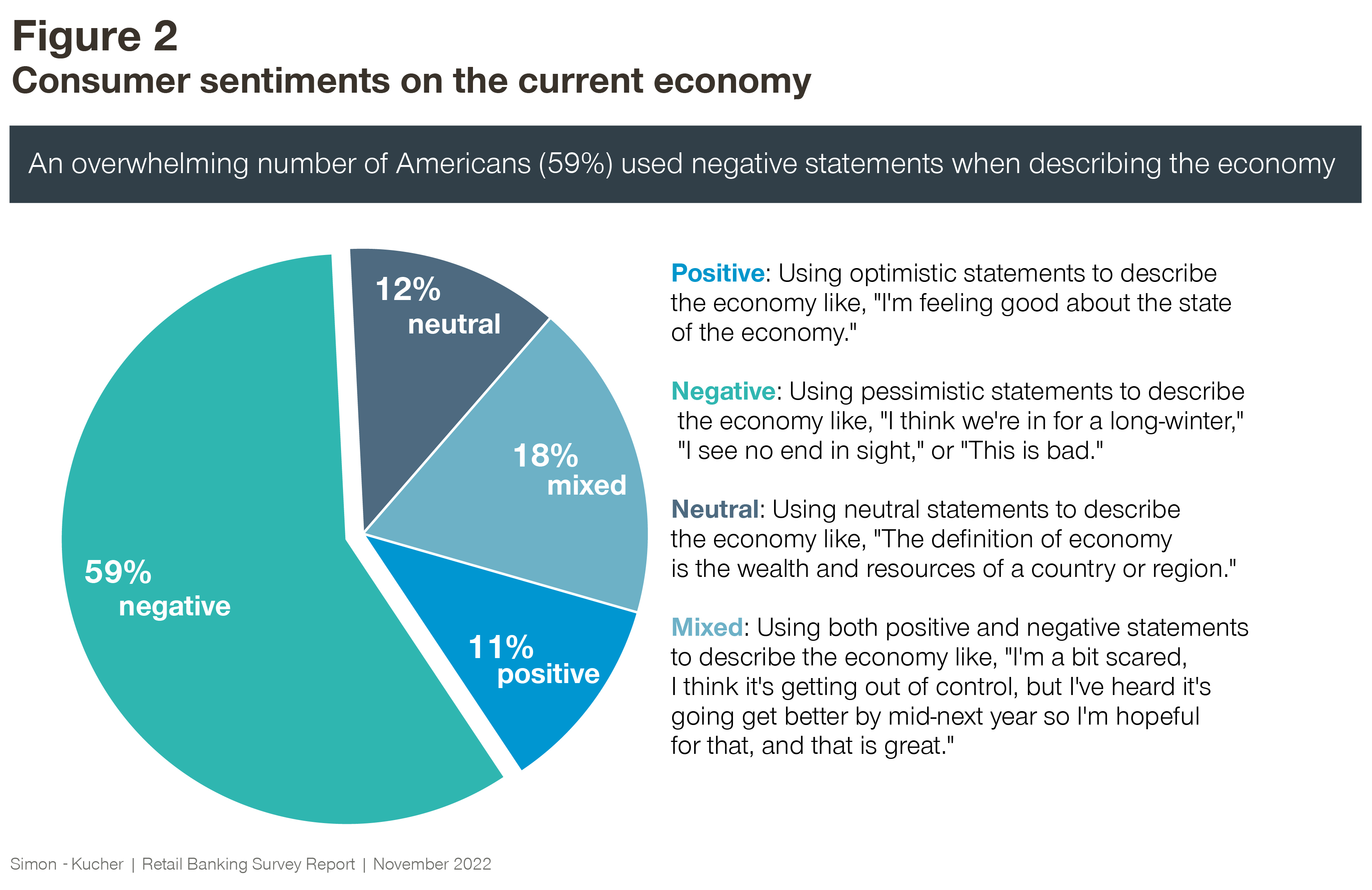

The study found an overwhelming majority (59 percent) of Americans identifying themselves as feeling negative about the current economic environment, and a long winter is ahead with no end in sight (Figure 2). These pessimists are angry, anxious, and depressed when faced with their declining financial situation. Concerns revolved around the belief that the country is in "bad shape," and higher prices impacting their ability to afford goods and services.

