2022 Wealth Management Study in the US and Canada: Financial institutions are grappling with how to adjust their client engagement models to remain relevant in a post-pandemic world. Is there still a place for face-to-face meetings, or should a digital-first approach take priority?

During the COVID-19 pandemic, social distancing requirements and clients’ low willingness to connect in person have pushed wealth management firms and private banks to accelerate digital transformation efforts. Large US institutions were particularly successful at leveraging their digital platforms to connect with clients. These bank behemoths are emerging from the pandemic proudly headlining record rates of client digital logins, digital account openings, and engagement with digital tools.

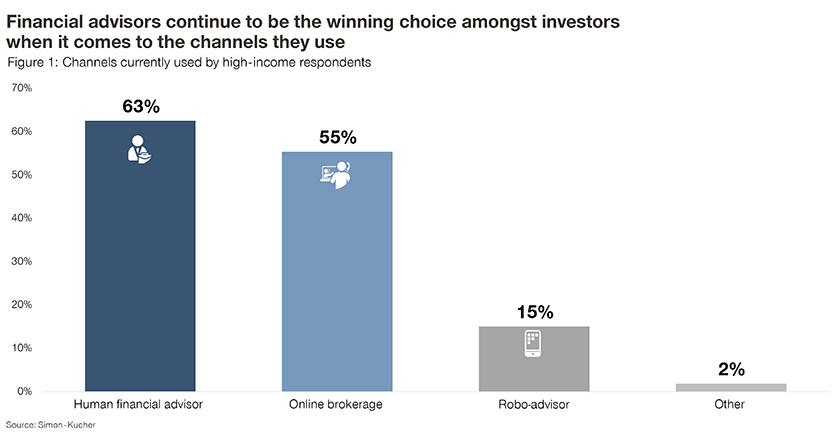

It’s now 2023, and the worst of the COVID-19 pandemic seems to be behind us. While there is still a business case for a digital service offering, wealth management clients are showing signs of digital fatigue, and a strong preference for in-person interactions with advisors over digital interfaces. In our latest Wealth Management Study of high-income earners in the US and Canada (at least 150,000 US dollars annually), 63 percent of respondents favor working with a financial advisor over other digital and self-directed options (Figure 1).

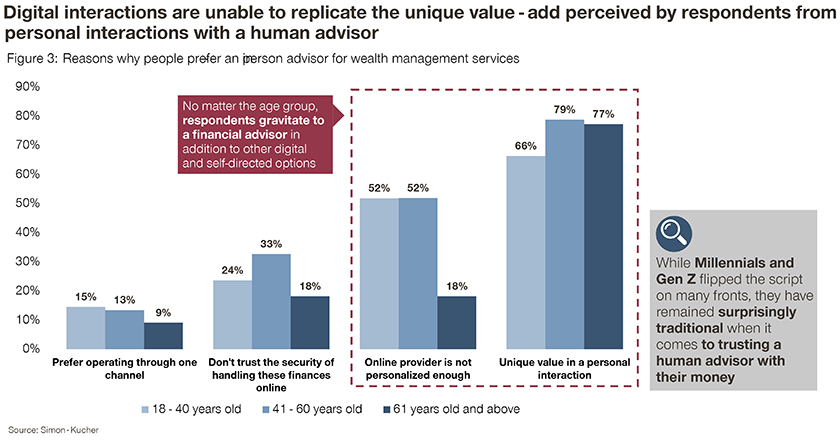

What was particularly surprising was the preference for interactions with human advisors among younger demographics. In the Simon-Kucher study, more than 50 percent of Millennials and Gen Z respondents (defined as people between the ages of 18 and 40) said they rely on a human advisor to make investments and financial planning decisions.

These findings have important implications for financial institutions hoping to position themselves for future growth. Despite their reputation as digital natives and overwhelming preference for digital channels, Millennials and Gen Zers have remained surprisingly traditional when it comes to who they trust with their money. How can financial institutions best leverage their channel assets to target the needs of this segment? And what does it take to stay ahead of digital-first players?