The study also found a minority (11 percent) of consumers with a positive outlook, and almost one-third (30 percent) of consumers with either an indifferent or mixed sentiment about the current interest rate and economic environment (Figure 2).

Income is a poor predictor of sentiment and money management skills

The survey revealed that income is a poor predictor of consumer sentiments, as Americans with negative outlooks earned just as much as those with positive outlooks. For example, the proportion of Americans with a household income above 100,000 dollars per year who are categorized as either a pessimist or an optimist about the current environment is comparable at 60 percent and 58 percent, respectively.

Income is also a poor predictor of money management skills. Despite having similar household incomes, Simon-Kucher found pessimists consistently had less money in the bank compared to optimists. A large majority (81 percent) of optimists had more than 50,000 dollars in total deposits in their bank accounts compared to 59 percent of pessimists.

Optimists and pessimists differ along three critical dimensions

There are three distinguishing characteristics separating optimists and pessimists that will greatly impact and inform retail banks' go-to-market strategies.

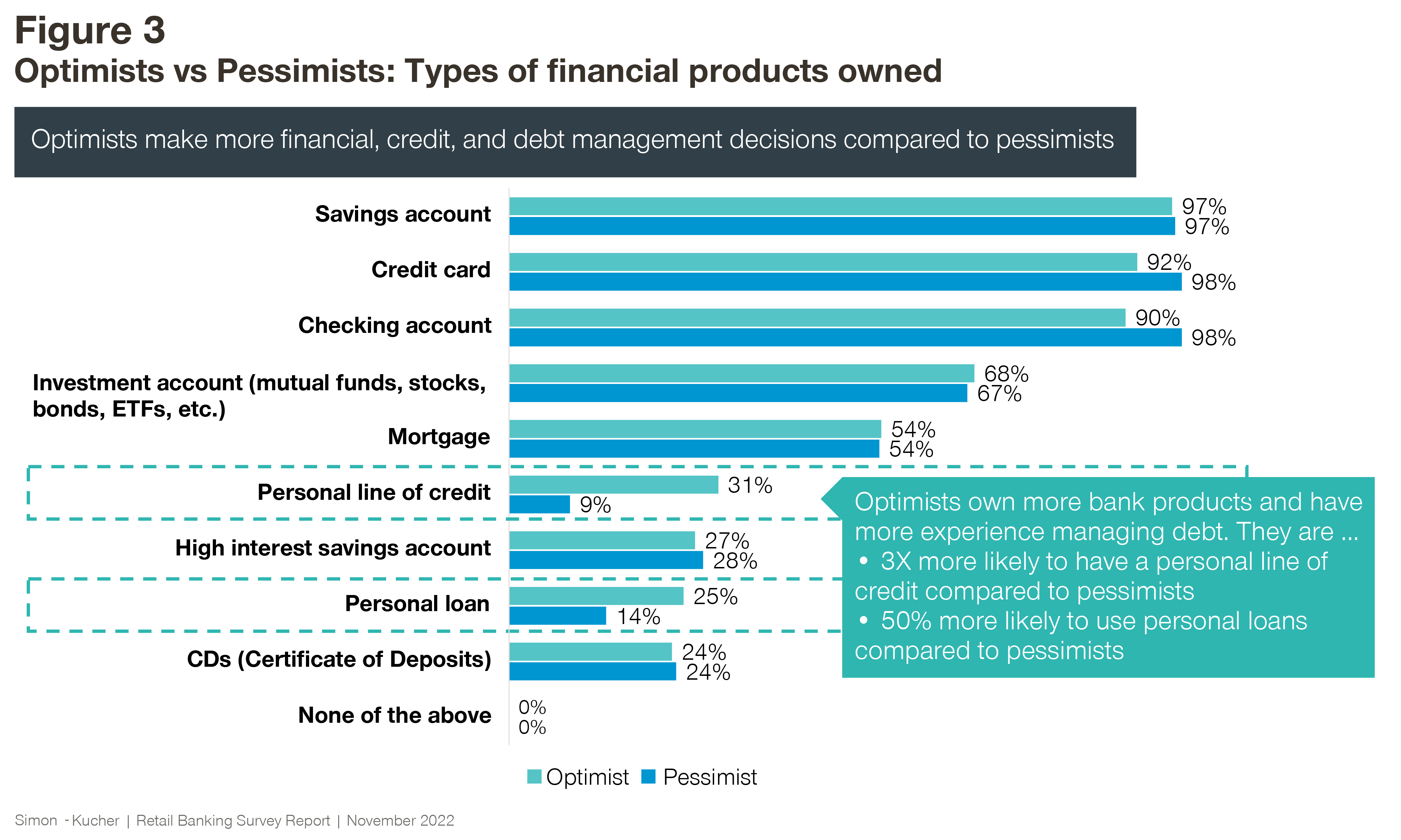

- Optimists are more financially savvy and open to using sophisticated financial products: The Simon-Kucher study found optimists to be more financially savvy compared to pessimists. Optimists are significantly more comfortable leveraging sophisticated credit, savings, and investment instruments to help them reach their financial goals. For example, optimists are three times more likely to have a personal line of credit compared to their pessimistic counterparts (31 percent versus 9 percent). They are also 50 percent more likely to use personal loans compared to pessimists (Figure 3).

Takeaway: There is a knowledge and usage gap between optimists and pessimists. Banks can build trust and confidence with pessimists by offering resources to address their acute need for financial tools, information, and support to help them navigate the challenging inflationary environment.