Take a hybrid approach at the intersection of digital and in-person

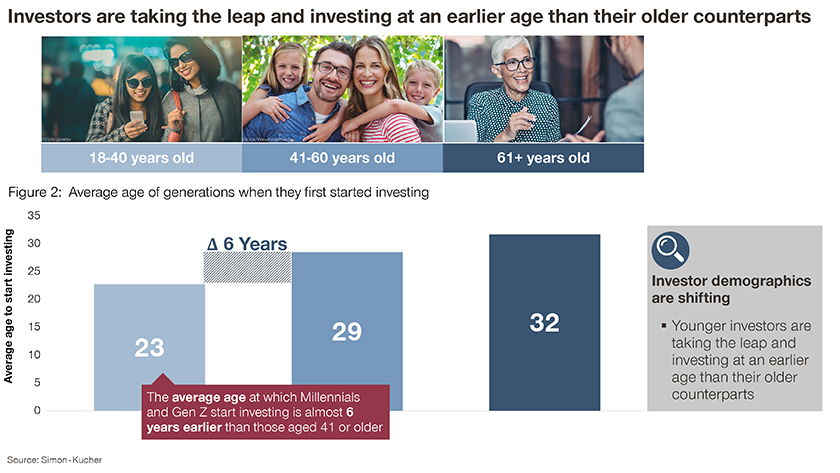

Millennials and Gen Zers are the next generations of wealth management clients, and financial institutions must adapt their client engagement models accordingly. These two generations of investors are investing at an earlier age than their older counterparts. The average age at which Millennials and Gen Zers start investing is almost six years earlier than those aged 41 or older (Figure 2).

Over 60 percent of high-income earners between the ages of 18 and 40 saw unique value in a personal interaction. In fact, roughly half of respondents in this age range felt that an online provider is not personalized enough, and 78 percent responded “yes” to being willing to pay a premium for a personal interaction. No matter the age group, our study showed respondents gravitating to a financial advisor in addition to other digital and self-directed options (Figure 3). It appears that there is something special about a conversation with a person that simply cannot be replicated across digital channels.

Recognize that clients want to move seamlessly between physical and digital worlds

In the US, digital-first competitors have already moved to secure the middle ground. As early as 2017, Betterment, one of the earliest and largest online robo-advisors in the US, launched premium service tiers that included access to an in-house team of financial advisors. Personal Capital also offers a similar telefinance service, albeit with a two-part platform. These digital-first investment firms are focusing on delivering a seamless experience across channels, ensuring that customers and advisors see virtually the same information and use the same tools.

Here is where financial institutions have the upper hand. According to the Simon-Kucher study, two-thirds of high-income earners between the ages of 18 and 40 wanted a dedicated personal financial advisor, almost three times higher than the 26 percent who wanted access to a general hotline. Digital-first firms are reaching up the value chain and adding human elements to their advisory models. But it will be a challenge for them to match the service quality from traditional institutions.

Digital-first players have already identified the hybrid advisory opportunity and offer a real alternative for wealth management customers. Financial institutions should play to their competitive advantage and act now to better integrate the use of their digital capabilities into their service offering.

A well-defined hybrid client advisory experience is a key differentiator and competitive advantage

Financial institutions should offer their customers the best of both worlds – a digital advisory embedded with traditional service offerings. Blended digital solutions, such as those offered by our BE Digital team, are a critical enabler for institutions wanting to futureproof their business.

A blended approach not only puts customers’ needs first, but it also combines the convenience of digital capabilities with the personal touch of speaking to a dedicated financial advisor. Compared to digital-first competitors, financial institutions that offer in-person advice still have an edge. This strength can be greatly amplified and scaled by building on their existing service model.

PostFinance transitioned to a hybrid advisory model over two years ago to stay relevant to their existing customer base and attract a new generation of investors. Since then, the Swiss bank has experienced exponential AUM growth. PostFinance attributes its success to “the smart combination of simple digital solutions and easy access to in-person advice” (read more about PostFinance and the five keys to success when implementing a hybrid advisory model here).

Below are three key takeaways from our study:

- Younger generations are starting to invest earlier, but their investment habits are more traditional than we would expect

- Digital-first competitors have already started crossing over to the middle ground by adding financial advisors to their portfolio of online services

- Financial institutions can stay ahead and scale their competitive advantages by integrating digital advisory into their traditional service offering

Contributors: Jenny Yao