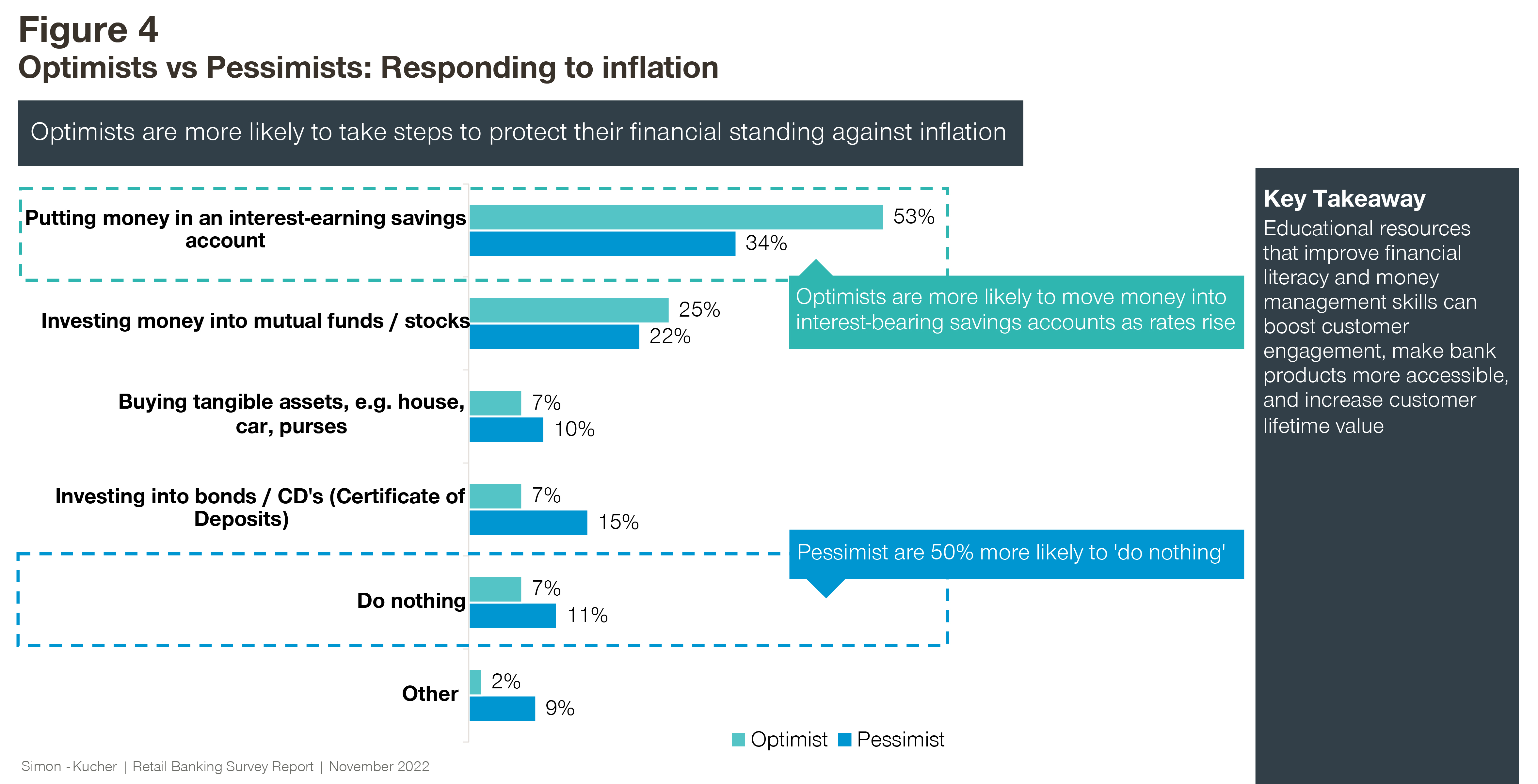

- Optimists are taking action, perhaps even benefit from inflation: Another important difference is the extent to which optimists were more prepared with strategies to combat inflation and protect their financial situation. While inflation is top-of-mind for everyone, optimists are excited about the opportunity to leverage rising interest rates to grow their wealth. In sharp contrast to optimists, pessimists were more passive in their response – many did not have a plan to counter the negative impact of inflation on their financial standing, and are most likely to do nothing.

Takeaway: As interest rates continue to rise, optimists will have a strategy in place to protect their financial position and will most likely seize the opportunity to put money in a high-interest savings account. Pessimists have been slow to react and will most likely do nothing. Banks need to step up efforts to incentivize pessimists to save, such as providing guidance and education in the form of financial health programs.

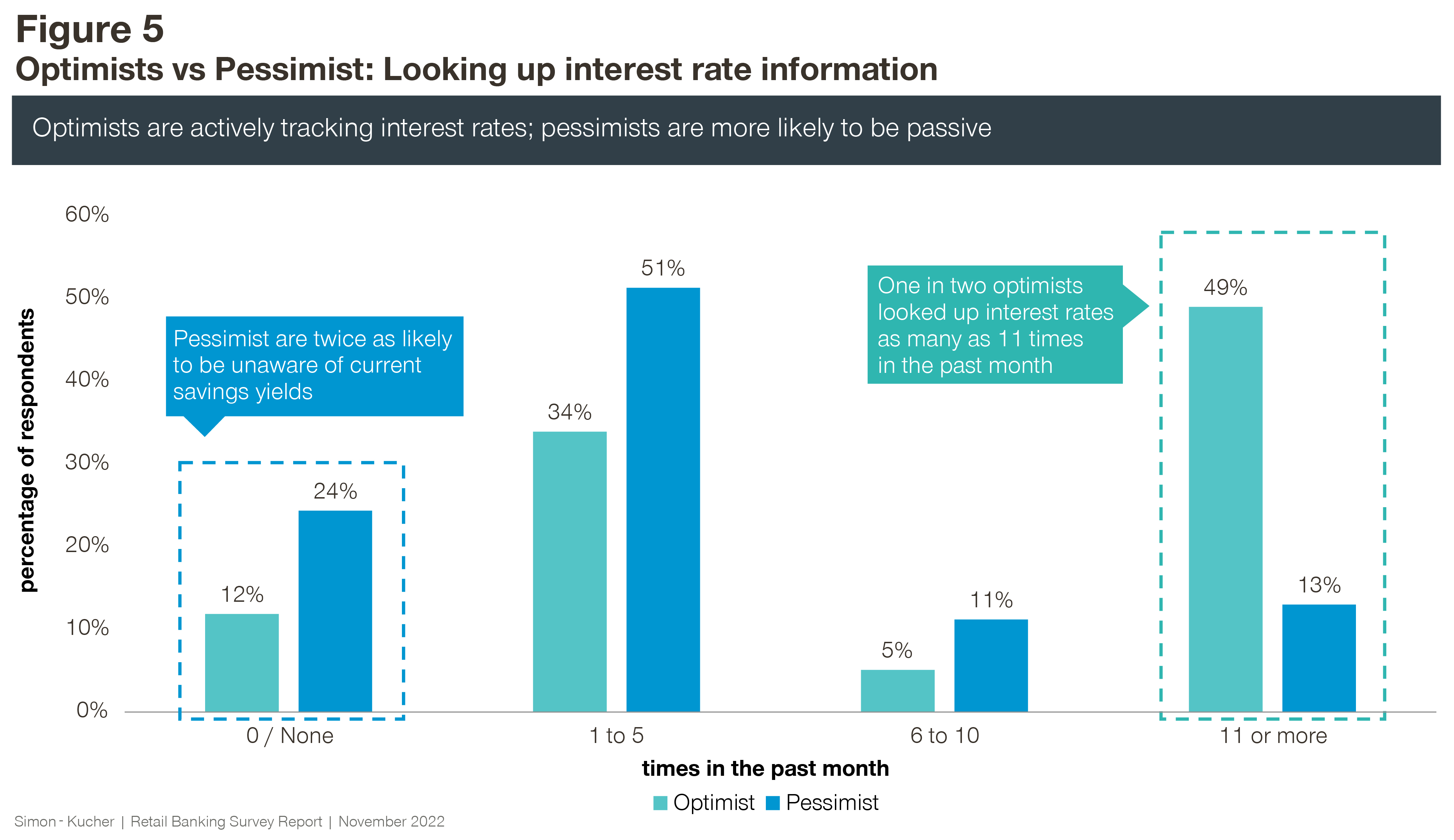

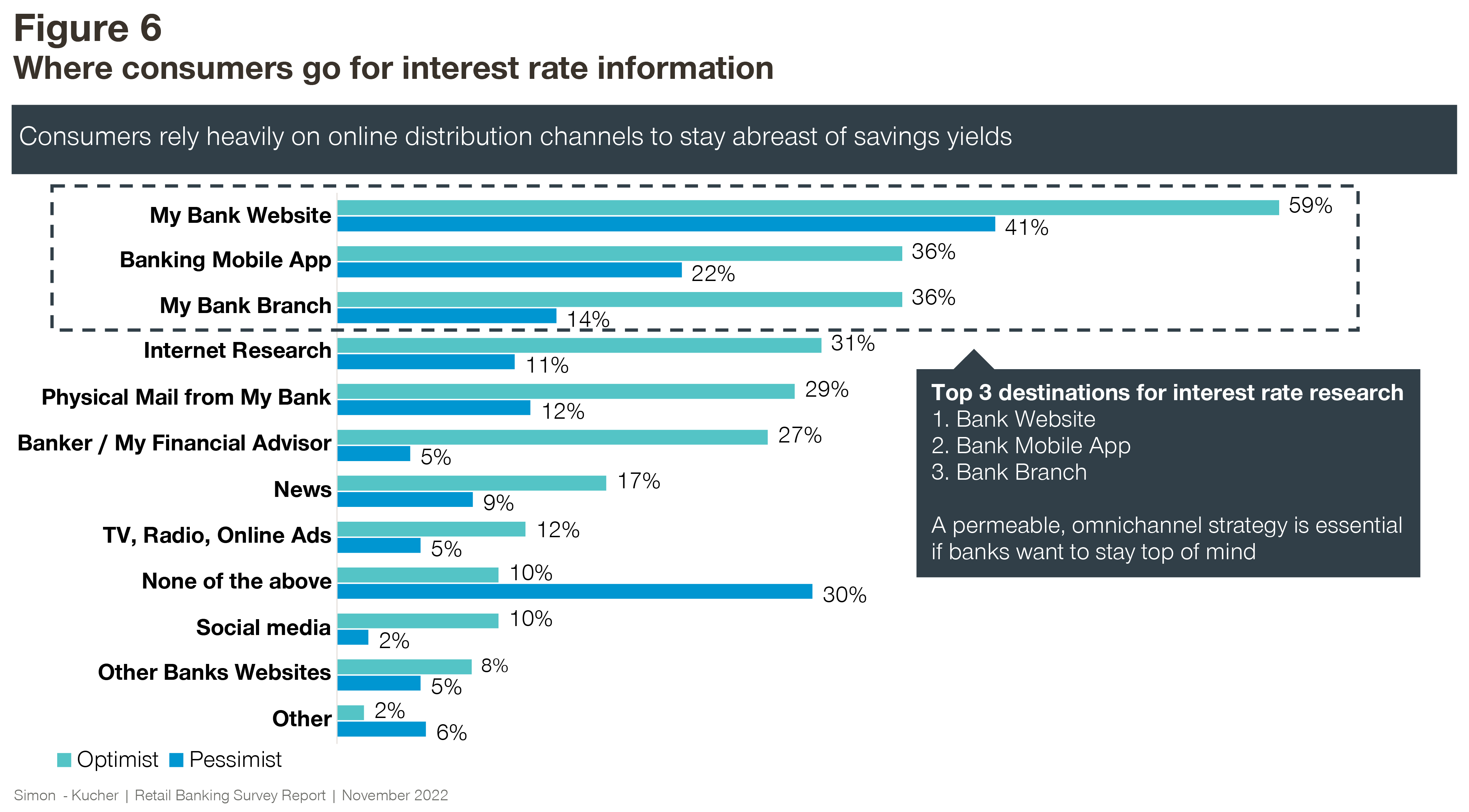

- Optimists are proactively and diligently searching for ways to improve their financial situation: The survey found optimists are closely monitoring the situation and keeping their fingers on the pulse of interest rate movements. They are actively seeking out rate information from multiple channels and sources, including through their bank mobile apps, bank websites, online databases, and financial advisors. By comparison, pessimists demonstrated higher levels of inactivity, and are less likely to research interest rates changes and competitive bank offerings.

Takeaway: Optimists are actively shopping for better interest rates and deals from competitors across all available media channels. Banks should seek to understand what drives their switching behaviors, and find ways to retain and engage them. In sharp contrast to their go-getter counterparts, pessimists are struggling in their actions against inflation. Banks must find ways to make it easy to access financial knowledge for this segment. Empowering them will translate to big rewards down the line in terms of customer loyalty and stable deposits. For both optimists and pessimists, a permeable omni-channel approach will be important (Figure 6).

How to create valuable and meaningful experiences for emerging customer segments

In the second part of our series, we will expand on how banks can create valuable and meaningful experiences for emerging customer segments, and elevate the banking relationship in the face of a challenging economic environment.

We will explore and expand on three areas:

- How to rethink your go-to-market strategy for deposit products and the retail banking experience to accommodate a rapidly changing inflationary and rising rate environment

- How to translate segmentation and pricing sensitivities to better target bank customers across different distribution channels and markets

- How to leverage the new determinants of switching behaviors to accelerate acquisition while creating more value for your existing customer base